Munis shrug off Fed rate decision, dot plot

7 min read

Municipals and U.S. Treasuries were little changed after the Federal Reserve held rates steady, while equities ended mixed.

The Federal Open Market Committee’s decision to “hold rates steady while signaling only two cuts this year was a subtle but powerful shift,” said James Pruskowski, CIO at 16Rock Asset Management.

“The threat of having both inflation and unemployment rising simultaneously continues to create a big headache for the Fed’s interest policy,” noted Luis Alvarado, global fixed income strategist at Wells Fargo Investment Institute. “There is still a possibility where the federal funds rate could remain on hold at current levels in the near-term, especially if inflation remains sticky.”

As such, WFII said, “fixed-income investors may benefit from being exposed to the intermediate portion of the curve (3- to 7-year maturities), striking the best balance between attractive yield and less sensitivity to potential interest rate risk.”

Munis are “finally catching a bid, stepping tighter with Treasuries as supply fades and reinvestment demand builds,” Pruskowski said.

A “lower for longer sentiment” should improve confidence in the long-end, Pruskowski said.

This week is a “little quirky” because of the Juneteenth holiday on Thursday and the Federal Open Market Committee meeting, which led to a drop in issuance, said Jeff Timlin, a managing partner at Sage Advisory.

Despite this, the muni market will be “well supported” this week, as the asset class is doing “fairly well with very little consternation,” mostly ignoring the volatility other markets are experiencing, he said.

The two-year muni-UST ratio Wednesday was at 67%, the five-year at 69%, the 10-year at 75% and the 30-year at 93%, according to Municipal Market Data’s 3 p.m. ET read. ICE Data Services had the two-year at 65%, the five-year at 68%, the 10-year at 73% and the 30-year at 92% at 4 p.m.

Muni-UST ratios are more in the attractive ranges and have remained stable, with 10-year ratio in the mid-70s and the 30-year ratio over 90%, Timlin said.

There is plenty of available cash to take down the new issuance without “causing any disruptions and having to do a significant amount of selling to fund those purchases,” he noted.

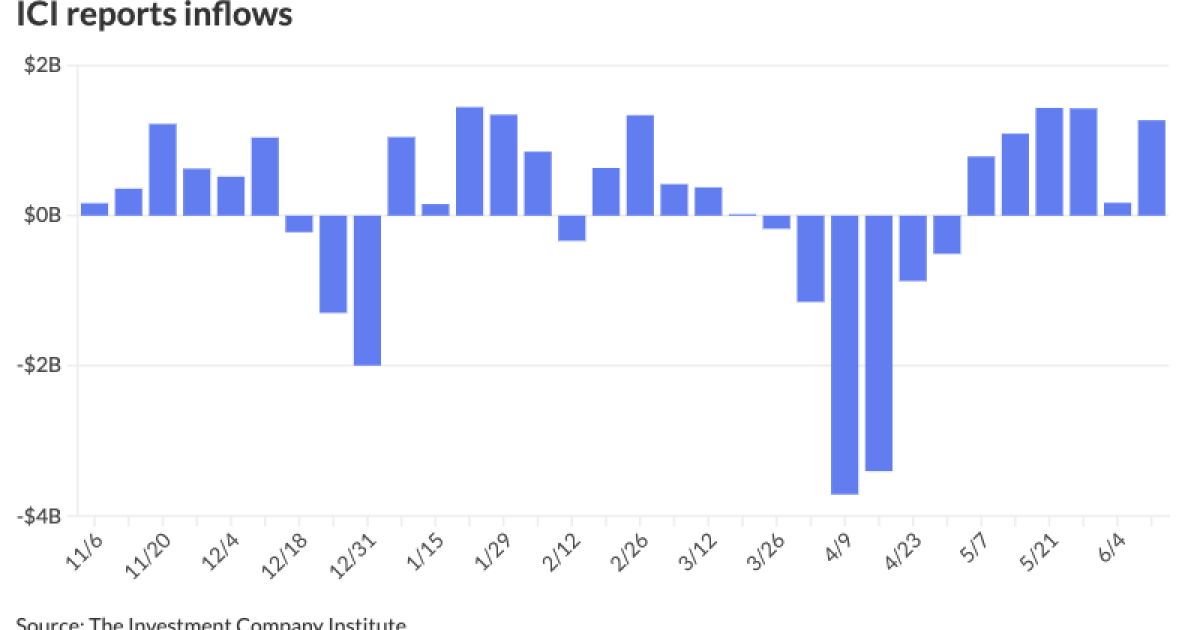

Generally, flows have been very stable, he said.

The Investment Company Institute Wednesday reported $1.27 billion of inflows for the week ending June 11, following $171 million of inflows the previous week.

Exchange-traded funds saw inflows of $1.075 billion after $13 million of outflows the week prior, per ICI data.

The market is approaching the fiscal budgetary season, with a majority of states planning to have their budget in place by June 30. This has led to budgetary issues “rearing up their ugly heads” in certain areas, Timlin said.

For example, cities and states that had challenges prior to the COVID-19 pandemic are now faced with those fiscal challenges again, he said.

The federal funding during the pandemic covered many challenges for several years, but with the money drying up, cities and states must figure out how to proceed with budgetary holes, which could potentially lead to spending cuts, he said.

Some municipalities that were so flush with cash have done a good job of putting money into the reserve fund, “but if they do dip into it this year to fund the coming year’s expenses, that will lead to a much greater problem come midyear in 2026,” Timlin said.

AAA scales

MMD’s scale was bumped two basis points 10 years and in: The one-year was at 2.62% (-2) and 2.63% (-2) in two years. The five-year was at 2.73% (-2), the 10-year at 3.30% (-2) and the 30-year at 4.54% (unch) at 3 p.m.

The ICE AAA yield curve was little changed: 2.68% (-1) in 2026 and 2.59% (-1) in 2027. The five-year was at 2.73% (unch), the 10-year was at 3.22% (unch) and the 30-year was at 4.50% (unch) at 4 p.m.

The S&P Global Market Intelligence municipal curve saw small bumps: The one-year was at 2.62% (-2) in 2025 and 2.62% (-2) in 2026. The five-year was at 2.72% (-2), the 10-year was at 3.30% (-2) and the 30-year yield was at 4.53% (unch) at 4 p.m.

Bloomberg BVAL was bumped up to two basis points: 2.63% (-2) in 2025 and 2.65% (-2) in 2026. The five-year at 2.76% (-2), the 10-year at 3.25% (-2) and the 30-year at 4.49% (unch) at 4 p.m.

Treasuries were little changed.

The two-year UST was yielding 3.936% (-2), the three-year was at 3.887% (-1), the five-year at 4.983% (-1), the 10-year at 4.388% (flat), the 20-year at 4.902% (-1) and the 30-year at 4.888% (flat) near the close.

FOMC

The FOMC held rates in a range between 4.25% and 4.5%, while keeping projections of two rate cuts this year.

The economy expanded “at a solid pace,” while the unemployment rate remained low and inflation was “somewhat elevated,” the statement said. “Uncertainty about the economic outlook has diminished but remains elevated.”

When questioned about that part of the statement, Fed Chair Jerome Powell noted uncertainty about tariffs peaked in April and has lessened but is still elevated. He said he expects to learn more about tariffs over the summer but can’t say when the Fed will have clarity on its impact on the economy and inflation.

The Summary of Economic Projections showed officials see inflation and unemployment rates ending the year higher than expected three months ago, while growth projections were reduced.

Although the two rate cuts for this year were the same as projected in the last dot plot, seven officials expect no cuts this year, up from four in the previous SEP. Two others see one cut this year. Eight predicted two cuts.

Officials also see one fewer cut next year.

Powell attributed the wide spread of projections for cuts among officials to diversity and officials’ differing assessments of risks. He again downplayed the importance of the dot plot. No officials have “real conviction” about their projections.

With the economy remaining solid, Powell said, monetary policy is in a good place. He added that the Fed’s action has helped keep the economy solid.

Powell defended the December cut by noting inflation expectations were lower and tariff proposals were not clear. He said the Fed expects “a meaningful amount of inflation” in the coming months.

“The larger story here is that there is a clear misalignment between political expectations and monetary policy objectives, as the Fed continues to maintain a wait-and-see approach to gauge the downstream impact of tariffs on the broader economy before taking action,” said Richard Flynn, managing director at Charles Schwab UK.

Dan Siluk, head of global short duration and liquidity and portfolio manager at Janus Henderson Investors, called it “a dovish hold that keeps the door open to rate cuts in the second half of 2025.”

The Fed continues to show patience “but is prepared to act if inflation continues to ease and labor market softness deepens,” he said. “The upward revision to inflation forecasts may temper expectations for aggressive easing, but the unchanged 2025 rate path reassures markets that the Fed remains flexible.”

Keeping two cuts penciled in for this year while expecting inflation to rise is “somewhat surprising,” said Seema Shah, chief global strategist at Principal Asset Management.

“Yet, any change in this year’s dot plot would have been interpreted as a signal that the Fed has a clear plan about its future policy path, when actually the likely truth is that, with the economic outlook still very much shrouded in uncertainty, the Fed is unsure of how things will pan out.”

Given inflation and the expected boost from tariffs, she said, “the current environment of persistent uncertainty is ripe ground for a policy misstep.”

As such, holding is “the wisest decision” the Fed could make, Shah said.

She expects one 25-basis-point cut in the final quarter of the year.

FHN Financial Chief Economist Chris Low said the Fed is “more concerned about future inflation and less inclined to cut rates than in April.”

“The Fed has flipped from a long-term data stance when inflation was raging, to this short-term data focus toward rising inflation, as we are seeing cracks in soft data coming from growth, consumers, labor markets and housing,” said Byron Anderson, head of fixed income at Laffer Tengler Investments. “The Fed seems obsessed with tariff inflation and [is] willing to sacrifice employment and GDP growth before adjusting this stance.”

“The Fed has pivoted to a more of a ‘kick the can down the road’ narrative as uncertainty may have diminished, but it’s still elevated according to their terms,” said Jay Woods, chief global strategist at Freedom Capital Markets.

Higher inflation and lower growth projections are not “the combination the Fed needs to make any rate cut or any rate move at this point,” he said.

The combination, Woods said, “does not bode well for any cuts in the foreseeable future.”

While the Fed will make decisions “one meeting at a time” until it has clarity on tariffs, he said, he expects no cuts before September. Woods is skeptical about the Fed cutting twice this year, calling that projection “murky at best.”

BMO Deputy Chief Economist Michael Gregory noted, “The Fed is weighing the risks of slower growth against those of faster inflation. If the former is significantly heavier, the Fed will likely ease, but if the latter is meaningfully heavier, the Fed will probably remain on hold (recall policy is still on the restrictive side). By summer’s end, we should be starting to see an emerging tilt to the slower growth side, setting the stage for a rate cut or two.”

Gary Siegel contributed to this story.