Munis slightly weaker, continuing to outperform USTs

6 min read

Municipals were steady to weaker in spots to kick off the week, outperforming U.S. Treasuries, while equities were in the black.

Triple-A benchmarks were cut up to three basis points, while U.S. Treasury yields fell three to seven basis points.

The three-year muni-UST ratio was at 54%, the five-year at 57%, the 10-year at 63% and the 30-year at 86%, according to Refinitiv MMD’s 3 p.m. ET read. ICE Data Services had the three at 55%, the five at 58%, the 10 at 64% and the 30 at 88% at 4 p.m.

For the first time in several weeks, munis last week outperformed “by a wide margin and across the entirety of the yield curve,” said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

While “not the best-performing tenor, the long end of the yield curve was the most interesting in that munis rallied [five] bps, while US Treasury rates sold off by 3.9 bps,” he said.

AAA municipal rates have rallied, on average, by 40 bps to start 2023, while “the first few years of the yield curve have declined closer to 50 bps,” he said.

Yields will continue fall this year, as the 10-year note fell 10 basis points last week, ending at 2.21%, per MMD.

With yields falling, muni-UST ratios fall as well as the 10-year ratio is now yielding 63% compared to 65% a week ago, and 70% at the start of the year, per MMD.

With yields falling for three consecutive weeks, said Jason Wong, vice president of municipals at AmeriVet Securities, said, the muni curve steepened by five basis points to 109 basis points.

Both exempt and taxable refundings “could begin to re-emerge if rates continue to tick lower,” Kazatsky.

“With only four trading days last week, secondary trading totaled to roughly $31.69 billion with 52% of trades being clients buying,” Wong said.

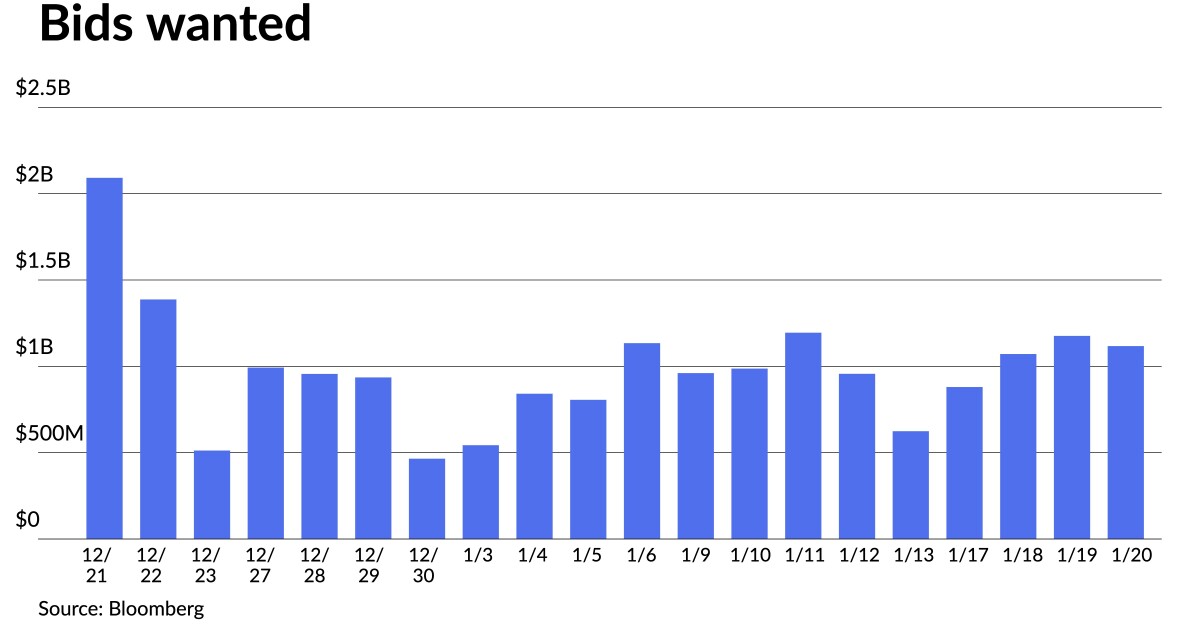

With supply still limited, he said, a high volume of secondary trading should continue. Clients’ bids-wanted totaled $4.25 billion last week, per Bloomberg.

January continues to have positive inflows going into to the last week of the month.

Investors added about $2 billion to municipal mutual funds last week following the prior week’s inflow of $2.5 billion.

“This is positive news for munis as it is showing that investors are coming back to munis following a dismal year in 2022 in which we saw record outflows as yields rose due to inflation concerns as well as the possibility of a pending recession,” Wong said.

“With over half of the month over, munis have started the year off on a high note with returns of about 2.8% so far,” he said.

This rally in munis results from “many factors,” Wong said. Low supply levels “coupled with high demand for bonds has led to yields falling to levels we have not seen since the second quarter of last year.”

And supply will continue to be an issue. “The forward muni calendar isn’t showing a large pipeline of deals yet,” partly due to “the rising volatility in tax-exempt rates over the past few weeks,” Kazatsky noted.

“As rates rallied to begin the year, what we thought would be catnip for issuers to flock back to the markets hasn’t played out that way,” he said. “The primary calendar remains muted, leaving us with more questions than answers.”

The supply-and-demand imbalance will “worsen with February’s cash returning to investors, putting issuers in the driver’s seat,” according to Kazatsky.

New deals should continue to see plenty of demand, “resulting in oversubscription and tighter spreads,” he said. Conversely, “issuers and their advisers may be deterred by muni volatility’s return to levels of two months ago and could wait for things to simmer down,” he noted.

A continual move lower in muni rates should draw more issuers in, regardless of volatility levels, he said.

As January nears its close, “February’s cash flows can give a sense of how technical dynamics will shape munis over the next 30 days,” Kazatsky said.

If demand continues to outpace supply, 10-year ratios could head to its historic low of 54% back in 2021,” said Wong. With the 10-year ratio at 63%, per MMD, “it’s not too far out of the realm of possibility of us hitting 54% as the 30-day supply is at [$7 billion] and supply isn’t expected to pick up until March,” he said.

In the primary market Monday, BofA Securities priced for the Oklahoma Water Resources Board (/AAA/AAA/) $150 million of Clean Water Program Revolving Fund revenue bonds, Series 2023 (2019 Master Trust), with 5s of 2/2025 at 2.15%, 5s of 2028 at 2.06%, 5s of 2033 at 2.28%, 5s of 2038 at 2.95% and 3.75s of 2043 at par, callable 4/1/2033.

Secondary trading

Energy Northwest, Washington, 5s of 2024 at 2.37%. North Carolina 5s of 2025 at 2.23% versus 2.41% on 1/6.

Illinois Finance Authority 5s of 2028 at 2.63%. Georgia 5s of 2030 at 2.14% versus 2.14%-2.15% Friday. NYC TFA 5s of 2032 at 2.27% versus 2.70%-2.67% on 1/5.

University of California 5s of 2035 at 2.38% versus 2.40%-2.37% Thursday. Massachusetts 5s of 2035 at 2.58%-2.56% versus 2.52% Friday. California 5s of 2037 at 2.76% versus 2.73% Friday and 2.81% on 1/17.

Bullard ISD, Texas, 5s of 2047 at 3.52% versus 3.82% on 1/4. Washington 5s of 2047 at 3.42%. NYC TFA 4s of 2051 at 4.13% versus 4.04%-4.14% Friday and 4.26% on 1/9.

AAA scales

Refinitiv MMD’s scale was unchanged. The one-year was at 2.33% and 2.17% in two years. The five-year was at 2.07%, the 10-year at 2.21% and the 30-year at 3.18% at 3 p.m.

The ICE AAA yield curve was cut two to three basis points: at 2.39% (+2) in 2024 and 2.25% (+2) in 2025. The five-year was at 2.09% (+2), the 10-year was at 2.21% (+3) and the 30-year yield was at 3.22% (+3) at 4 p.m.

The IHS Markit municipal curve was unchanged: 2.32% in 2024 and 2.15% in 2025. The five-year was at 2.08%, the 10-year was at 2.20% and the 30-year yield was at 3.18% at a 4 p.m. read.

Bloomberg BVAL was cut up to two basis points: 2.32% (unch) in 2024 and 2.16% (+1) in 2025. The five-year at 2.10% (unch), the 10-year at 2.22% (+1) and the 30-year at 3.22% (+2).

Treasuries were weaker.

The two-year UST was yielding 4.238% (+7), the three-year was at 3.901% (+7), the five-year at 3.631% (+7), the seven-year at 3.576% (+5), the 10-year at 3.526% (+4), the 20-year at 3.813% (+3) and the 30-year Treasury was yielding 3.696% (+4) at 4 p.m.

Primary to come:

The Triborough Bridge and Tunnel Authority is set to price $1 billion of general revenue refunding bonds, Series 2023A. Jefferies.

Wisconsin (Aa2//AA/) is set to price Tuesday $383.645 million of taxable general fund annual appropriation refunding bonds of 2023, Series A, serials 2024-2036. Jefferies.

The Lake Travis Independent School District, Texas, (/AA+/AA+/) is set to price Thursday $300 million of unlimited tax school building bonds, Series 2023, serials 2024-2053. BOK Financial Securities.

The Spring Independent School District, Texas, (Aa2/AA-//) is set to price Thursday $297.945 million of unlimited tax school building bonds, Series 2023, serials 2024-2052. Siebert Williams Shank.

The Pflugerville Independent School District, Texas, (/AA+//AA+/) is set to price Tuesday $292.235 million of unlimited tax school building bonds, Series 2023A, serials 2024-2043, term 2048. Siebert Williams Shank.

The Weld RE-4 School District, Colorado, (Aa2/AA//) is set to price Tuesday $271 million of general obligation bonds, Series 2023, insured by the Colorado State Intercept Program. RBC Capital Markets.

The Waller Independent School District, Texas, (A1/A+//) is set to price Tuesday $159.055 million of unlimited tax school building bonds, Series 2023, serials 2027-2043, terms 2048 and 2053. Jefferies.

The Texarkana Independent School District, Texas, (Aaa///) is set to price Tuesday $144 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2026-2053. Stephens.

The Nebraska Investment Finance Authority (/AA+//) is set to price Wednesday $114.850 million of single-family housing revenue bonds, consisting of $85 million of non-AMT social bonds, Series 2023A, and $29.850 million of taxable bonds, Series 2023B. J.P. Morgan.

Competitive:

The Kansas Development Finance Authority (//AAA/) is set to sell $157.540 million of revolving fund revenue bonds, Series 2023SRF (Kansas Department of Health and Environment), at 11:15 a.m. Eastern Wednesday.

The Spartanburg County School District 5, South Carolina, (Aa1/AA//) is set to sell $100 million of GOs, Series 2023 (South Carolina School District Credit Enhancement Program) at 11 a.m. Eastern Thursday.