Federal Reserve Raises Benchmark Interest Rate by 0.25%, Disinflationary Process ‘Early,’ Says Powell – Economics Bitcoin News

3 min read

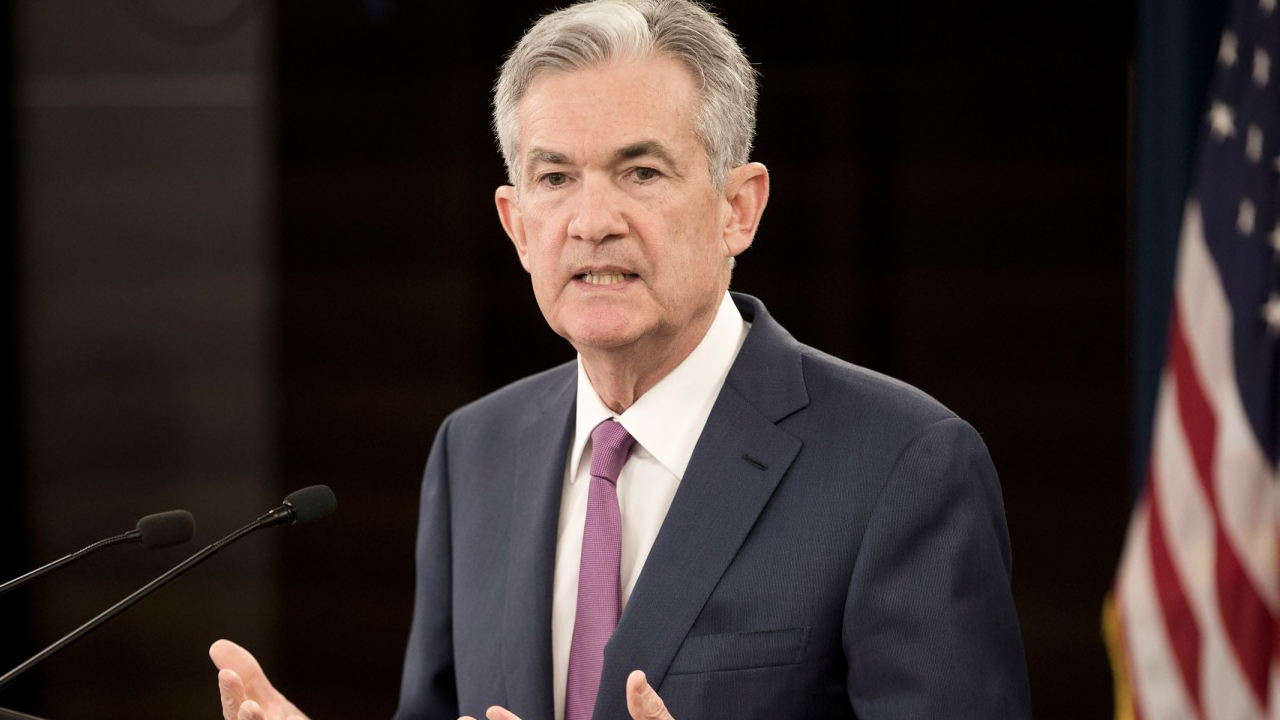

The U.S. Federal Reserve raised its benchmark federal funds rate by 0.25% on Wednesday after markets priced in near 100% certainty the Federal Open Market Committee (FOMC) would codify the quarter-point increase. The FOMC statement further detailed that ongoing rate increases are anticipated to bring inflation down to the target range of 2%.

FOMC Outlines Expectations for Future Rate Hikes

The central bank of the United States raised the federal funds rate on Wednesday, increasing it by 0.25% to the current range of 4.5% to 4.75%. The FOMC detailed in a statement that indicators show there has been “modest growth in spending and production” and job gains have been “robust in recent months.” However, the committee says that while inflation has dropped, it “remains elevated,” and it believes the conflict in Ukraine is “causing tremendous human and economic hardship.”

“The committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run,” the FOMC statement details. “In support of these goals, the committee decided to raise the target range for the federal funds rate to 4-1/2 to 4-3/4 percent. The committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

The federal funds rate has been increased eight consecutive times and is now at its highest level in about 15 years. The Federal Open Market Committee has stated that “ongoing increases” would be appropriate at every meeting since March. Market analysts and investors have shown conflicting signals over the Fed rate hikes, with some expecting the central bank to soften its stance, and others anticipating that Jerome Powell will continue to raise the benchmark interest rate. The Fed’s rate hike on Wednesday was the smallest since March 2022.

On Wednesday, Powell said that monetary tightening will continue “until the job is done” and added that the “disinflationary process that is now underway is really in its early stages.” The crypto economy appeared unfazed by the Fed’s decision on Wednesday, and prices jumped 0.9% higher after Powell’s comments. Bitcoin (BTC) rose 1.4% and ethereum (ETH) jumped more than 2% higher.

After sliding during the early morning trading sessions on Wednesday, U.S. stocks regained most of the losses following the Federal Open Market Committee statement. All four U.S. benchmark equity indexes are in the green as Wednesday’s closing bell nears. Precious metals such as gold and silver also saw gains, with gold up 0.79% and silver up 0.72% following the Fed’s statement.

What are your thoughts on the Federal Reserve’s decision to raise the benchmark interest rate and how will it affect the economy in the long run? Let us know your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons