Anatomy of a deal: Texas power plant financing wins small issuer category

5 min read

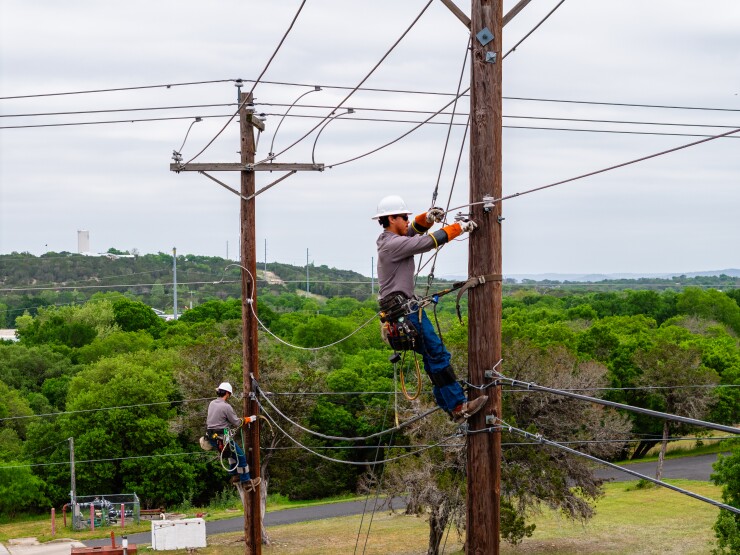

Kerrville Public Utility Board

The path to an inaugural bond sale by the Kerrville Public Utility Board Public Facility Corp. in Texas to help finance construction of a 122-megawatt natural gas-fired power plant was full of twists and turns.

Officials behind the $74.4 million tax-exempt power supply revenue bond offering persevered through unexpected events, including a devastating flood that occurred between the June 25 pricing and July 10 closing. The deal, which is aimed at delivering energy reliability, affordability, and economic resilience in the Texas Hill Country, is the

The Kerrville Public Utility Board, which serves about 24,500 customers in Kerr County, created the non-profit corporation last year as part of a plan to build the board’s first generating plant, according to Amy Dozier, the board’s assistant general manager.

“We could basically maintain our same kind of purchase power structure that we currently have, and the way that our rates are structured, and the way that we bill our customers, if we set up a separate company that just owned this power generation plant,” she said.

The facility, which will be operated by a private company, is targeted to be online in 2027.

A long-term power purchase agreement between the corporation and KPUB provides security for the bonds, which will only partially fund the plant. A low-cost loan from the Texas Energy Fund — which was created by a constitutional amendment approved by voters in November 2023 to spur additional power generation — was also sought.

The Texas Attorney General’s Office determined legislation was needed to permit the fund to provide a loan to a municipally owned utility, which would secure the debt with revenue rather than with the asset itself, according to Dozier.

That ability was added to a

The up to $105 million, 20-year loan at a 3% interest rate with the Public Utility Commission of Texas, which is also secured by the power purchase agreement,

“This natural gas power plant will help bear the load of the largest electricity demand area in the state as we continue our mission to add more power to the grid and power more homes,” Abbott said in a statement announcing the loan.

Ahead of pricing the revenue bonds, a supplement to the preliminary official statement was posted to disclose that plaintiffs in a 2023 challenge to the constitutional amendment’s voting results filed a petition for review June 13 with the Texas Supreme Court, which subsequently denied the request on Aug. 1, Dozier said.

Steven Adams, a managing director at Specialized Public Finance, the deal’s financial advisor, said insurance from BAM Mutual, rated AA by S&P Global Ratings, provided a present value benefit.

“When you have an electric utility in (Electric Reliability Council of Texas), when you have a new project like we have, bond insurance really helps because ERCOT in itself is hard to understand, much less a new issuer with a first-time power plant,” he said.

Jill Schmidt, BAM Mutual’s head of public power, said Kerrville PUB has “a stable, diverse customer base, affordable rates and provided solid legal protections for bondholders, which supported our decision to insure the bonds.”

“The planning that the PUB put into the project, along with the Texas Energy Fund’s participation, make it clear that this is an essential asset with strong community support,” she added in a statement.

S&P gave the bonds an underlying A rating with a stable outlook, citing “KPUB’s planned power supply transition from a well-diversified load-following contract with CPS Energy at the end of 2026 to a power supply reliant on natural-gas-fired peaking resources and additional power purchase agreements to mitigate its exposure to price spikes in the (ERCOT) market, particularly during summer and winter months.”

The bonds, which were structured with serial maturities from 2028 through 2047, faced market headwinds amid heavy supply, particularly from Texas issuers, on pricing day. Senior manager BofA Securities took down an unsold balance of $18.07 million at initial pricing levels.

Adams said the unsold debt was “kind of on the short end of the curve,” noting it had less impact than if it had been on the long end of the curve where it would have impacted the yield on the overall transaction the most.

“What we were happy with about the whole thing is the yield came in lower than our projections that we were using for the pro forma models,” he added.

The deal’s true interest cost was 4.77%, according to Dozier.

Kerrville Public Utility Board

Tragedy struck before the bond closing. A July 4 deadly flash flood on the Guadalupe River led to the posting of another supplement on July 8 disclosing the disaster, power outages, and estimated repair costs for a flooded KPUB electric substation, which was insured, and the repair or replacement costs for about two miles of destroyed overhead electric distribution lines.

“Key disclosures include the fact that the site of the new power plant was outside the affected area, as well as information that demonstrated that the system’s finances are likely to be resilient, even accounting for the direct costs of storm-related damage to the PUB’s property, and the potential longer-term revenue losses from destroyed properties,” a nomination statement for the deal said.

KPUB filed claims with the Federal Emergency Management Agency seeking a 75% reimbursement of about $1.6 million for damages, according to Dozier.

She and Adams said they were not aware of any investors pulling out of the deal ahead of the closing. Financing team members donated significant amounts of money to flood relief efforts, according to the nomination statement.

Co-managers in the deal were Wells Fargo Securities, RBC Capital Markets, and PNC Capital Markets. Bond counsel was Norton Rose Fulbright.