Investors flock to safe haven assets after tech-led selloff

6 min read

A new artificial intelligence model from Chinese firm DeepSeek led to a selloff in tech stocks, which, in turn, scared the broader market. In response, investors flocked to safe haven assets like municipal bonds and U.S. Treasuries.

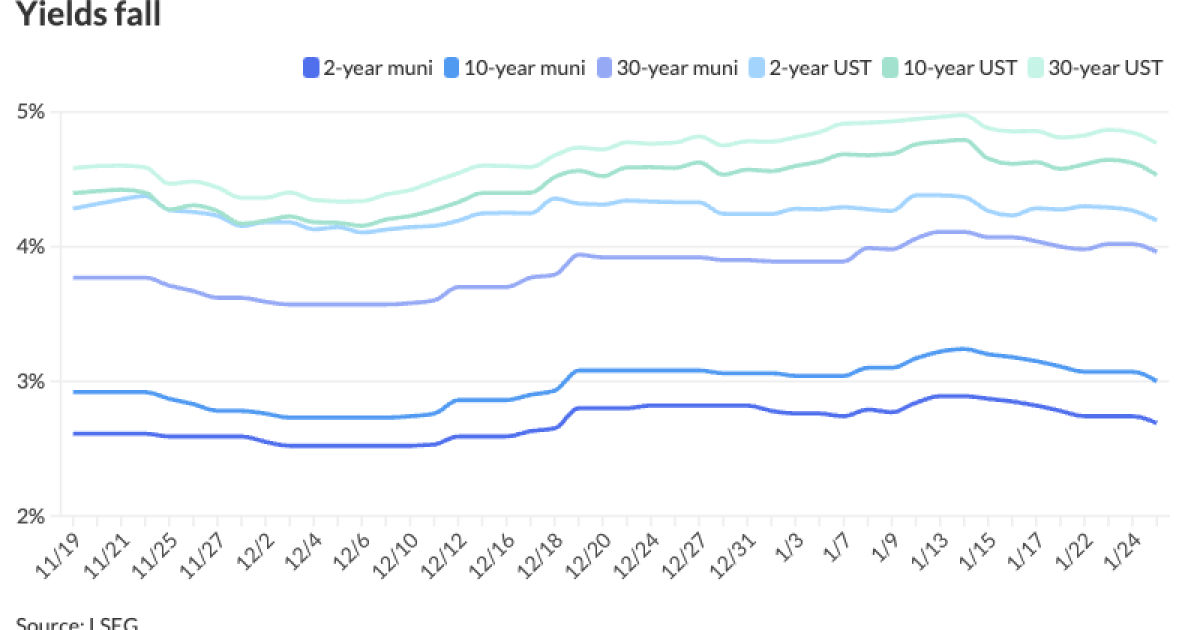

Muni yields fell five to seven basis points, depending on the scale, while UST yields fell seven to 10 basis points, while equities were mixed toward the close.

Municipals are “a less volatile fixed-income asset class,” said Chris Brigati, managing director and chief investment officer of SWBC, noting from a credit standpoint, the safety of high-grade municipals, which has a low default rate, is key.

Tech stocks suffered on “worries that Beijing is becoming increasingly competitive in the high-stakes artificial intelligence race,” said José Torres, senior economist at Interactive Brokers.

DeepSeek sparked concerns upon announcing its open-source model was built in two months, costing less than $6 million, he said.

This “disruptive technology” impacted Nvidia, in particular, as DeepSeek’s new “Chat-GPT-like” product implies there may be a better solution out there and another game in town, Brigati said.

Elsewhere, the two-year municipal to UST ratio Monday was at 64%, the five-year at 64%, the 10-year at 66% and the 30-year at 83%, according to Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the five-year at 63%, the 10-year at 65% and the 30-year at 80% at 3:15 p.m.

“Coming off a week when multiple high-grade names came to market, there is a certain amount remaining to be distributed,” said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

While taxable rates remain volatile, munis’ main focus is the absolute value component, which should help with “attrition of balances,” she noted.

With the Federal Open Market Committee meeting midweek, the new-issue calendar looks “relatively light,” with only around $5.2 billion expected to price, said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

The Fed is expected to keep rates in a range between 4.25% and 4.50% this week, with the next cut potentially coming in June, with additional cuts in September and December, he noted.

Last week, the muni market continued to recover from the start of 2025’s volatility, as muni yields ended the week firmer, while UST yields were largely flat across the curve, Clements said.

Munis returned 0.26% last week, leading to the asset class being nearly flat at only negative 0.05% year-to-date.

The muni market “clawed back some of its recent relative underperformance,” Clements said.

“After underperforming last week, but seeing a late surge in buying activity, the muni market picked up right where it left off,” leading to an outperformance of USTs across all tenors, said Birch Creek strategists in a weekly report.

Benchmark AAA MMD curve saw yields fall two to eight basis points, with short tenors “favored” by separately managed accounts seeing the largest moves, they said.

Strong demand contributed to some of last week’s outperformance, with LSEG Lipper reporting the

Additionally, “attractive absolute yields on a tax-adjusted basis seem to be catching investors’ eyes,” Birch Creek strategists said.

On the new-issue front, they said strong interest was seen from “spreadier names.”

For instance, St. Luke’s Health System (NR/A/A+/) was 15 times oversubscribed and bumped 15 basis points, they noted.

“That said, given how tight credit spreads are relative to ultra-high grades, deals like this don’t provide all that much room to run on the break,” Birch Creek strategists said.

By Friday, bonds were trading two basis points worse than they priced, they said.

AAA scales

MMD’s scale was bumped five to seven basis points: The one-year was at 2.67% (-5) and 2.69% (-5) in two years. The five-year was at 2.79% (-5), the 10-year at 3.00% (-7) and the 30-year at 3.96% (-6) at 3 p.m.

The ICE AAA yield curve was bumped five to seven basis points: 2.70% (-7) in 2026 and 2.72% (-7) in 2027. The five-year was at 2.80% (-5), the 10-year was at 3.01% (-7) and the 30-year was at 3.88% (-6) at 3:15 p.m.

The S&P Global Market Intelligence municipal curve was bumped five to six basis points: The one-year was at 2.68% (-5) in 2025 and 2.72% (-5) in 2026. The five-year was at 2.78% (-5), the 10-year was at 2.99% (-6) and the 30-year yield was at 3.86% (-6) at 3:15 p.m.

Bloomberg BVAL was bumped five to six basis points: 2.65% (-5) in 2025 and 2.71% (-5) in 2026. The five-year at 2.82% (-5), the 10-year at 3.07% (-6) and the 30-year at 3.91% (-5) at 3:15 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.198% (-7), the three-year was at 4.242% (-9), the five-year at 4.331% (-10), the 10-year at 4.529% (-9), the 20-year at 4.827% (-9) and the 30-year at 4.768% (-8) at 3:30 p.m.

Primary to come

The Oklahoma Turnpike Authority (Aa3/AA-/AA-/) is set to price Tuesday $1.311 billion of Oklahoma Turnpike System second senior revenue bonds, consisting of $1.088 billion of Series 2025A bonds and $233.315 million of forward-delivery Series 2025B bonds. Goldman Sachs.

The Columbus Regional Airport Authority (A2/A//) is set to price Tuesday $1.028 billion of John Glenn Columbus International Airport airport revenue bonds, consisting of $836.475 million of Series 2025A AMT bonds, serials 2030-2045, terms 2050, 2055, and $191.445 million of Series 2025B non-AMT bonds, serials 2030-2045, terms 2050, 2055. RBC Capital Markets.

The Orlando Utilities Commission (Aa2//AA/) is set to price Tuesday $272.255 million of utility system revenue bonds, consisting of $186.455 million of Series 2025A bonds and $85.8 million of Series 2025B refunding bonds. Morgan Stanley.

The Sumter Landing Community Development District (/AA//) is set to price Tuesday $249.25 million of Assured Guaranty-insured taxable recreational revenue bonds, serials 2025-2035, terms 2045, 2054. Jefferies.

Temple University (Aa3/A+//) is set to price Wednesday $219.475 million of revenue refunding bonds, First Series of 2025, serials 2026-2045. Loop Capital Markets.

The Mesa County Valley School District No. 51 (Aa3/AA-//) is set to price Thursday $190 million of Colorado State Intercept Program-insured GOs, serials 2042-2049. RBC Capital Markets.

The Colorado Housing and Finance Authority (Aaa/AAA//) is set to price Tuesday $160 million of taxable Class I single-family mortgage bonds, 2025 Series D-1, serials 2026-2036, terms 2040, 2044, 2055. RBC Capital Markets.

The Virginia Housing Development Authority (Aaa/AAA//) is set to price Tuesday $150 million of taxable 2025 Series A commonwealth mortgage bonds. Morgan Stanley.

The Highline School District No. 401, Washington, (Aaa///) is set to price Tuesday $133.495 million of Washington School District Credit Enhancement Program-insured unlimited tax GOs. Piper Sandler.

The New York State Environmental Facilities Corp. (Aaa/AAA/AAA/) is set to price Tuesday $132.245 million of green State Revolving Funds revenue bonds, consisting of $124.885 million of tax-exempts, Series 2025A, serials 2025-2044, terms 2049, 2054, and $7.39 million of taxables, Series 2025B, terms 2029, 2034. RBC Capital Markets.

The Public Finance Authority is set to price Wednesday $112.61 of non-rated essential housing revenue bonds, consisting of $93.775 million of senior bonds, Series 2025A, and $18.835 million of junior bonds, Series 2025B. Jefferies.

L’Anse Creuse Public Schools, Michigan, (/AA//) is set to price Tuesday $102.795 million of Michigan School Bond Qualification and Loan program-insured 2025 school building and site unlimited tax GOs, Series I. J.P. Morgan.

The Missouri Housing Development Commission (/AA+//) is set to price Monday $100 million of non-AMT First Place Homeownership Loan Program single-family mortgage revenue bonds, 2025 Series A, serials 2026-2037, terms 2040, 2045, 2050, 2055, 2056. Raymond James.

Competitive

Mecklenburg County, North Carolina, (Aa1/AA+/AA+/) is set to sell $232.925 million of limited obligation bonds, at 11 a.m., Eastern, Tuesday.

The Tamalpais Union High School District, California, (Aaa///) is set to sell $175 million of GO 2024 Election bonds, 2025 Series A, at noon Tuesday.

The Bristol-Plymouth Regional Vocational Technical School District, Massachusetts, is set to sell $120 million of state-qualified GO school bonds at 11 a.m., Wednesday.

Frederick County, Maryland, (Aaa/AAA/AAA) is set to sell $194.185 million of GO public facilities project bonds, Series 2025A, at 10:30 a.m., Thursday.