Market performs ‘exceedingly well’ for the week

4 min read

Municipals were steady to firmer in spots Thursday, as U.S. Treasuries cheapened and equities ended mixed.

The two-year muni-UST ratio Thursday was at 69%, the five-year at 70%, the 10-year at 76% and the 30-year at 93%, according to Municipal Market Data’s 3 p.m. ET read. ICE Data Services had the two-year at 68%, the five-year at 70%, the 10-year at 74% and the 30-year at 92% at 4 p.m.

So far this week, the market has performed “exceedingly well” with the tailwind of June 1 reinvestment capital, said J.P. Morgan strategists led by Peter DeGroot.

ETFs saw $243 million of inflows on Wednesday after two sessions of outflows, they said.

“Better market conditions were reflected in lower bid wanteds (-11% vs avg.) and a better hit ratio (+1% vs. avg.) while the yield on customer purchases was 1-4bps lower throughout the curve, with 20yr and longer bonds outperforming,” the J.P. Morgan strategists said.

Elevated volume continued with $4.6 billion of tax-exempt issuance Thursday, and a large calendar is expected for next week, including $1.4 billion of tax and revenue anticipation notes from Los Angeles County, $817 million of GOs from Philadelphia and $700 million of GOs from Massachusetts in three series, they said.

“Cooperation of the UST market and muni ETF inflows will be essential to performance going forward as we move through the spate of issuance, particularly as each new deal expends more of June’s investment capital,” the J.P. Morgan strategists said.

“Whether the current pace going into the mid-summer continues is not known but visible supply of $22.2 billion may suggest that strong issuance is expected to carry over into early July,” said Mohammed Murad, head of municipal credit research at PTAM.

The “Liberation Day” effects of “postponed or shelved deals seem to have dissipated quickly,” he said, as April and May volumes ended 2% and 3.6% above last year, respectively.

“The market’s relief from the tax reconciliation bill preserving the tax exemption is one more element of certainty for municipal issuers in an environment of several unknowns, allowing them to potentially better plan long-term debt issuance for capital projects,” Murad said.

Some uncertainty remains “as to the final form of the tax bill that may impact state, higher education and healthcare credit and issuance specifically as it relates to potential for Medicaid expansion cuts,” he noted.

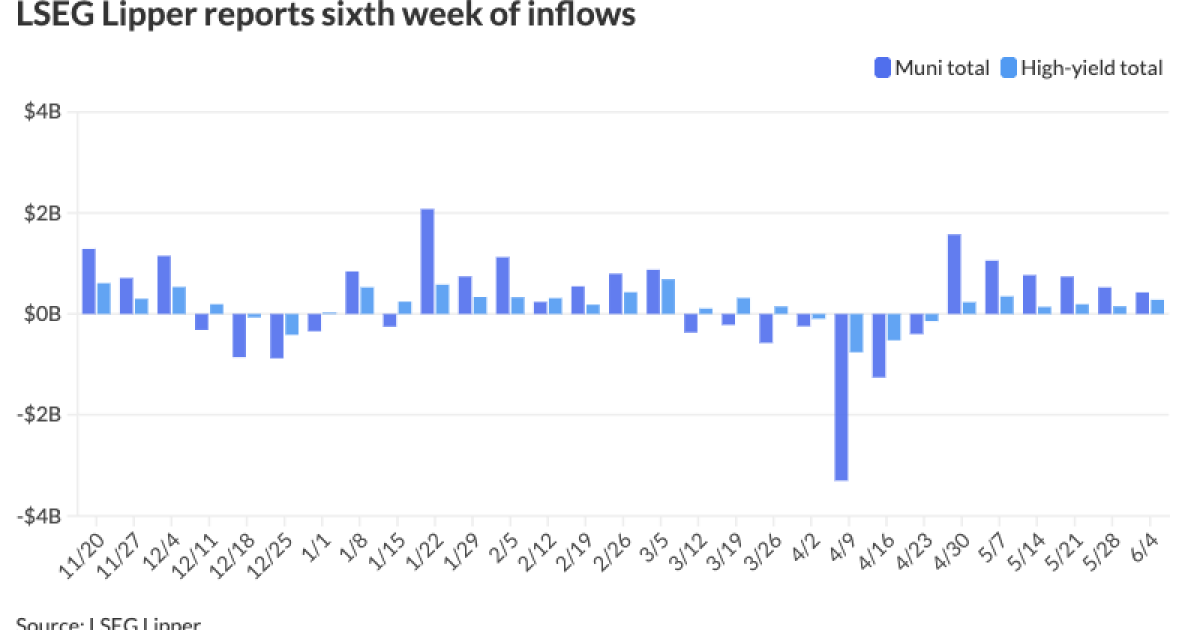

Fund flows have reversed course since President Trump’s tariff announcements, with six consecutive weeks of inflows.

There are already more inflow weeks year-to-date than in 2022 and 2023, Murad said.

“The tariff extensions and moratoriums of certain tariffs may have triggered a change in sentiment, whether temporary or permanent, is yet to be seen over the summer months,” he said.

In the primary market Thursday, Goldman Sachs priced for the

The second tranche, $207.355 million of Series 2025B (A3///), saw 5s of 6/2026 at 3.23%, 5s of 2030 at 3.31%, 5s of 2035 at 3.92%, 5s of 2040 at 4.57%, 5.25s of 2045 at 4.96%, 5.5s of 2050 at 5.03% and 5.5s of 2055 at 5.06%, callable 6/1/2035.

Barclays priced for the Los Angeles Department of Water and Power (Aa2//AA-/AA) $504.335 million of power system revenue bonds, with 5s of 7/2030 at 3.45% and 5s of 2035 at 3.93%, noncall.

Raymond James priced for the Jackson County School District, Georgia, (Aa1/AA+//) $200 million of general obligation school bonds, insured by the Georgia State Aid Intercept Program, with 5s of 3/2028 at 2.83%, 5s of 2030 at 2.96%, 5s of 2035 at 3.49%, 5s of 2040 at 4.10% and 5s of 2041 at 4.23%, callable 3/1/2035.

In the competitive market, Springfield, Missouri, (/AA+/AA+/) sold $307.51 million of public utility refunding revenue bonds, with 5s of 8/2026 at 2.83%, 5s of 2030 at 2.92%, 5s of 2035 at 3.52% and 5s of 2036 at 3.67%, callable 8/1/2035.

The Fayette County Board of Education, Kentucky, sold $229.97 million general obligation bonds, Series 2025A (Kentucky School District Enhancement Program), to BofA Securities, with 5s of 6/2026 at 2.92%, 5s of 2030 at 3.05%, 5s of 2035 at 3.65%, 5s of 2040 at 4.22%, 5.25s of 2045 at 4.65% and 5s of 2047 at 4.80%, callable 6/1/2034.

Fund flows

Investors added $426.2 million to municipal bond mutual funds in the week ended Wednesday, following $525.7 million of inflows the prior week, according to LSEG Lipper data.

High-yield funds saw inflows of $281.1 million compared to the previous week’s inflows of $150.5 million.

Tax-exempt municipal money market funds saw inflows of $168.6 million for the week ending June 3, bringing total assets to $141.553 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 2.04%.

Taxable money-fund assets saw $67.26 billion added, bringing the total to $6.833 trillion.

The average seven-day simple yield was at 3.99%.

The SIFMA Swap Index fell to 1.68% on Wednesday compared to the previous week’s 1.97%.

AAA scales

MMD’s scale was bumped up to three basis points: The one-year was at 2.72% (-3) and 2.70% (-3) in two years. The five-year was at 2.79% (-1), the 10-year at 3.34% (-1) and the 30-year at 4.56% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to four basis points: 2.74% (-1) in 2026 and 2.67% (unch) in 2027. The five-year was at 2.78% (-4), the 10-year was at 3.25% (-1) and the 30-year was at 4.51% (unch) at 4 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to three basis points: The one-year was at 2.73% (-3) in 2025 and 2.71% (-3) in 2026. The five-year was at 2.79% (unch), the 10-year was at 3.34% (unch) and the 30-year yield was at 4.56% (unch) at 4 p.m.

Bloomberg BVAL saw yields bumped up a basis point: 2.71% (-1) in 2025 and 2.73% (-1) in 2026. The five-year at 2.82% (-1), the 10-year at 3.30% (-1) and the 30-year at 4.52% (unch) at 4 p.m.

Treasuries saw losses.

The two-year UST was yielding 3.935% (+7), the three-year was at 3.904% (+7), the five-year at 3.999% (+8), the 10-year at 4.399% (+4), the 20-year at 4.904% (+2) and the 30-year at 4.886% (+1) near the close.