Muni yields keep falling as supply remains light

7 min read

Municipals were firmer Monday as yields continue to fall, while U.S. Treasuries were better and equities ended mixed.

Triple-A benchmarks were bumped four to eight basis points, depending on the scale, while UST yields fell three to six basis points.

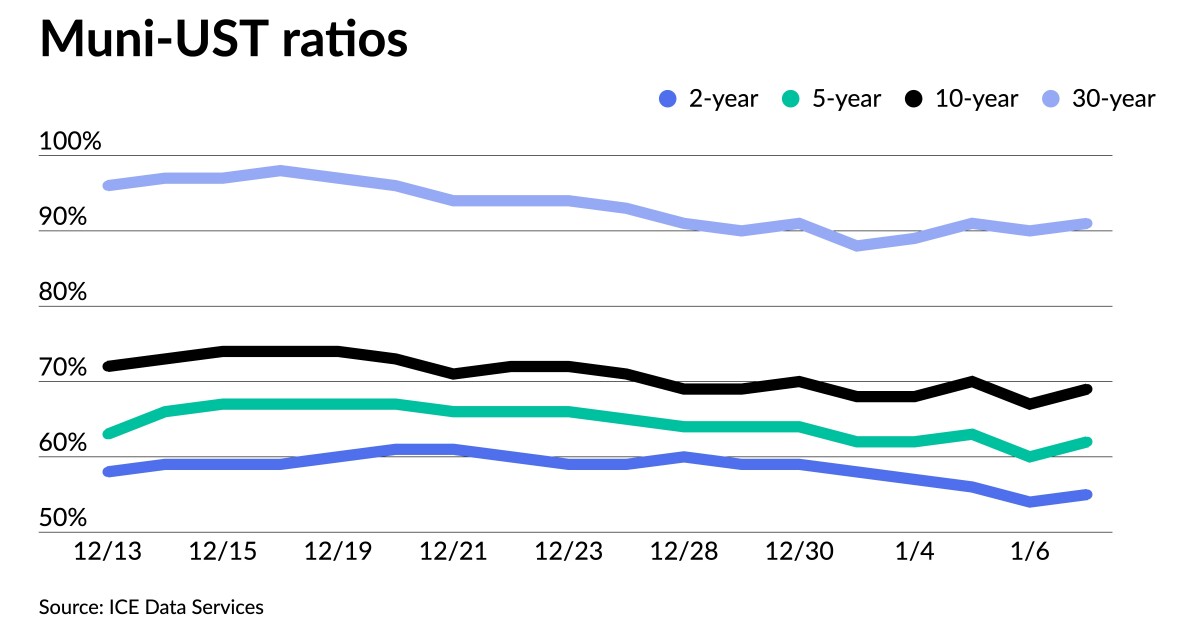

The three-year muni-UST ratio was at 59%, the five-year at 63%, the 10-year at 69% and the 30-year at 92%, according to Refinitiv MMD’s final 3 p.m. ET read. ICE Data Services had the three at 58%, the five at 62%, the 10 at 69% and the 30 at 91% at a 4 p.m. read.

Munis started “the year off on a high note as just one week into the new year munis are up by 1.15% with the long end up by over 2%,” due “in part to the lack of new issue supply with just $1.1 billion in total issuance,” said Jason Wong, vice president of municipals at AmeriVet Securities.

He said, “this has played a significant role in muni bond prices as munis have become increasingly expensive relative to Treasuries.”

Ratios “should continue to fall as the 30-day supply is at just $6 billion and with investors receiving $28 billion in principal and interest payments this month,” he said.”Demand is exceeding supply.”

Secondary trading for the first week of 2023 totaled around “$31 billion with 56% of the trading volume being clients buying,” said Wong. Given the small calendar, he said, that’s not surprising.

With only four trading days last week, “clients bids-wanted totaled only $3.32 billion as many traders started to slowly come back to work from the long holiday,” he said.

Munis, though, “started off the year on a good note with yields falling by 14.7 basis points to end the week at 2.47%.”

With January normally “being a month with a lighter weekly calendar and with investors needing to reinvest,” he expects yields to continue to fall this month.

Despite falling yields, munis underperformed slightly to UST with “the 10-year now yielding 69.96% of Treasuries compared to 68.14%,” according to Wong.

He noted the muni curve steepened “by 8.4 basis points to 103 basis points.”

Outflows continued as investors pulled $2.5 billion from municipal bond mutual funds, per Refinitiv Lipper, “continuing the trend we saw all last year in regards to outflows,” he said.

This follows the prior week’s outflow of $1.9 billion, the fourth straight week of withdrawals.

“Although we are continuing to see yields fall, we are still seeing outflows even as yields are still attractive if you compare them to a year ago,” Wong said.

This week’s “manageable” calendar will continue what has been a quiet start to the year in the municipal market, which has been much less volatile than its taxable counterpart so far in 2023, according to John Mousseau, president and chief executive officer and director of fixed income at Cumberland Advisors.

Others say there is a more noticeable demand for higher coupons given the recent market strength and lack of supply.

This week, “should be a good barometer with a manageable calendar and most folks back in the saddle,” Mousseau said.

“The attractiveness of taxable equivalent yields and their comparison to long-term equity returns on a risk-adjusted credit basis is starting to attract assets,” he added.

The municipal market had a strong performance in the last two trading sessions, a New York trader said Monday.

“The Treasury market the last two days put in decent performance — and we tracked them on Friday when MMD and Treasuries were up 10,” he said.

The light calendar last week and this week helps the market, the trader said.

“The strong market and not a lot of bonds around is contributing to a bond grab — the secondary trades today are seeing better levels,” he explained. “I think people woke up on Friday and decided to get their heads into the market,” the trader added, noting that supply is expected to pick up next week.

The largest deal last week, the $765 million New York Triborough Bridge & Tunnel Authority sale, saw significant demand, he added, but besides that, the market has had little supply to focus on.

“As long as Treasuries hang in there, I expect it to remain firm in the tax-exempt market,” he continued.

Large new issues would do well the remainder of the month, and he expects a heavier demand among institutional investors for deals structured or priced with 5% coupon bonds.

“As 4% coupons gravitate to par, we are starting to see more interest in 5% coupons today — and I think that will continue,” the trader explained. “Four percent coupons were trading up to 4.50% but they are now trading at 4.10% and starting to trade at a whole different dollar price as they gravitate to par,” and 4% coupons “have run their course,” he added.

In addition, outside the municipal market, he said there is a lot of attention on the Federal Reserve’s actions.

“Everyone’s got one eye on the Fed and a lot is going to start to depend on the market’s perception,” the trader said. The Fed will meet at the end of the month, with another rate hike expected, although the market is divided about whether it will be 25 basis points or 50 basis points. Thursday’s consumer price index report will help clarify expectations.

Secondary trading

NYC 5s of 2024 at 2.45%. California 5s of 2025 at 2.32%. Maryland 5s of 2025 at 2.33% versus 2.54% on Tuesday and 2.63% on 12/30/22.

New York State Urban Development Corp. 5s of 2028 at 2.28%. California 4s of 2028 at 2.35%-2.32%. Massachusetts 5s of 2029 at 2.33%.

DC 5s of 2042 at 3.35%. LA DWP 5s of 2042 at 3.41%-3.36% versus 3.50% Friday and 3.55% Thursday. Fort Lauderdale, Florida, 5s of 2043 at 3.49% versus 3.65% Wednesday and 3.73%-3.72% Tuesday.

LA DWP 5s of 2052 at 3.62%-3.60% versus 3.75%-3.72% Thursday and 3.87%-3.85% Tuesday. Illinois Finance Authority 5s of 2052 at 4.40% versus 4.52%-4.50% Wednesday and 4.57% on 12/22/22.

AAA scales

Refinitiv MMD’s scale was bumped two to five basis points: the one-year at 2.52% (-2) and 2.36% (-5) in two years. The five-year was at 2.31% (-5), the 10-year at 2.43% (-5) and the 30-year at 3.35% (-5).

The ICE AAA yield curve was bumped four to eight basis points: at 2.47% (-8) in 2024 and 2.37% (-5) in 2025. The five-year was at 2.31% (-6), the 10-year was at 2.43% (-4) and the 30-year yield was at 3.37% (-4) at 4 p.m.

The IHS Markit municipal curve was bumped two to four basis points: 2.53% (-4) in 2024 and 2.36% (-4) in 2025. The five-year was at 2.34% (-4), the 10-year was at 2.45% (-2) and the 30-year yield was at 3.36% (-4) at a 4 p.m. read.

Bloomberg BVAL was bumped four to five basis points: 2.51% (-4) in 2024 and 2.36% (-4) in 2025. The five-year at 2.32% (-5), the 10-year at 2.43% (-5) and the 30-year at 3.36% (-4).

Treasuries were firmer.

The two-year UST was yielding 4.201% (-6), the three-year was at 3.946% (-4), the five-year at 3.662% (-4), the seven-year at 3.597% (-4), the 10-year at 3.527% (-4), the 20-year at 3.821% (-3) and the 30-year Treasury was yielding 3.655% (-3) at 4 p.m.

Primary to come:

The Plano Independent School District, Texas, (Aaa/AA+//) is set to price Tuesday $632.660 million of unlimited tax school building bonds, Series 2023, serials 2024-2043. RBC Capital Markets.

The Tomball Independent School District, Texas, (Aaa/AAA//) is set to price Tuesday $246.355 million of PSF-insured unlimited tax school building bonds, Series 2023. Piper Sandler & Co.

North Dakota (Aa1///) is set to price Tuesday $185 million of Housing Finance Agency Home Mortgage Finance Program housing finance program bonds, consisting of $125 million of non-AMT social bonds, Series 2023A; $40 million of taxables, Series 2023B; and $20 million of taxables, Series 2023C. RBC Capital Markets.

The Municipal Electric Authority of Georgia (A3/A/BBB+/) set to price Wednesday $184.890 million of Plant Vogtle Units 3&4 Project J bonds, Series 2023A. Goldman Sachs & Co.

The New Jersey Economic Development Authority (Baa1/BBB+//) is set to price Wednesday $160 million of taxable Offshore Wind Port Project state lease revenue bonds, 2023 Series A, serials 2024-2033. Loop Capital Markets.

The Georgetown Independent School District, Texas, (Aaa/AAA//) is set to price Tuesday $148.075 million of unlimited tax school building bonds, Series 2023. FHN Financial Capital Markets.

The Municipal Electric Authority of Georgia (A3/A/BBB+/) is also set to price 128.495 million of New York Plant Vogtle Units 3&4 Project M bonds, Series 2023A. Goldman Sachs & Co.

The authority (Baa2/BBB+/BBB+/) is set to price $127.600 million of Plant Vogtle Units 3&4 Project P bonds, consisting of $67.065 million of taxables, Series 2023A, and $60.535 million of exempts, Series 2023B. Goldman Sachs & Co.

The Oklahoma County Finance Authority is set to price Tuesday $110.410 million of Choctaw-Nicoma Park Public Schools Project education facilities lease revenue bonds, Series 2023, serials 2026, 2028, 2030-2032 and 2034-2038, term 2041. D.A. Davidson & Co.

Competitive:

Colorado is set to sell $425 million Education Loan program tax and revenue anticipation notes, Series 2022B, at 11 a.m. Wednesday.

The Santa Clara Valley Water District, California, (Aa1//AA+/) is set to sell $212.820 million of water system refunding revenue bonds, Series 2023A, and revenue certificates of participation, 2023C-1 and Series 2023C-2 (Water Utility System Improvement Projects), (Bid Group A) at 10:30 a.m. eastern Tuesday.

The district (Aa1//AA+/) is also set to sell $130.580 million of water system refunding revenue bonds, Series 2023B, and taxable revenue certificates of participation, 2023D (Water Utility System Improvement Projects), (Bid Group B) at 11:15 a.m. Tuesday.

Wisconsin is set to sell $204.550 million of GOs, Series 2023A, at 10:45 a.m. Tuesday.