Senior living sector impairments grow amid weak demand

4 min read

Growing indicators suggest bonds from assisted living facilities and nursing homes may show increasing defaults in the coming months.

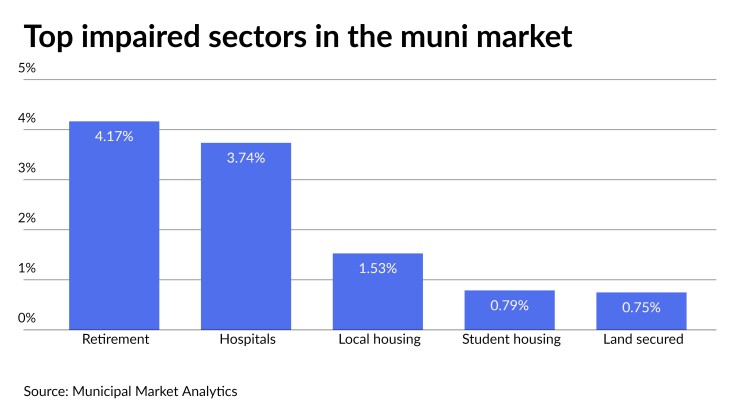

Through the first six months of 2023, Municipal Market Analytics’ Default Trends found that 4.17% of all retirement sector par became impaired, compared to 3.09% of the sector’s par that became impaired in all of 2022. Along with defaults, impairments include issuers using emergency means for bond payments and other problems like covenant violations.

At the current rate, 2023 will be the worst year in MMA’s Default Trends records going back to 2010 for newly impaired retirement sector debt, eclipsing the 7.56% of par impaired in 2021 as the effects of the COVID-19 pandemic weighed heavily on the sector.

While MMA Managing Director Lisa Washburn said she wouldn’t say the sector was a growing credit concern, she said it was a “persistent one.”

Analysts offered several factors working against the sector’s credit and a few areas that show signs of improvement.

Most of the factors they presented as working against it are connected to weak demand for the facilities themselves. The COVID pandemic led to many of the centers’ residents dying and that means fewer people paying rent.

“Pressure in the senior living space continues to percolate because of revenue and expense pressures,” said HilltopSecurities’ Senior Managing Director Yaffa Rattner. “This trend of sector impairment growth will continue until the demand profile changes allowing for … higher occupancy and additional pricing leverage.”

Washburn and Rattner noted that occupancy levels have not returned to pre-pandemic levels.

“The COVID pandemic exposed certain risks of this sector due to negative attention from the high mortality rates and need for isolation,” said Evercore Director of Municipal Bond Research Howard Cure. “Therefore, many people are choosing to stay in their homes … and are not necessarily seeking congregate care.”

Another negative COVID aftermath is federal pandemic relief funds have dried up. “Pandemic-related funds are no longer available to bolster finances and some facilities are reporting troubles that may have resulted earlier if not for the extraordinary funds,” Washburn said.

Besides pandemic-related factors, higher interest rates and the resulting weakening housing market are curtailing demand for assisted living centers and nursing homes, said Cure and Muni Credit News Publisher Joseph Krist.

“Now that younger people are effectively priced out of housing ownership, the model of selling granny’s house to pay the entrance fee doesn’t work as well,” Krist said.

Aside from weak demand, increasing costs are also buffeting the sector.

“Cost inflation is … putting financial pressure on this sector in terms of higher wages, food prices and construction costs,” Cure said.

While most sectors are facing these problems, “there is a national shortage of skilled nurses and other medical staff in hospitals across the country that has put significant cost pressure in the overall healthcare industry.”

In an April S&P Global Ratings report, Analyst Wendy Taylor and Analytical Team Manager Stephen Infranco said “growing workforce shortages” were pressuring the industry.

“Rising insurance costs are also an issue,” Washburn said.

Reduced ability to borrow is also hurting the sector’s credit, two analysts said. “The days of multiple refundings to adjust debt service schedules as problems arise is diminished,” Krist said. “Only able to refund once and only on a current basis, a borrower has a much more limited menu of options to deal with cash shortfalls. This will show up in more defaults but supported by the willingness of lenders to hold back on covenant enforcement.”

Washburn doubted the lenders’ willingness to hold back on covenant enforcement, saying, “there may be a reduced ability for challenged credits to restructure via access to fresh capital or investor willingness to adjust terms owing to higher interest rates and a more credit sensitive environment.”

In comparing the senior facilities sector to the healthcare sector at large, Krist said, “many of the senior living credits are site-specific, so the flexibility which one might hope to find is limited by the relatively smaller resource base supporting those credits.”

However, Cure said, “unlike hospitals that must serve patients, some of these retirement communities have more operating flexibility as they are able to take skilled nursing beds offline in response to staff shortage or cost concerns.”

Analysts said there are other factors they expect will help the sector in the long-term. With the aging of members of the large Baby Boom generation, now between 58 and 77 years old, “demographics are certainly on the industry’s side,” Cure said.

The slow growth of new facilities, “because of reduced construction during the pandemic and now because of higher interest rates and construction costs,” will help existing senior centers’ occupancy rates, Washburn said.

Some parts of the sector are holding their own. Fitch Ratings Director Gary Sokolow said the life plan communities he covers are doing “fairly well” but there are growing concerns. In LPCs, seniors pay upfront fees to live indefinitely in senior communities holding independent senior housing, assisted living centers, and nursing homes.