Munis see large cuts on front end ahead of $6.8B new-issue calendar

7 min read

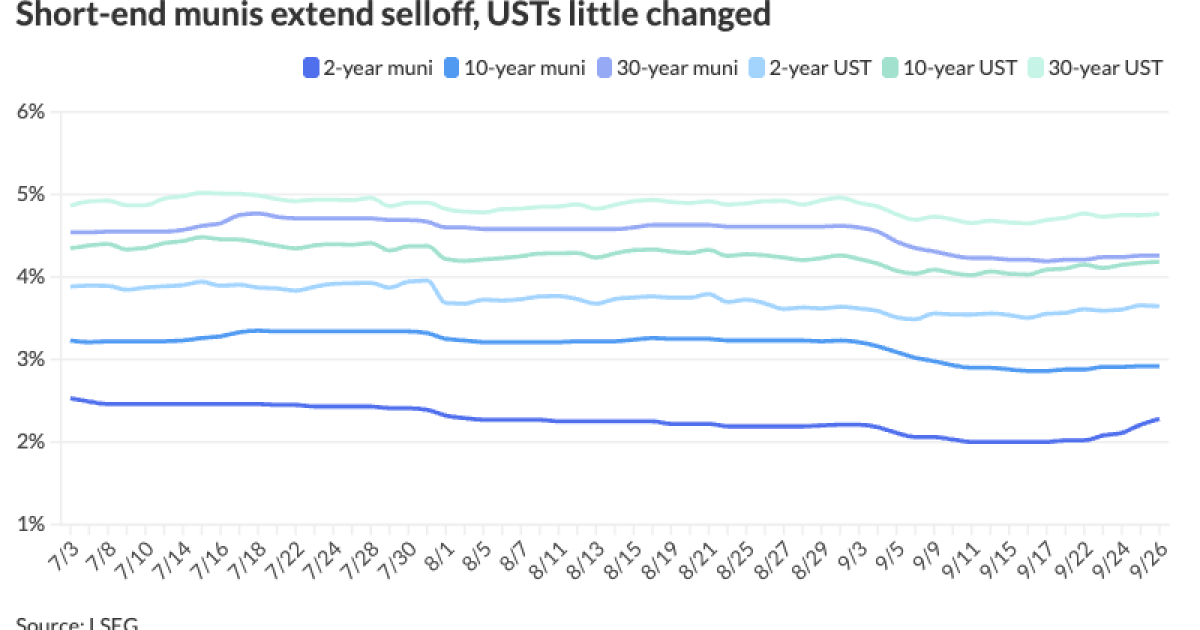

Munis faced pressure on the front end of the curve as U.S. Treasury yields were little changed and equities ended up.

Muni yields rose up to eight basis points, depending on the scale, with the largest losses again on the front end of the curve.

Part of the front-end correction has been a result of the level of ratios, said Ajay Thomas, head of public finance at FHN Financial.

The two-year muni-UST ratio Friday was at 62%, the five-year at 61%, the 10-year at 70% and the 30-year at 89%, according to Municipal Market Data’s 3 p.m. ET read. ICE Data Services had the two-year at 61%, the five-year at 61%, the 10-year at 71% and the 30-year at 90% at a 4 p.m. read.

“Up front, it’s been a little bit more challenging. So I think that they’ve been just trying to catch up a little bit,” Thomas said.

The spike in muni yields comes as people are positioning for the end of the third quarter, which happens Tuesday, and a potential federal government shutdown, which would add volatility to the market, he said.

“People are focused on this federal budget deal to see if anything can get struck,” and with Tuesday fast approaching, it doesn’t look good, Thomas said.

Currently, the market has learned to “take a breather” before reacting to macroeconomic and policy news. If a shutdown happens, the market will react accordingly, he said.

Even with this week’s selloff, which saw MMD yields rise up to 26 basis points on the front end, MMD-UST ratios have outperformed and are no longer as cheap as they were, Barclays strategists, led by Mikhail Foux said.

“They are actually very rich in the 3-7y range, are on the more expensive side in the 7-12y maturity bucket, and are close to fair value for the long end,” they said.

Barclays strategists are optimistic about muni performance in the fourth quarter, but the upside is “capped,” at least for the time being.

October has not been an “overly profitable” month for tax-exempt munis over the past 10 years, when 10-year munis underperformed USTs six times, they said.

If 2020 is removed, a time when tax-exempts had a strong performance in the post-COVID recovery, “the average ratio change is virtually zero in that month — more so year-end rallies frequently start in late October, meaning that performance is typically worse in the first half of the month,” Barclays strategists said.

Muni market internals seem to be “mixed” in October, at least the first two weeks of the month, said BofA strategists.

“There appears to be no slowdown in the primary market despite the light issuance volume [next week],” they said.

The surge in issuance next month has contributed to poor performance in the past, as October is usually one of the heaviest supply months of the year, Barclays strategists said.

BofA strategists expect October supply to be $58 billion, significantly higher than September, while principal redemption and coupon payments are forecast at $47 billion.

Constant large inflows into muni mutual funds “should keep the market roughly balanced in October, but a more sideways market next month is most likely,” BofA strategists said.

“Macro rates environment and muni market internal supply/demand dynamics support the idea that the muni market is going nowhere for the next few weeks, and that large, positive performance will come in the November/December time frame,” they said.

New-issue calendar falls

Issuance for the week of Sept. 29 is an estimated $6.771 billion, with $5.85 billion of negotiated deals and $921.2 million of competitive deals on tap, according to LSEG.

The Los Angeles Department of Water and Power leads the negotiated calendar with $812.69 million of power system revenue bonds, followed by the Lower Alabama Gas District with $678.14 million of gas project revenue refunding bonds.

The competitive calendar is led by the Arlington Economic Development Corp. with $70.86 million of taxable sales tax revenue bonds.

AAA scales

MMD’s scale saw large cuts on the front end: 2.38% (+7) in 2026 and 2.28% (+7) in 2027. The five year was at 2.30% (+4), the 10-year was at 2.92% (unch) and the 30-year was at 4.26% (unch) at 3 p.m.

The ICE AAA yield curve was cut up to eight basis points: 2.30% (+8) in 2026 and 2.25% (+8) in 2027. The five-year was at 2.31% (+6), the 10-year was at 2.95% (+3) and the 30-year was at 4.27% (unch) at 4 p.m.

The S&P Global Market Intelligence municipal curve saw large cuts on the front end of the curve: The one-year was at 2.34% (+6) in 2025 and 2.24% (+6) in 2026. The five-year was at 2.30% (+5), the 10-year was at 2.93% (unch) and the 30-year yield was at 4.27% (unch) at 3 p.m.

Bloomberg BVAL was cut nine years and in: 2.27% (+6) in 2025 and 2.24% (+6) in 2026. The five-year at 2.28% (+4), the 10-year at 2.91% (unch) and the 30-year at 4.25% (unch) at 4 p.m.

Treasuries were little changed.

The two-year UST was yielding 3.644% (-1), the three-year was at 3.654% (flat), the five-year at 3.769% (+1), the 10-year at 4.184% (+1), the 20-year at 4.738% (+2) and the 30-year at 4.761% (+1) at the close.

PCE

Despite the Federal Reserve’s preferred inflation measure remaining above target, economists still see the Fed easing policy.

“We think the Federal Open Market Committee is still on track for two more rate cuts this year and three next year, bringing the fed funds rate to 2.75%-3% by the end of 2026,” said Payden & Rygel Chief Economist Jeffrey Cleveland.

That would take rates “below the market’s implied rate at the moment as well as the FOMC’s median dot,” he said.

Inflation should moderate in the next year, Cleveland said, “though there are concerns raised by the slowdown in payroll hiring.”

Still, he noted, “the U.S. economy and consumer remain resilient.”

The report “will do nothing to derail the continued high expectation that the Federal Reserve will cut rates again at their October 29th meeting,” said Greg Wilensky, head of U.S. fixed income at Janus Henderson Investors.

Despite recent suggestions of economic strength, he said, the Fed “will continue to lean into its view that the downside risks to its full employment mandate are the bigger concern now unless they see convincing evidence to the contrary. This would give them a green light to continue to make policy less restrictive.”

Katy Stoves, investment manager at Mattioli Woods, agreed the report hasn’t altered market expectations of an October rate cut.

“The trajectory of future rate cuts appears increasingly tied to employment data rather than inflation metrics, given PCE’s relatively stable trajectory around the Fed’s 2% target,” she said.

“If businesses remain in a ‘low hire – low fire’ mode, the job market should remain stable enough to keep the economy out of recession but at the same time, add frustrations for the Fed interested in easing rates without stoking greater inflation pressure,” said Jeffrey Roach, chief economist at LPL Financial.

But Gary Schlossberg, market strategist at Wells Fargo Investment Institute, said the report “may raise fresh doubts about the Fed’s tilt toward a soft jobs market as the main driver of multiple rate cuts during the balance of the year. The data added to the evidence of brisk summer growth atop second-quarter strength, contributing to inflation still materially above the Fed’s 2% target.”

Goods and services are now contributing to inflation pressure, said Olu Sonola, head of U.S. economic research at Fitch Ratings. “While there isn’t much evidence of tariff-induced inflation in this report, the Fed will not be happy with services inflation — it’s been accelerating since April.”

If services inflation reaccelerates, he said, it will contradict the belief that tariffs will cause a one-time price increase.

“The Fed can’t look away now — the upside risk to inflation is clear and present,” Sonola said.

Primary to come

The Los Angeles Department of Water and Power (Aa2//AA-/AA/) is set to price Wednesday $812.69 million of power system revenue bonds, Series 2025C. Wells Fargo.

The Lower Alabama Gas District (A1///) is set to price $678.14 million of gas project revenue refunding bonds, Series 2025A. Goldman Sachs.

The Allegheny County Sanitary Authority (Aa3/AA-//) is set to price Tuesday $421.61 million of sewer revenue bonds. J.P. Morgan.

Norfolk, Virginia, (/AAA/AA+/) is set to price Tuesday $261.93 million of GO capital improvement and refunding bonds, consisting of $247.145 million of tax-exempts and $14.785 million of taxables. BofA Securities.

The Park Creek Metropolitan District (/AA//) is set to price Tuesday $244.475 million of senior limited property tax supported revenue refunding and improvement bonds. RBC Capital Markets.

Memphis, Tennessee, (Aa2//AA/) is set to price Tuesday $233.165 million of Memphis Light Gas and Water Division electric system revenue bonds. Raymond James.

The New Mexico Finance Authority (Aa1/AAA//) is set to price Tuesday $216.68 million of subordinate lien public project revolving fund revenue bonds, Series 2025C. BofA Securities.

The Cherry Creek School District No. 5, Colorado, (Aa1/AA//) is set to price Wednesday $193.09 million of GO refunding bonds. RBC Capital Markets.

The Birmingham Special Care Facilities Financing Authority, Alabama, (/AA-/AA-/) is set to price Wednesday $187.87 million of health care facilities revenue bonds, Series 2025A Children’s Hospital. J.P. Morgan.

The North East Texas Regional Mobility Authority is set to price Wednesday $181.52 million of revenue and refunding bonds, consisting of $133.935 million of senior lien bonds, Series 2025 (Baa1/A//), and $47.585 million of subordinate lien bonds, Series 2025B (Baa2/A-//). BofA Securities.

The Riverside County Public Finance Authority (/AA//) is set to price Wednesday $175.75 million of tax allocation refunding revenue bonds, Series 2025A. Loop Capital Markets.

The Indiana Housing and Community Development Authority (Aaa///) is set to price Tuesday $175.53 million of social single-family mortgage revenue bonds, consisting of $102.78 million of non-AMT Series 2025C-1 bonds, $57.75 million of taxable Series 2025C-2 bonds and $15 million of taxable pass-through Series 2025C-3 bonds. RBC Capital Markets.

Cook County, Illinois, (/AA-/AA/AAA) is set to price Wednesday $149.41 million of sales tax revenue bonds. Ramirez.

Riverside County is set to price Thursday $148.1 million of Teeter Plan obligation notes, Series 2025A. Loop Capital Markets.

New Haven, Connecticut, (Baa1/A-/A-/) is set to price Tuesday $118.72 million of refunding GOs. Cabrera Capital Markets.

The Maine State Housing Authority (Aa1/AA+//) is set to price Tuesday $117.825 million of social mortgage purchase bonds, Series 2025D. BofA Securities.

The Wisconsin Housing and Economic Development Authority (Aa3/AA+//) is set to price $105.34 million of non-AMT housing revenue bonds, consisting of $39.92 million of Series 2025A bonds and $65.42 million of Series 2025B bonds. Wells Fargo.

Competitive

The Arlington Economic Development Corp. (Aa1/AA//) is set to sell $70.86 million of taxable sales tax revenue bonds at 11 a.m. Eastern Tuesday.

Gary Siegel and Frank Gargano contributed to this report.