Munis sell off, playing catch-up to UST losses

5 min read

Municipals sold off Wednesday, with the largest losses out long, while U.S. Treasuries closed with small gains and equities were mixed after Fed meeting minutes showed a more cautious approach and slower pace to rate cuts.

Muni yields were cut up to 12 basis points, depending on the curve, playing catch-up to recent UST losses.

Ratios out long rose slightly on the moves. The two-year municipal to UST ratio Wednesday was at 65%, the five-year at 65%, the 10-year at 66% and the 30-year at 81%, according to Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the five-year at 64%, the 10-year at 65% and the 30-year at 79% at 4 p.m.

The Federal Reserve will be more cautious and slow rate cuts going forward, according to minutes of the December Federal Open Market Committee meeting, released Wednesday.

“The minutes confirm that the Fed will take a more cautious approach to policy easing, cementing expectations of a rate pause in January,” said Sal Guatieri, senior economist at BMO Capital Markets.

The minutes said participants believe the panel is “at or near the point at which it would be appropriate to slow the pace of policy easing.” Many factors contributed to this viewpoint, including higher than desired inflation reads, consumer spending levels, “reduced downside risks to the outlook for the labor market and economic activity, and increased upside risks to the outlook for inflation.”

“This explains why the median member halved the amount of easing in 2025 to just 50 bps,” Guatieri said. “The Fed’s staff, based on preliminary assumptions about potential policy changes, lowered its growth outlook slightly, perhaps a nod to the corrosive effect of tariffs. It also said the changes could hold inflation up this year while imparting an upside risk to the outlook.”

Officials also noted future policy uncertainty and how these will impact the economy, as a reason to move slowly, he said.

“The bond market sure feels like it has lost confidence in the Fed and Treasury, and it is showing in the yield curve,” said Byron Anderson, head of Fixed Income at Laffer Tengler Investments.

The short sellers are now “the captain of this boat” and there is pressure on this market, he noted.

“We are starting to see sloppy Treasury auctions with tails everywhere on the curve and we still have the bulk of Janet Yellen’s stack of Treasury maturities to come,” he said.

Over the next two years, $14.6 trillion will come due, meaning there is “a lot of debt to extend beyond one year if we want to get to historic percentages,” Anderson said.

Market participants should expect record auctions to be even higher records, he said.

“Primary dealers are having to take larger percentages from these auctions at a time when their inventories are nearing record highs again,” Anderson noted, potentially because of liquidity issues in the bond market but also because the Fed will shift shortly from QT as this selloff continues.

There may be a “marginal rally from the shift out of QT which will hopefully calm this down,” he said.

“Yellen and the Treasury funding everything short is going to come back and bite the U.S., and with the Fed’s recent rate cuts, the problem seems to have come to the forefront,” Anderson said.

For the muni market, the asset class currently offers a “compelling case” of risk and reward, said Cooper Howard, a fixed income strategist at Charles Schwab.

“Although yields relative to Treasuries are low and could be a hindrance for performance, absolute yields remain attractive — especially after considering the impact of taxes,” he said. “Additionally, we’re past the peak in credit quality, but the overall backdrop remains favorable for most issuers.”

While short-term and lower-rated issuers were winners last year, Howard notes that may shift in 2025.

Spreads for lower-rated investment-grade issuers are “tight,” a potential headwind to performance, he said.

Long-term yields, which have already risen 40 basis points over the last month and may move higher, may have some upside, Howard said, noting an increase in the term-premium contributed to rising yields.

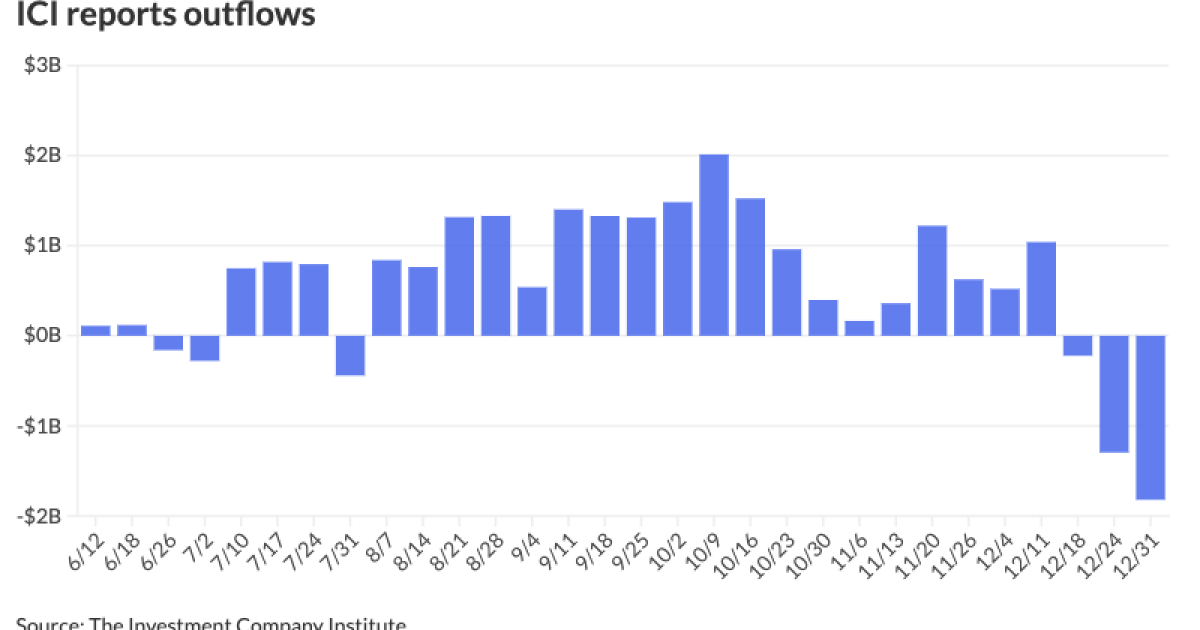

The Investment Company Institute reported final outflows for the last week of 2024, with investors pulling $1.821 billion for the week ending Dec. 31, following $1.296 billion of outflows the previous week.

Exchange-traded funds saw inflows of $541 million after inflows of $105 million the week prior, per ICI data.

In the negotiated market Wednesday, RBC Capital Markets priced and repriced for the San Diego Community College District (Aa1/AAA//) $700 million of Election of 2024 GO dedicated unlimited ad valorem property tax bonds, Series A-1, with yields little changed: 5s of 8/2036 at 2.90% (-2), 5s of 2040 at 3.20% (unch), 5s of 2045 at 3.69% (unch), 4s of 2050 at 4.15% (unch) and 5s of 2055 at 4.05% (+3), callable 8/1/2035.

RBC Capital Markets preliminarily priced for the Board of Regents of the University of Texas System $387.895 million of revenue financing system bonds, Series 2025A, with 5s of 8/2026 at 2.90%, 5s of 2030 at 3.04% and 5s of 2032 at 3.08%.

BofA Securities priced for the Utah Housing Corp. (Aa2///) $225 million of single-family mortgage bonds. The first tranche, $74 million of Series A non-AMT bonds, saw all bonds at par — 3.15s of 1/2026, 3.55s of 1/2030, 3.6s of 7/2030, 3.95s of 1/2035, 3.95s of 7/2035, 4.1s of 7/2040, 4.45s of 7/2045, 4.6s of 7/2040 and 4.65s of 1/2055 — except for 6.5s of 7/2055 at 3.91%, callable 1/1/2033.

The second tranche, $151 million of Series B taxables, saw all bonds at par — 4.479s of 1/2026, 4.828s of 1/2030, 4.976s of 7/2030, 5.539s of 1/2035, 5.589s of 7/2035, 5.769s of 7/2040, 6.12s of 7/2045, 6.17s of 7/2040 and 6.22s of 1/2055 — except for 6.75s of 7/2055 at 5.428%, callable 1/1/2033.

In the competitive market, the Florida Department of Transportation (Aaa/AAA/AAA/) sold $138.695 million of right-of-way acquisition and bridge construction bonds, Series 2025A, to Baird, with 5s of 7/2025 at 2.80%, 5s of 2030 at 2.92%, 5s of 2035 at 3.19%, 4s of 2040 at 3.82%, 4s of 2045 at 4.07%, 4s of 2050 at 4.16% and 4.125s of 2054 at 4.20%, callable 7/1/2034.

AAA scales

MMD’s scale was cut up to 10 basis points: The one-year was at 2.75% (unch) and 2.79% (+5) in two years. The five-year was at 2.89% (+5), the 10-year at 3.10% (+6) and the 30-year at 3.99% (+10) at 3 p.m.

The ICE AAA yield curve saw cuts throughout most of the curve: 2.77% (-2) in 2026 and 2.79% (+2) in 2027. The five-year was at 2.85% (+4), the 10-year was at 3.06% (+5) and the 30-year was at 3.90% (+8) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut up to nine basis points: The one-year was at 2.82% (unch) in 2025 and 2.83% (+6) in 2026. The five-year was at 2.86% (+5), the 10-year was at 3.06% (+6) and the 30-year yield was at 3.91% (+9) at 4 p.m.

Bloomberg BVAL was cut up to 12 basis points: 2.87% (unch) in 2025 and 2.80% (+3) in 2026. The five-year at 2.90% (+6), the 10-year at 3.16% (+7) and the 30-year at 3.96% (+12) at 4 p.m.

Treasuries were slightly stronger.

The two-year UST was yielding 4.274% (-2), the three-year was at 4.343% (-2), the five-year at 4.451% (-2), the 10-year at 4.677% (-1), the 20-year at 4.979% (flat) and the 30-year at 4.916% (flat) at the close.