Muni buyers focus on primary while inflation data tempers rate cut size

8 min read

Municipal triple-A scales were little changed Wednesday, ignoring the U.S. Treasury market’s weaker tone following August inflation data that tempered expectations of a higher rate cut this month, while investors focused on the muni primary as more large new-issues cleared the market.

The August consumer price index showed inflation remains above the Federal Reserve’s target level and makes a 50-basis-point

The FOMC will now have “more flexibility in its rate decision,” said Mark Malek, CIO at Siebert. He noted the futures market is pricing in just a 17% chance of a half-point cut.

“Two-year Treasury note yields climbed in response to the CPI release reflecting bond traders’ pricing out a larger up-front cut,” Malek said.

With UST yields rising on the short end and munis’ nonreaction, ratios fell slightly on the short end as a result.

The two-year muni-to-Treasury ratio Wednesday was at 64%, the three-year at 67%, the five-year at 68%, the 10-year at 72% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 68%, the 10-year at 71% and the 30-year at 88% at 3:30 p.m.

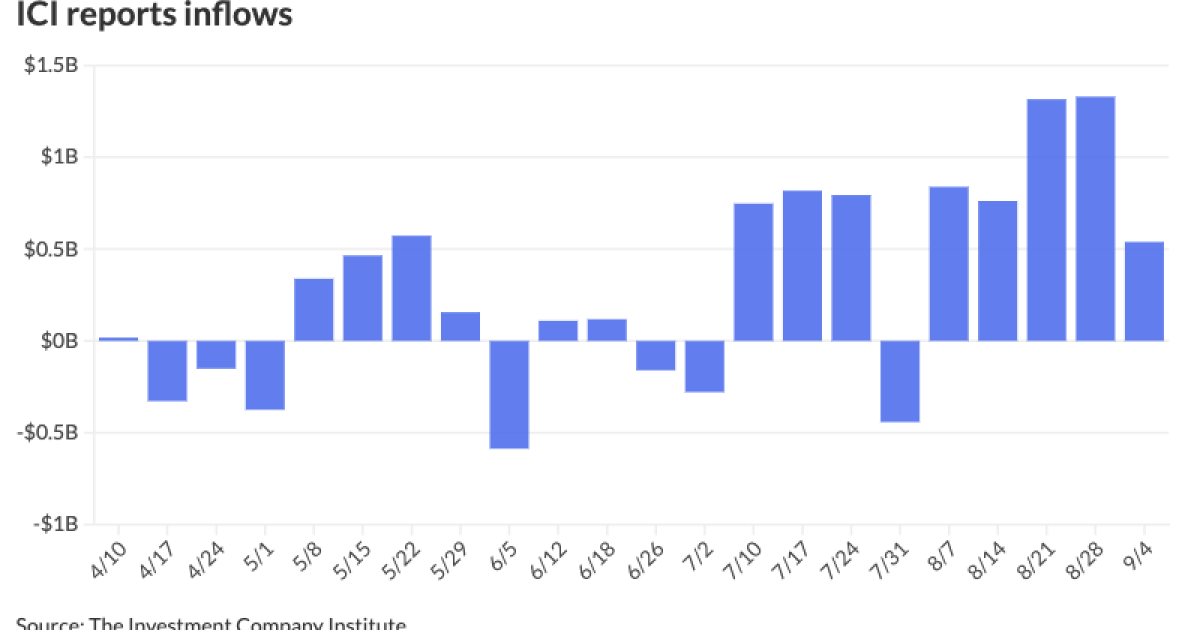

The Investment Company Institute reported $539 million of inflows into municipal bond mutual funds for the week ending Sept. 4 after $1.33 billion of inflows the week prior. Exchange-traded funds saw $212 million of inflows after $667 million of inflows the previous week.

This year, summer technicals were the “wind at the sails” of the muni market, despite surging supply, said AllianceBernstein strategists.

The Bloomberg Municipal Bond Index was up 3.27% during June, July and August, they said, noting the returns for BBB and high-yield indices were “even better,” up 3.91% and 4.79%, respectively.

Meanwhile, issuance for

“Even more impressive is that the Index returned +0.80% in August 2024, but was down 0.37% in August 2021,” they said.

“This is just another piece of data pointing to the demand for muni bonds” as the Fed’s first rate cut approaches, AllianceBernstein strategists said.

“With over $6 trillion sitting in money market funds and seemingly every investor rolling a U.S. T-bill, when the Fed cuts, it will be the dinner bell or signal to the market that it is done tightening and is beginning its easing cycle,” they said. “Some of that cash will come in off the sidelines, further accelerating a bond rally.”

Tax-exempt money market funds saw a second consecutive week of outflows, though it was roughly a third of the size as the week prior, as $727.7 million flowed out during the week ending Sept. 2, decreasing their total AuM to $128.08 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 2.67%.

In the primary market Wednesday, J.P. Morgan priced for institutions $1.5 billion of tax-exempt future tax-secured subordinate bonds, Fiscal 2025 Series C, Subseries C-1 for the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with yields bumped up to six basis points from Tuesday’s preliminary pricing: 5s of 5/2026 at 2.50%, 5s of 2029 at 2.48% (-6), 5s of 2032 at 2.76% (-6), 5s of 2039 at 3.28% (unch), 5s of 2044 at 3.64% (unch), 5.25s of 2049 at 3.79% (unch) and 4s of 2051 at 4.09% (-4), callable 11/1/2034.

BofA Securities priced for institutions $630.59 million of wastewater system revenue bonds from the City and County of Honolulu, with yields bumped up to 15 basis points from Tuesday’s retail pricing. The first tranche, $289.57 million of senior green bonds, Series 2024A, (/AA+/AA/), saw 5s of 7/2041 at 3.31% (-8), 5s of 2044 at 3.49% (-10), 5s of 2049 at 3.68% (-12) and 5.25s of 2054 at 3.78% (-8), callable 7/1/2034.

The second tranche, $22.99 million of senior refunding bonds, Series 2024B, (/AA+/AA/), saw 5s of 7/2040 at 3.25% (-5), callable 7/1/2034.

The third tranche, $193.055 million of senior forward refunding bonds, Series 2025A, (/AA+/AA/), saw 5s of 7/2034 at 3.11% (-12) and 5s of 2038 at 3.30% (-15), callable 7/1/2035.

The fourth tranche, $58.055 million of junior refunding bonds, Series 2024A, (/AA+/AA-/), saw 5s of 7/2039 at 3.20% (-15), callable 7/1/2034.

The fifth tranche, $66.92 million of junior forward refunding bonds, Series 2025A, (/AA+/AA-/), saw 5s of 7/2032 at 3.08% (-10) and 5s of 2034 at 3.20% (-8), noncall.

Wells Fargo priced for Charleston, South Carolina, (Aaa/AAA//) $338.815 million of waterworks and sewer system revenue bonds. The first tranche, $262.115 million of capital improvement bonds, Series 2024A, saw 5s of 1/2027 at 2.39%, 5s of 2029 at 2.40%, 5s of 2034 at 2.67%, 5s of 2039 at 3.02%, 5s of 2044 at 3.37%, 5s of 2049 at 3.56% and 5s of 2054 at 3.68%, callable 1/1/2035.

The second tranche, $76.7 million of refunding bonds, Series 2024B, saw 5s of 1/2025 at 2.48%, 5s of 2029 at 2.40%, 5s of 2034 at 2.67% and 5s of 2037 at 2.98%, noncall.

Jefferies priced for the Los Angeles Harbor Department (Aa2/AA+/AA/) $215.99 million of refunding revenue bonds. The first tranche, $103.325 million of AMT bonds, 2024 Series A-1, saw 5s of 8/2027 at 3.01%, 5s of 2029 at 3.04%, 5s of 2034 at 3.41% and 5s of 2036 at 3.50%, callable 8/1/2034.

The second tranche, $26.875 million of green AMT bonds, 2024 Series A-2, saw 5s of 8/2036 at 3.50% and 5s of 2038 at 3.58%, callable 8/1/2034.

The third tranche, $34.7485 million of non-AMT exempt facility bonds, 2024 Series B-1, saw 5s of 8/2038 at 2.80% and 5s of 2042 at 3.18%, callable 8/1/2034.

The fourth tranche, $23.065 million of green non-AMT exempt facility bonds, 2024 Series B-2, saw 5s of 8/2042 at 3.18% and 5s of 2044 at 3.30%, callable 8/1/2034.

The fifth tranche, $28.365 million of non-AMT governmental bonds, 2024 Series C, with 5s of 8/2027 at 2.06%, 5s of 2029 at 2.07%, 5s of 2034 at 2.44%, 5s of 2039 at 2.90% and 5s of 204 at 3.30%, callable 8/1/2034.

BofA Securities priced for the Clark County Public Utility District No. 1, Washington, (Aa3/A+/AA/) $109.305 million of electric system revenue and refunding bonds, Series 2024, with 5s of 1/2026 at 2.52%, 5s of 2029 at 2.50%, 5s of 2034 at 2.92%, 5s of 2039 at 3.25%, 5s of 2044 at 3.62% and 5s of 2045 at 3.68%, callable 1/1/2034.

In the competitive market, Tulsa, Oklahoma, (Aa1/AA//) sold $108.64 million of GOs, 2024 Series C, to Baird, with 3s of 10/2028 at 2.80%, 4s of 2029 at 2.48% 4s of 2034 at 2.90% and 4s of 2036 at 3.10%, noncall.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.42% and 2.35% in two years. The five-year was at 2.34%, the 10-year at 2.63% and the 30-year at 3.52% at 3 p.m.

The ICE AAA yield curve was unchange: 2.47% in 2025 and 2.38% in 2026. The five-year was at 2.34%, the 10-year was at 2.58% and the 30-year was at 3.49% at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.42% (unch) in 2025 and 2.36% (unch) in 2026. The five-year was at 2.35% (unch), the 10-year was at 2.58% (-1) and the 30-year yield was at 3.50% (-1) at 3 p.m.

Bloomberg BVAL was unchanged: 2.44% in 2025 and 2.38% in 2026. The five-year at 2.36%, the 10-year at 2.61% and the 30-year at 3.50% at 3:30 p.m.

Treasuries were slightly weaker.

The two-year UST was yielding 3.641% (+3), the three-year was at 3.462% (+2), the five-year at 3.445% (+2), the 10-year at 3.653% (+1), the 20-year at 4.037% (+1) and the 30-year at 3.964% (+1) just before the close.

CPI

The CPI figures serve “as a bit of a reminder not to get too carried away with a few months of better inflation data,” said Brian Coulton, Fitch Ratings chief economist.

While the headline gain of 0.2% was as predicted, core rose 0.3% in August and core services rose to 0.4%, “the fastest pace since April,” he said. “Transport services leapt — with air fares up a whopping 4% — and shelter inflation picked up again. Certainly not enough to stop the Fed cutting rates later this month, but the stickiness of services inflation at around 5% y/y will be one reason why the Fed will not be cutting rates at an aggressive pace over the next year or so.”

Scott Anderson, chief U.S. economist and managing director at BMO Economics, said the numbers were “good, but not great,” with inflation still “a mixed bag with relatively firm services and housing inflation, but continued signs of weakness and price declines in consumer goods and energy prices.”

Inflation is trending downward, he noted, “with encouraging hints that inflation could moderate further on energy price declines and with services and housing inflation having room to ease.”

The Fed can still cut this month, Anderson said, “but market hopes for a bigger half point cut seem to be fading away.”

The year-over-year headline gain (2.5%) was the lowest since February 2021, noted Mercatus Center macroeconomist Patrick Horan.

“Although year-over-year inflation numbers are still high, the last few months show inflation stabilizing close to 2%, the Fed’s target,” he said. “Today’s report likely cements the Fed’s plan for a 25-basis-point cut next week. If inflation shows sign of continuing to fall, then the Fed should consider further cuts this fall.”

No “harm” to the market resulted from the report, said Jack McIntyre, portfolio manager at Brandywine Global. “It provided further evidence to the Fed that they should move by 25bps next week,” he said. “A 50bp cut should not be in the cards as the recession call needs further deterioration in the labor market and the Fed likes its optionality.”

The report “should tilt the Fed toward an initial 25 bps rate cut,” said Josh Jamner, investment strategy analyst at ClearBridge Investments. “While the Fed’s focus has shifted toward the maximum employment side of the dual mandate given hints of softness in recent labor data releases, price stability (inflation) is still a key consideration.”

This “modestly less favorable print will not prevent the Fed from beginning to normalize interest rate policy next week, but it could re-frame the debate around the monetary policy path over the next several quarters, Jamner said.

Signs of a bit stickier inflation “than previously thought would likely result in a slower and shallower cutting cycle,” he added. “This would be a disappointment to short-term bond markets that have priced over 250 bps of rate cuts by the end of 2025.”

But it wasn’t all bad news, said Chris Low, chief economist at FHN Financial. “Inflation is marching lower, as is evident in the declining year-on-year CPI inflation rate.”

Still, he believes even a “surprisingly low inflation” report was unlikely to result in a half-point cut at this meeting, and “it is an even bigger stretch to expect 50bp now, given inflation was not just a little worse than expected, but the monthly increase in the core CPI was biggest since April.”

The report leaves room for interpretation, said University of Central Florida economist Sean Snaith, and observers will “see what they want to see.”

While the Fed wants to cut rates, he said, the headline number and core data offer different takes.

“I see the totality of the data about the economy, and I don’t see an economy that’s in dire risk of a recession or that needs the Fed to act immediately and start cutting rates,” Snaith said. “Progress toward the inflation target has slowed to a crawl, and we’re not there yet.”

Primary to come:

Philadelphia (A3/A/A-/) is set to price Thursday $446.875 million of gas works revenue bonds Seventeenth Series, consisting of $336.74 million of new-issue bonds, Series 2024A, and $110.135 million of refunding bonds, Series 2024B. J.P. Morgan.

The Harris County Cultural Education Facilities Finance Corp. (Aa2/AA-/AA-/) is set to price Thursday

The National Finance Authority is set to price Thursday $194 million of non-rated Bridgeland Water and Utility Districts 490, 491, AND 158 special revenue bonds, Series 2024, term 2035. Wells Fargo.

Competitive:

The Board of Trustees of the University of Alabama is set to sell $210.82 million of general revenue bonds, Series 2024-B, at 11 a.m. Thursday.

Gary Siegel contributed to this story.