Primary picks up steam led by large Georgia GOs

7 min read

Municipals are steady to slightly firmer in spots Tuesday as the primary market took the focus with gilt-edged Georgia selling its large general obligation offering in the competitive market to strong demand. U.S. Treasuries were weaker and equities rallied.

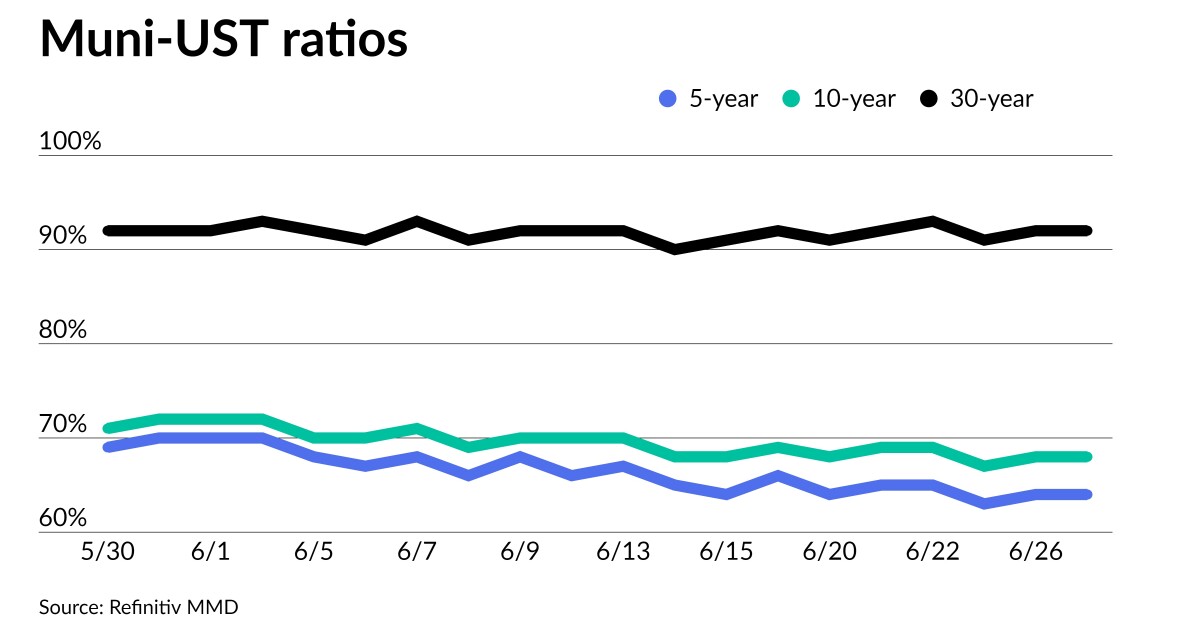

The two-year muni-to-Treasury ratio Tuesday was at 61%, the three-year at 63%, the five-year at 64%, the 10-year at 67% and the 30-year at 90%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 62%, the three-year at 64%, the five-year at 64%, the 10-year at 68% and the 30-year at 92% at 4 p.m.

It was another relatively quiet day in the secondary as munis once more outperformed the UST market, which continues to experience heightened volatility, AllianceBernstein strategists said in a weekly report.

“It is not surprising to see continued municipal outperformance, as technical tailwinds in the form of stronger investor flows, low levels of new-issue supply, and a swarm of reinvestment cash from coupon payments and bond redemptions have kept the market relatively stable,” they said.

With expected negative $22.8 billion in net supply for June and the large amount of reinvestment dollars out there, the market has a significant amount of cash that needs to be invested and a lower number of bonds to choose from,” they said.

AllianceBernstein strategists noted that is usually a good sign for performance.

With July and August expected to have negative $28 billion and negative $26 billion in net supply, respectively, they “expect this muni market momentum to continue.”

During the summer reinvestment season, Matt Fabian, a partner at Municipal Market Analytics said, tax-exempt munis usually rally as long as there is not “a direct push or pull by U.S. Treasuries.”

However, “moribund fund flows, an ongoing retreat by bank buyers that seems on pace to cut muni bond holdings by 1% to 2% in 2Q23 and an insurance industry that is still absorbing [property and casualty insurance] losses while waiting for higher premiums and stricter underwriting to restore profitability” has contributed to the thinner institutional demand, according to Fabian.

This continues to “mean a reliance on retail and [separately managed account] buyers for the bulk of going-away demand, which would explain the persistent concessions being priced into the primary market despite ‘rich’ valuation of munis” per the muni-UST ratio, he said.

It also supports the “domination of that primary calendar by retail friendly and defensive 5% coupons along with the perceived thinness in long-end secondary market liquidity,” he noted.

Muni performance, which is “unusually dependent on retail, has seen a larger-than-typical benefit from reduced new-issue supply and still-constructive credit and rating trends for core (i.e., safe sector) borrowers,” Fabian said.

Munis, he noted, may be vulnerable to reversals in same: a concern with the [outsized] primary calendar planned for this week; deal setbacks or repricings on headline events would not be surprising.”

But while supply has started to pick back up with an outsized primary market calendar this week, it’s still not enough to meet demand, said Cooper Howard, a fixed income strategist at Charles Schwab.

Supply, he said, “continues to be dwarfed by the amount of money that’s coming due either via calls, maturities, or other redemptions.”

In the near term, he expects ratios to move lower “as the market begins to adjust to this.”

Given the combination of strong credit conditions and attractive yields, Howard has a positive view for the muni market over the rest of 2023.

“Despite an awful 2022 for total returns and an eventful first half of the year dominated by concerns about banking instability and the debt-ceiling drama, the outlook for the muni market is largely unchanged from out 2023 outlook,” he said.

In the primary market Tuesday, Ramirez & Co. held a one-day retail order for $600 million of climate-bond payroll mobility tax senior lien green bonds from the Triborough Bridge and Tunnel Authority (/AA+/AA+/AA+/) with 5s of 11/2028 at 2.85% and 5s of 2033 at 2.92%.

Wells Fargo Bank priced for the San Diego County Regional Transportation Commission (/AAA/AAA/) $434.695 million of limited tax sales tax revenue bonds, Series 2023A, with 5s of 4/2024 at 2.89%, 5s of 2028 at 2.49%, 5s of 2033 at 2.47%, 5s of 2038 at 3.01% and 5s of 2042 at 3.30%, callable 4/1/2033.

In the competitive market, Georgia sold (Aaa/AAA/AAA/) sold $886.610 million of GOs in four deals, with some maturities through certain triple-A scales.

The state sold $261.050 million of refunding GOs, Series 2023C, to Morgan Stanley, with 4s of 1/2024 at 2.98%, 4s of 2028 at 2.61% and 5s of 2033 at 2.55%, noncall.

Georgia also $220.120 million of GOs, Series 2023A, Bidding Group 1, to BofA Securities, with 5s of 07/2024 at 2.98%, 5s of 2028 at 2.57% and 5s of 2033 at 2.51%, noncall.

Additionally, the state sold $203.600 million of taxable GOs, sold to J.P. Morgan, with 5.15s of 07/2024 at 5.11%, 4.4s of 2028 at 4.32%, 4.4s of 2033 at 4.36%, 4.66s of 2038 at par, and 4.9s of 2043 at 4.88%.

The state sold $201.390 million of GOs, Series 2023A, Bidding Group 2, to Citigroup Global Markets, saw 5s of 7/2034 at 2.60%, 5s of 2038 at 3.10%, and 4s of 2043 at 3.79%, callable 7/1/2033.

Secondary trading

NY Dorm PIT 5s of 2024 at 3.03%-3.00%. Georgia 5s of 2024 at 3.00%-2.98%. North Carolina 5s of 2025 at 2.98%-2.96%.

Washington 5s of 2027 at 2.80% versus 2.85% Monday. NYC 5s of 2029 at 2.84% versus 2.82% Thursday and 2.84% on 6/16. LA USD 5s of 2030 at 2.42%-2.41%.

Washington 5s of 2033 at 2.66% versus 2.69%-2.68% Monday and 2.71% Thursday. California 5s of 2035 at 2.75%. NYC TFA 5s of 2036 at 3.07%-3.05%.

Massachusetts 5s of 2047 at 3.70%-3.71%. Tampa waters, Florida, 5s of 2052 at 3.75%.

AAA scales

Refinitiv MMD’s scale was bumped up to two basis points: The one-year was at 3.01% (-2) and 2.89% (-2) in two years. The five-year was at 2.58% (-2), the 10-year at 2.53% (unch) and the 30-year at 3.46% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to three basis points: 2.99% (-3) in 2024 and 2.91% (-3) in 2025. The five-year was at 2.57% (-1), the 10-year was at 2.53% (-1) and the 30-year was at 3.51% (flat) at 4 p.m.

The IHS Markit municipal curve was bumped up to two basis points: 3.01% (-2) in 2024 and 2.89% (-2) in 2025. The five-year was at 2.58% (-2), the 10-year was at 2.53% (unch) and the 30-year yield was at 3.46% (unch), according to a 3 p.m. read.

Bloomberg BVAL was bumped up to one basis point: 2.98% (unch) in 2024 and 2.88% (unch) in 2025. The five-year at 2.57% (-1), the 10-year at 2.50% (-1) and the 30-year at 3.49% (unch) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.762% (+4), the three-year was at 4.393% (+9), the five-year at 4.033% (+7), the 10-year at 3.766% (+5), the 20-year at 4.038% (+3) and the 30-year Treasury was yielding 3.835% (+1) near the close.

Primary to come:

Los Angeles is set to price Wednesday $1.491 billion of 2023 tax and revenue anticipation notes, term 2024. UBS Financial Services.

Massachusetts (Aa1/AA+/AA+/) is set to price Wednesday $993.465 million of general obligation refunding bonds, consisting of $720 million of Series 2023A and $273.465 Series 2023B. J.P. Morgan Securities.

The Battery Park City Authority, New York, (Aaa//AAA/) is set to price Wednesday $743.710 million of senior revenue bonds, consisting of $341.700 million of sustainability bonds, Series 2023A; $392.805 million of bonds, Series 2023B; and $9.205 million of taxable bonds, Series 2023C. Morgan Stanley.

The Middlesex County Improvement Authority, New Jersey, (Aa3/A+//) is set to price Wednesday on behalf of Rutgers University t $307.405 million of GO lease revenue bonds for the New Jersey Health + Life Science Exchange — H-1 Project, consisting of $193.655 million of tax-exempts, Series 2023A, serial 2053 and $113.750 million of taxables, Series 2023B, serials 2027-2036. Citigroup Global Markets. Citigroup Global Markets.

The authority is also set to price Wednesday on behalf of Middlesex County $111.35 million for the New Jersey Health + Life Science Exchange — H-1 Project, consisting of $42.380 million of taxable guaranteed lease revenue and revenue bonds, Series 2023B, serials 2027-2033, terms 2038, 2047; $25.610 million of taxable guaranteed revenue bonds, Series 2023D, serials 2027-2036; $25.135 million of guaranteed lease revenue and revenue bonds, Series 2023A, terms 2049, 2053; and $18.225 million of guaranteed revenue bonds, Series 2023C, serials 2027-2036. Citigroup Global Markets.

Collin County, Texas, (Aaa/AAA//) is set to price Wednesday $245.445 million of limited tax permanent improvement bonds, Series 2023, serials 2024-2043. Jefferies.

The California Statewide Communities Development Authority is set to price Thursday $220.355 million of taxable sustainability Open Properly Assessed Clean Energy program limited obligation improvement bonds, Series 2023. KeyBanc Capital Markets.

The Williamsburg Economic Development Authority, Virginia, (/AA//) is set to price Wednesday on behalf of the Provident Group — Williamsburg Properties — Williams & Mary Project $208.975 million of student housing revenue bonds, Series 2023A, serials 2027-2043, terms 2048, 2053, 2058, 2063, insured by Assured Guaranty. RBC Capital Markets.

The Chula Vista Elementary School District, California, (/AA-//), is set to price Thursday $162.500 million of bonds, consisting of $100 million of Series A, serials 2024-2025, 2028-2044, and $62.500 million of Series B, serials 2024-2038. Loop Capital Markets.

Corpus Christi, Texas, is set to price Thursday $150.780 million of utility system senior lien revenue improvement and refunding bonds, Series 2023, serials 2024-2043, terms 2048, 2053. Jefferies.

Competitive

The Clark County School District, Nevada (A1/AA-//), is set to sell $200 million of limited tax GO building bonds, Series 2023A, at 11:30 a.m. eastern Wednesday.

Texas (Aaa/AAA//) is set to sell $128.490 million of GO college student loan bonds, Series 2023A, at 11 a.m. eastern Wednesday and $65.290 million of GO college student loan bonds, Series 2023B, at 12 p.m. Wednesday.

The Clark County Water District, Nevada (A1/AA-//), is set to sell $340 million of limited tax GO water reclamation bonds, Series 2023, at 11:30 a.m. eastern Thursday.

Christina Baker contributed to this report.