Stakes raised in Washington, D.C. budget impasse

3 min read

Bloomberg News

City leaders in Washington, D.C. are dealing with an upcoming billion-dollar bond issuance, approving an NFL stadium deal and a delayed budget that has the City Council riled up.

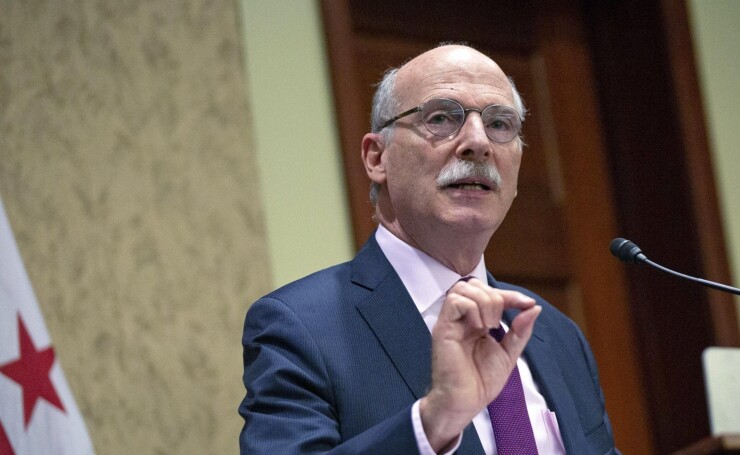

“We cannot keep waiting and waiting and waiting,” said Chairman Phil Mendelson. “If the mayor misses the deadline on May 15, I’m going to talk to our general counsel about going to court.”

The mayor contends that the 2026 budget is finished but submitting it has been delayed by the ongoing saga of the House of Representatives’ refusal to deal with omitted language in the continuing resolution that forces the city to revert to its 2024 budget, causing a $1.1 billion shortage.

“It’s their snafu,” said Mayor Muriel Bowser. “Everybody knows it, and they need to fix it. (There’s) bipartisan support in the Senate, the President of the United States supports it, and we need speaker Johnson to move it, and I know when he moves it, it will pass.”

The city is required by law to submit balanced budgets in four-year cycles and have them certified by the CFO, who acts independently from mayor and the city council. The mayor’s 2026 budget was due on April 2 and the City Council has been pressing to get back on schedule.

The situation is raising the stakes for a major bond issuance tentatively scheduled for May 15. The city is planning to go to market with $1.189 billion of tax-exempt income tax secured revenue and refunding bonds, and $301 million of federally taxable bonds that are also secured by income tax revenue.

The proceeds are earmarked for capital project expenditures and refunding of older bonds. The new issuance is rated Aa1 by Moody’s Ratings and AAA by Standard & Poor’s Global Ratings.

The main stumbling block for the House to pass a new bill allowing the city to access its approved funds for 2025 appears in the form of Rep. Andy Harris, R-Md.

“The bill is not ready for prime time in the House,” said Harris. “If it were a clean bill that didn’t put some constraints on how the district was going to spend that money, I would vote against the bill.”

Congress is also busy working on major legislation that will secure the border, reduce the budget deficit and deliver promised tax cuts.

“Every indication I have is that it’s not going to happen this week and probably not going to happen next week, and it’s not clear that it will happen,” said Mendelson.

The ongoing confusion adds to the drama of a city trying to move forward with a plan to return the NFL’s Washington Commanders to a

Washington, D.C. is also dealing with a Trump administration determined to downsize the federal government, which is the area’s largest employer.

The financial threat from a smaller federal workforce combined with a soft downtown office space market caused Moody’s to downgrade the city’s issuer rating to Aa1 from Aaa and revise its outlook to negative from stable in