Atlanta keeps economic uncertainty in mind in structuring housing bond

4 min read

Despite a cloudy national economic forecast, officials in Atlanta expect a warm welcome from the municipal marketplace for their planned housing bond sale.

Pending a vote in the largely supportive Atlanta City Council, the city will come to market in early to mid-summer with $100 million of bonds by negotiated sale, one of several expected issuances under a push by Mayor Andre Dickens to address the growing gulf between average incomes and rising housing costs in the city.

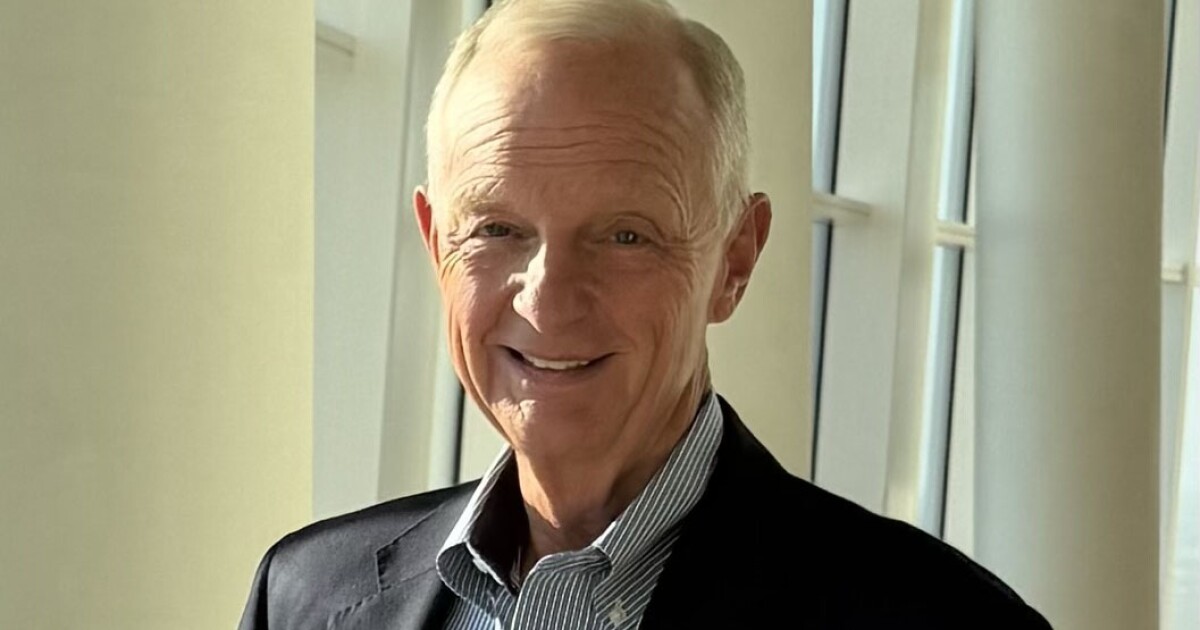

Appealing to investors in the current marketplace means mitigating risks presented by inflation, high interest, and general economic malaise, said Mohamed Balla, Atlanta’s chief financial officer.

The issuance will be structured with a drawdown facility allowing the city to tap funds on an as-needed basis while avoiding locking in traditional borrowing commitments and interest rates; that will help cut carrying costs and reduce overall exposure for the city while providing investors with security through built-in flexibility, Balla said, something that could prove useful in a dicey global economy where labor and material costs are on the rise and forcing some municipalities to reevaluate major projects.

The mitigation of those potential risks provides the bonds with an extra layer of security, which is appealing in the current marketplace, Balla added. .

“We only pay interest when we utilize the facility and draw down on it as construction is happening,” he said. “Issuance costs are also limited by this structure, so it’s flexible and if things do change we can adapt.”

A financial team was still being formed in coordination with the city’s economic development arm, Invest Atlanta, and the bonds will place with “one of the larger financial institutions,” Balla said, in a tax-exempt issuance by Atlanta’s Urban Residential Finance Authority along the lines of past drawdown deals.

Bond financing features promptly into the mix of funding behind the authority’s housing program, making up and over half of the capital stack behind several large initiatives providing low interest loans to developers for the acquisition, construction, or renovation of affordable housing in the city, according to information available on the authority’s website.

Balla believes most, if not all, of the funds available in the proposed issuance will be tapped by the city as it faces a “significant” housing crisis and the Dickens administration is focused on “tackling it from many fronts.”

“We do have a thesis that this is beneficial for the city of Atlanta,” Balla said. “It stimulates economic growth by investing in affordable housing, so the workforce can be in close proximity to jobs we want to bring into the city.”

The new bond sale is one of several expected future issuances under the mayor’s new initiative and will be matched by a philanthropic donation of $100 million from the Robert W. Woodruff Foundation and Joseph B. Whitehead Foundation to further leverage the proposed public funding under a deal brokered by Dickens and announced May 2.

Dickens promised then to “aggressively pursue multiple vehicles for funding” to address a mounting housing crisis putting rents, housing prices and mortgage rates out of reach for a growing percentage of the city’s population.

The Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor records a steep decline in affordable housing options over the last few years, with average annual mortgage and interest payment rates increasing from 28% to 40% of median salary levels between 2021 and 2022 alone.

Dickens began championing the issue after his election in 2021, forming Atlanta’s first official task force dedicated to coordinating public and private efforts on the issue just months after taking office.

In his most recent spending plan, he allocated $8 million for the effort while proposing an increase in contributions to a dedicated trust fund for housing development from 1% to 2% of the city’s budget annually.

He floated the idea of the $100 million bond sale in early May as a means to have “immediately available public funding that allows us to act nimbly and urgently on our holistic vision for leveraging public land for affordable housing.”

Atlanta’s 16-member city council is currently reviewing the city’s proposal and a vote is scheduled for the week of June 5.

“There’s strong support in the City Council for affordable housing,” Balla said. “It’s something that a lot of the council members gave heard from their constituency that a critical need for the city right now, so we do anticipate strong support.”

Moody’s Investors Service rates Atlanta’s GO bonds Aa1 with stable outlook and Fitch Ratings rates them AA-plus with stable outlook.

The city sold more than $400 million of GO bonds in November, including a $369 million social bond component. City officials said they received $1.2 billion of priority orders for the social bonds, Atlanta’s first such deal.