Bond insurance grows in 1H as demand remains strong

3 min read

Bond insurance increased in the first half of 2025 as demand for deals carrying debt wrapped by insurance remains strong, data showed.

Municipal bond insurance grew 12.4% in the first half of 2025 year-over-year, according to LSEG data.

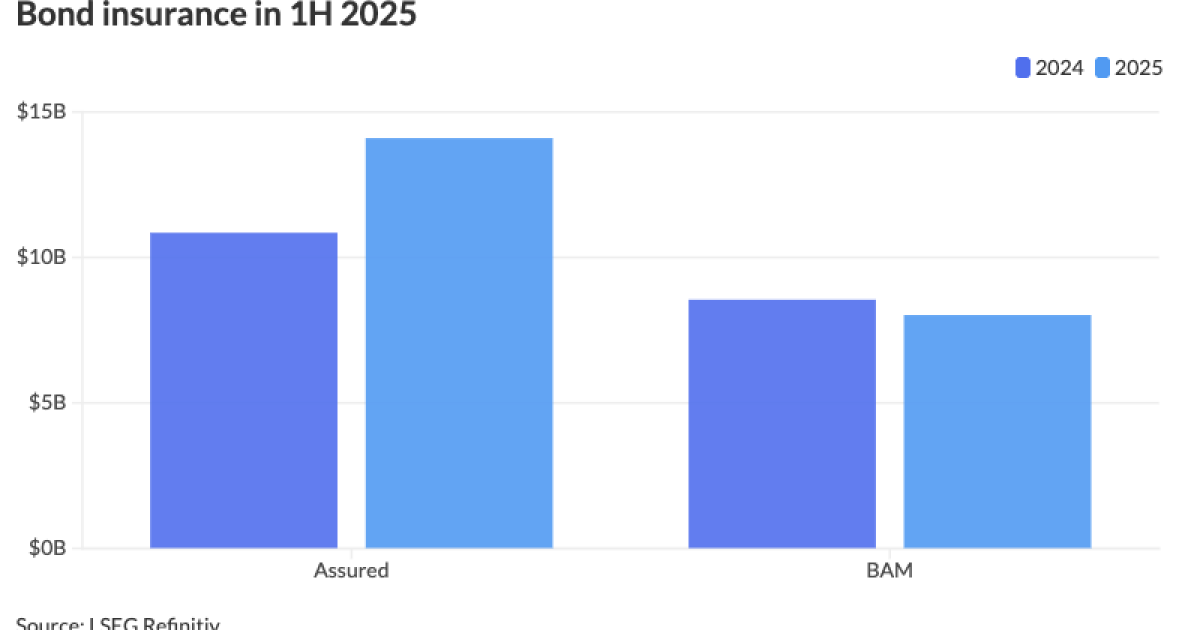

The top two municipal bond insurers wrapped $22.121 billion in 1H 2025, up from $19.4 billion in 1H 2024, the data shows.

The industry par amount was achieved in 873 deals versus 770 deals a year ago.

Bond insurance penetration was at 7.9% for the first half of 2025, in line with the 7% to 8% range seen since 2021 for all bonds, said Matt Fabian, a partner at Municipal Market Analytics.

“More insured bond volumes overall suggest better financial metrics for the companies themselves, plus improved liquidity for insured paper,” he said. “The latter is an important feature as, in the coming years, municipal credit quality and borrowing capacity are apt to become more strained via climate change and federal policy retrenchment.”

While it’s unclear what both “vectors” indicate in the long term for the muni market, in the near– to medium-term, “MMA sees bond insurance as a solid means for bond buyers to add incremental credit protection/diversification for climate and otherwise vulnerable portfolios,” Fabian said.

Both Assured Guaranty and Build America Mutual commented about the importance of bond insurance, especially its value among institutional investors.

“Assured Guaranty has continued to insure a significant number of large transactions launched in the municipal market,” said Robert Tucker, senior managing director of investor relations and communications at Assured Guaranty. “This demonstrates the continued value and confidence institutional investors place on our guaranty, which includes the price stability and increased market liquidity our insurance can potentially provide.”

“Institutional investors have become increasingly significant consumers of bond insurance, using it to mitigate risks tied to large single-name exposures and to improve price stability in their portfolios,” said Mike Stanton, head of strategy and communications at BAM.

Assured Guaranty accounted for a total of $14.099 billion in 473 deals for a 63.7% market share in the first half of 2025, up from $10.846 billion in 330 deals for a 55.9% market share in the first half of 2023.

The 473 primary market deals guaranteed during 1H 2025 was up over 43% from the first half of 2024, Tucker said.

Overall, during the first half of 2025, the firm’s primary and secondary insured par totaled around $15 billion.

In the second quarter, Assured provided more than $100 million of insurance to 19 deals totaling $5.3 billion in par, Tucker said.

The insured par amounts of some of these sizable deals included $1 billion for the Dormitory Authority of the State of New York; $844 million for Utah’s Downtown Revitalization Public Infrastructure District; $411 million for Allegheny County Airport in Pennsylvania and $361 million for Meritus Health in Maryland, through the Maryland Health and Higher Educational Facilities Authority, he said.

Assured continued to add value on double-A credits in Q2, writing 54 policies — 43 new issue transactions and 11 secondary market policies — totaling $3.3 billion, Tucker noted.

“Even on such highly rated credits, we believe issuers and investors see our guaranty as a way to further enhance credit quality, reduce borrowing costs, mitigate the impact of downgrade and headline risk, improve market liquidity and potentially stabilize market value,” Tucker said.

Meanwhile, BAM insured $8.022 billion, or a 36.3% market share, in 400 deals during 1H 2025, compared to $8.554 billion, or a 44.1% market share, in 440 deals in the first half of last year.

While BAM saw a small year-over-year decline, the firm saw a record second quarter in the primary market and the trend has continued into the third quarter, Stanton said.

“The very heavy new-issue volume and increased volatility across all fixed-income markets highlights the opportunity for investors to enhance liquidity and credit stability with insured bonds,” he said.

In the muni market, issuers were almost 40% more likely to use bond insurance on new deals in Q2 compared with Q1, according to Stanton.

BAM insured 11 deals with par of at least $100 million during the first half, and 27% of BAM’s insured new issues had underlying ratings in the double-A category from S&P Global Ratings or Moody’s Ratings, he said.

Noteworthy deals included the Los Angeles Department of Water and Power’s $455 million of power system revenue bonds, BAM’s largest-ever deal in California; $297 million for student housing at the University of Washington; and $221 million for the Board of Education in Fayette County, Kentucky, he noted.