Munis firm slightly, $1.5B Washington GOs sell

7 min read

Municipals were slightly firmer Thursday as $1.46 billion of Washington general obligation bonds sold in the competitive market in four series. U.S. Treasury yields were little changed and equities ended lower.

The two-year muni-UST ratio Thursday was at 61%, the five-year at 64%, the 10-year at 76% and the 30-year at 96%, according to Municipal Market Data’s 3 p.m. ET read. ICE Data Services had the two-year at 61%, the five-year at 66%, the 10-year at 76% and the 30-year at 96% at a 4 p.m. read.

Tax-exempt munis have underperformed year-to-date, said David Hammer, a managing director and portfolio manager at PIMCO.

Taxable fixed-income is seeing gains of 3.5%, he said, citing the Barclays Aggregate Bond Index.

Investment-grade munis are down on average close to 1%, while some high-yield funds are down as much as 5% or 6% due to credit widening.

“It’s a rare occurrence for investment-grade municipals to underperform taxable fixed income by 400 basis points in a calendar year,” Hammer said.

The main driver of the underperformance has been increased supply, with issuance in 2025 totaling the “high 500s,” which would be up 35% to 40% from the average of the pre-COVID years, he noted.

In the long term, the average supply is likely higher given the cost of infrastructure, increased state expenses and the “pull forward effect ” of issuance during the first half of 2025 because of the tax reform bill, Hammer said.

Supply will likely “taper” a bit in the second half of the year, he said.

The 10s30s municipal curve has a slope of around 150 basis points, which is 100 basis points wider than the UST curve, per Hammer.

Some of the structural steepness comes from the high concentration from traditional retail investors inside of 10 years and lower corporate tax rates, he said.

The curve will stay steeper, but it’s probably currently “excessively” steep because valuations on the long end are cheap, he noted.

Meanwhile, retail has been slow to return to longer-duration muni bonds, according to Hammer.

In 2022 and 2023, around $150 billion left the market, with only a third of that returning — mainly concentrated 10 years and in — through “programmatic” separately managed account investment, he said.

Banks and insurance companies, historically big supporters of the long end, have less demand at lower relative yield levels due to lower corporate tax rates, he said.

“So all of that has contributed to a steeper curve, but really attractive valuations versus other asset classes at today’s prices,” Hammer said. “Particularly longer-maturity high-quality bonds with tax-exempt yields of 5%. Investors in the highest tax bracket would have to earn well north of 8% to get the same after-tax return.”

“And for banks and insurance companies in a 21% tax bracket, we see about a 50-basis-point pickup of buying munis over corporate bonds. That’s attractive. That’s a relative valuation that we would expect more support from banks and insurance companies. So there’s been a fair amount of underperformance, but current yields are attractive for a variety of investor types,” he said.

In the competitive market Thursday, Washington (Aaa/AA+/AA+/) sold $539.43 million of various purpose GOs, Series 2026A, Bid Group 1, to Barclays, with 5s of 8/2031 at 2.78%, 5s of 2035 at 3.42%, 5s of 2040 at 4.16% and 5s of 2043 at 4.49%, callable 8/1/2035.

The state sold $486.66 million of various purpose GOs, Series 2026A, Bid Group 2, to J.P. Morgan, with 5s of 8/2044 at 4.60%, 5s of 2045 at 4.66% and 5s of 2050 at 4.82%, callable 8/1/2035.

Additionally, Washington sold $283.77 million of motor vehicle fuel tax and vehicle-related fees GOs, Series 2026B, to BofA Securities, with 5s of 6/2026 at 2.43%, 5s of 2030 at 2.65%, 5s of 2035 at 3.46%, 5s of 2040 at 4.15%, 5s of 2045 at 4.63% and 5s of 2050 at 4.80%, callable 6/1/2035.

The state sold $152.835 million of taxable GOs, Series 2026T, to Wells Fargo, with all bonds priced at par: 4.12s of 8/2026, 4.07s of 2030 and 4.2s of 2031, noncall.

In the primary market, J.P. Morgan priced for Orlando, Florida, (/AA//) $422.29 million of contract tourist development tax revenue bonds (Camping World Stadium), insured by Assured Guaranty, with 5s of 11/2025 at 2.74%, 5s of 2030 at 3.01%, 5s of 2035 at 3.90%, 5s of 2040 at 4.66%, 5.25s of 2045 at 5.04%, 5.5s of 2050 at 5.23%, 5.125s of 2050 at 5.28% and 5.5s of 2055 at 5.29%, callable 11/2/2035.

BofA Securities priced for the Capital Trust Authority (A3/A//) $299.27 million of UF Health projects healthcare facilities revenue and revenue refunding bonds, Series 2025A, with 5s of 12/2030 at 3.26% (non-Assured Guaranty-insured), 5s of 2030 at 3.16% (AGM-insured), 5s of 2035 at 4.06% (non-AGM-insured) and 5s of 2035 at 3.95% (AGM-insured), noncall.

Jefferies priced for the Dormitory Authority of the State of New York (Baa3/BBB//) $246.52 million of Mount Sinai Obligated Group revenue bonds, with 5s of 7/2031 at 3.47%, 5s of 2035 at 4.19%, 5.5s of 2040 at 4.88%, 5s of 2045 at 5.32% and 5.25s of 2050 at 5.51%, callable 7/1/2035.

Mesirow Financial priced for the Comal Independent School District, Texas, (Aaa///) $209.295 million of PSF-insured unlimited tax school building bonds, with 5s of 2/2026 at 2.53%, 5s of 2030 at 2.76%, 5s of 2035 at 3.57%, 5s of 2040 at 4.30%, 5s of 2045 at 4.75% and 5s of 2050 at 4.89%, callable 2/1/2035.

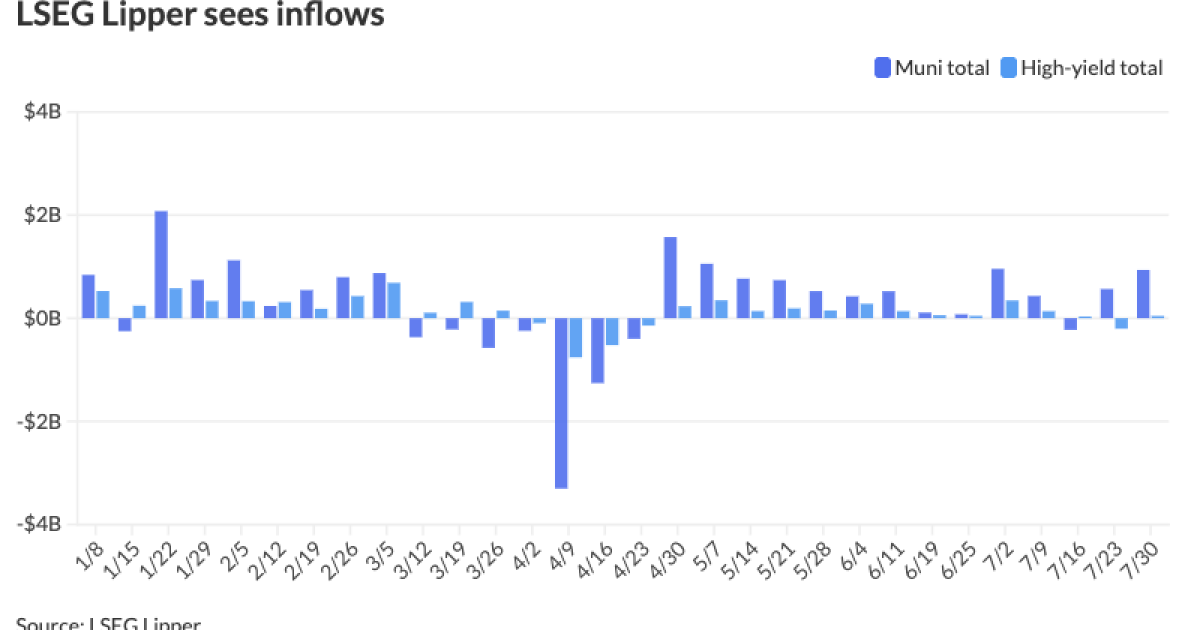

Fund flows

Investors added $937.3 million to municipal bond mutual funds in the week ended Wednesday, following $567.6 million of inflows the prior week, according to LSEG Lipper data.

High-yield funds saw inflows of $44.1 million compared to outflows of $202.5 million the previous week.

Tax-exempt municipal money market funds saw inflows of $246 million for the week ending July 29, bringing total assets to $136.315 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds rose to 2.41%.

Taxable money-fund assets saw $2.774 billion added, bringing the total to $6.905 trillion.

The average seven-day simple yield was at 3.99%.

The SIFMA Swap Index was at 2.29% on Wednesday compared to the previous week’s 2.73%.

AAA scales

MMD’s scale was bumped two basis points: The one-year was at 2.39% (-2) and 2.39% (-2) in two years. The five-year was at 2.53% (-2), the 10-year at 3.32% (-2) and the 30-year at 4.67% (-2) at 3 p.m.

The ICE AAA yield curve was bumped three to four basis points: 2.40% (-3) in 2026 and 2.35% (-3) in 2027. The five-year was at 2.54% (-3), the 10-year was at 3.25% (-3) and the 30-year was at 4.62% (-3) at 3:15 p.m.

The S&P Global Market Intelligence municipal curve was bumped two basis points: The one-year was at 2.39% (-2) in 2025 and 2.40% (-2) in 2026. The five-year was at 2.53% (-2), the 10-year was at 3.31% (-2) and the 30-year yield was at 4.67% (-2) at 3 p.m.

Bloomberg BVAL was bumped two basis points: 2.36% (-2) in 2025 and 2.38% (-2) in 2026. The five-year at 2.50% (-2), the 10-year at 3.25% (-2) and the 30-year at 4.63% (-2) at 3:15 p.m.

Treasuries were little changed.

The two-year UST was yielding 3.952% (+1), the three-year was at 3.896% (+1), the five-year at 3.965% (flat), the 10-year at 4.363% (-1), the 20-year at 4.887% (-1) and the 30-year at 4.893% (-1) at 3:15 p.m.

FOMC redux

Economists continued to opine on the Federal Open Market Committee meeting and its consequences.

Federal Reserve Chairman Jerome Powell faces “renewed pressure to cut the fed funds rate” with two governors dissenting in favor of a 25-basis-point easing of monetary policy, said Arthur Laffer, Jr., president of Laffer Tengler Investments.

“Unfortunately, the appearance of political pressure and bias seems to be more and more apparent on both sides of the fence as it involves the Fed,” he said, noting President Donald Trump visited the Federal Reserve to observe the renovation project “that he has accused the chairman of criminal negligence for cost overruns and lack of oversight of the project.”

And while one could make a case to cut or not cut, Laffer said, “what’s interesting is that the market is already pricing in 100-150 basis points in fed funds cuts with the 10-year bouncing around the 4.40% level. Assuming a term premium of between 100-150 basis points, the Fed could cut the fed funds rate by 125-150 and the 10-year should stay where it is, all things considered.”

And while the meeting outcome, with the dissents, was expected, Natalia Lojevsky, managing director at CIFC Asset Management, said it sets “up September to be a potentially contentious meeting.”

While the Fed will retain an easing bias through the summer, “inflation readings for July and August will ultimately determine the timing of the first cut,” she said.

“Political pressure is unlikely to affect the Fed’s interest rate decisions before Powell’s term ends,” said Bill Adams, chief economist at Comerica Bank. “Chair Powell is a huge admirer of former Chairman Paul Volker whose legacy is based on resisting pressure for rate cuts. He is independently wealthy. He’s admired on both sides of the aisle in Congress. He is respected on Wall Street. At 72 years young, he does not need to worry about his next job. If he is thinking about anything besides the Fed’s mandate for stable prices and maximum employment, it is his legacy.”

Comerica expects a 25-basis-point cut in December. “If the unemployment rate holds steady and tariffs push up inflation, it will be hard to justify a rate cut in the next few months.”

James Knightley, chief international economist at ING, agrees December is the likely time for the next rate cut, but “it may be a 50 bp cut if the evidence on weaker jobs and GDP growth becomes more apparent as we anticipate. This would be a similar playbook to the Federal Reserve’s actions in 2024, where it waited until it was completely comfortable to commit to a lower interest rate environment. Then it made a 50 bp move in September, followed by 25 bp cuts in November and December.”

Gary Siegel contributed to this story.