Munis open with a firmer tone ahead of substantial calendar

7 min read

Municipals were slightly firmer to start off the week as a larger new-issue calendar looms, while U.S. Treasury yields fell and equities ended the session up.

Triple-A yields fell one to two basis points while UST fell two to three.

Munis started off last week at “extremely rich valuations throughout most of the curve after outperforming over the past few weeks, causing them to underperform the strength in USTs,” said Birch Creek Capital strategists.

It was “no surprise,” though, that munis lagged the Treasury rally, as they “have been trading rich to Treasuries and continue to do so,” said Nuveen strategists Anders S. Persson and Daniel J. Close said in a weekly report. “Fixed-income markets in general have a good tone.”

For the second week in July, muni yields fell throughout the curve with “10-year notes falling by 6.5 basis points to end the week at 2.55%,” said Jason Wong, vice president of municipals at AmeriVet Securities.

As municipals were outperforming USTs for numerous sessions, by the time Treasuries had their big rally on Wednesday and Thursday, munis underperformed. As a result, ratios have been “trending higher,” he said, noting that the 10-year has risen from about 64% a week ago to now around 67%-68%.

The two-year muni-to-Treasury ratio Monday was at 61%, the three-year at 64%, the five-year at 64%, the 10-year at 68% and the 30-year at 89%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 61%, the three-year at 63%, the five-year at 62%, the 10-year at 67% and the 30-year at 90% at 4 p.m.

Macroeconomic data has led the market moves as “inflation has declined to 3%, and Fed officials indicate at least one more rate increase this year to get inflation down to their 2% target,” Nuveen strategists said.

Wong agreed, noting that munis ended the week firmer “as the markets are indicating that one more rate hike is likely as the consumer price index report, as well as other positive economic data showed that inflation has cooled bringing muni yields down further,” Wong said.

Investors, believing rates will fall as early as the first part of next year, continue to lock in long bond yields, Nuveen strategists said.

Tax-exempt bonds also continue “to be well bid due to more than $100 billion to be reinvested this summer,” they noted.

The July 1 reinvestment of $40 billion “continues to support the market as it has not been completely deployed,” according to Nuveen.

Secondary volumes were very light last week, “especially early on as accounts were mainly focused on new issues, which saw heavy subscription levels,” Birch Creek Capital strategists said.

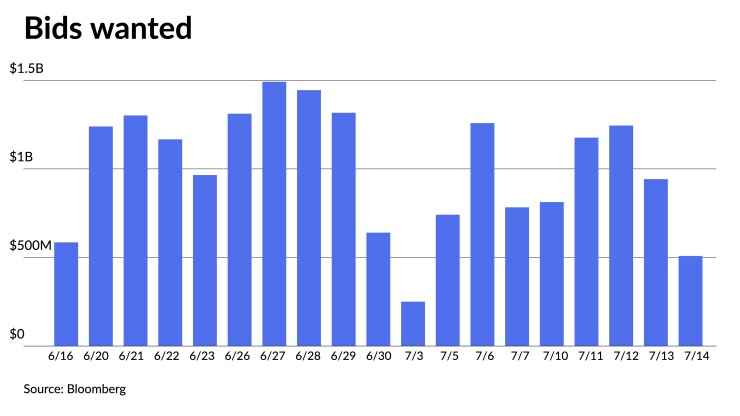

Investors put up $4.68 billion for the bid last week with two days having bids-wanteds of over $1 billion, according to Bloomberg data.

Secondary trading for last week was under $36 billion with 53% of trades being dealer sells, Wong noted.

Longer-duration bonds were the one bright spot in the secondary market, with J.P. Morgan “reporting a 40% increase in customer buys in 20y+ maturities,” Birch Creek Capital strategists said.

Long-term bonds (22+) are returning 0.14% month-to-date and 5.11% year-to-date, per Bloomberg

Last week, there was a surge in demand for 3% coupons due to the “positive sentiment and reach for duration bonds,” Birch Creek Capital strategists said.

With 4% high grades trading around or through the coupon, they said “investors are flocking to better convexity/discount bond structures that have more room to run if the rally continues.”

Despite the new-issue calendar coming in at an estimated $8.6 billion, they expect the “supply/demand imbalance will continue to be supportive for muni prices throughout the summer.”

Bond Buyer 30-day visible supply sits at $13.45 billion while Bloomberg data puts net negative supply at $15 billion.

Munis should trend higher this month as July is usually a positive month for munis, along with positive economic data, Wong said.

Munis are up slightly month-to-date returning 0.16%, bringing the year-to-date returns to 2.84%. In 2022, munis were looking down negative 7.68% returns during the same period, Wong noted.

Secondary trading

Georgia 5s of 2024 at 2.99% versus 3.07% Friday. Maryland 5s of 2024 at 3.02%-2.90% versus 3.08% Wednesday. Washington 5s of 2025 at 2.99%-2.95%.

Seattle waters 5s of 2028 at 2.61%. Washington 5s of 2029 at 2.65% versus 2.67% Friday. California 5s of 2030 at 2.52% versus 2.55% Friday and 2.57% Thursday.

Triborough Bridge and Tunnel Authority 5s of 2033 at 2.79%-2.80% versus 2.90% Wednesday and 2.93% on 7/11. Board of Regents of the University of Texas System 5s of 2033 at 2.75% versus 2.77%-2.76% Friday and 2.73%-2.76% on 7/5. California 5s of 2036 at 2.86% versus 2.85% Thursday and 2.92%-2.90% Wednesday.

Huntsville, Alabama, 5s of 2044 at 3.61%-3.60%. Denton ISD, Texas, 5s of 2048 at 3.80%-3.79% versus 3.88%-3.85% Thursday and 4.02%-3.88% original on Wednesday.

AAA scales

Refinitiv MMD’s scale was bumped two basis points: The one-year was at 3.01% (-2) and 2.88% (-2) in two years. The five-year was at 2.56% (-2), the 10-year at 2.57% (-2) and the 30-year at 3.49% (-2) at 3 p.m.

The ICE AAA yield curve was bumped up to two basis points: 3.01% (-1) in 2024 and 2.92% (-1) in 2025. The five-year was at 2.55% (-2), the 10-year was at 2.55% (-1) and the 30-year was at 3.54% (flat) at 4 p.m.

The IHS Markit municipal curve was bumped up to two basis points: 3.03% (unch) in 2024 and 2.91% (unch) in 2025. The five-year was at 2.55% (-2), the 10-year was at 2.57% (-2) and the 30-year yield was at 3.49% (-2), according to a 3 p.m. read.

Bloomberg BVAL was bumped up to one basis point: 2.98% (-1) in 2024 and 2.88% (-1) in 2025. The five-year at 2.57% (-1), the 10-year at 2.52% (-1) and the 30-year at 3.50% (-1) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.745% (-2), the three-year was at 4.341% (-3), the five-year at 4.017% (-3), the 10-year at 3.808% (-2), the 20-year at 4.101% (-1) and the 30-year Treasury was yielding 3.928% (flat) near the close.

Primary to come:

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $950 million of tax-exempt future tax-secured subordinate bonds, Fiscal 2024 Series A, Subseries A-1. J.P. Morgan Securities. Retail orders Tuesday.

The Trustees of the California State University (Aa2/AA-//) is set to price Wednesday $906.529 million of systemwide revenue bonds, consisting of $343.945 million of tax-exempts, Series 2023A, serials 2024-2043, terms 2048, 2053; $462.575 million of taxables, Series 2023B, serials 2024-2039, term 2053; and $100 million of tax-exempts, Series 2016B-3, term 2051. Barclays.

The Santa Clara Valley Transportation Authority, California (Aa2/AAA//), is set to price Tuesday $574.130 million of 2000 Measure A sales tax revenue refunding bonds, Series 2023A, serials 2024-2036. Wells Fargo Bank.

The Lamar Consolidated Independent School District, Texas (Aaa/AAA//), is set to price Thursday $516.925 million of PSF-insured unlimited tax schoolhouse bonds, Series 2023A. Jefferies.

Salt Lake City (A2/A+//AA) is set to price Wednesday $429.110 million of AMT airport revenue bonds, Series 2023A, serials 2025-2043, terms 2048, 2053, on behalf of Salt Lake City International Airport. BofA Securities.

The Arkansas Development Finance Authority is set to price this week $330 million of Hybar Steel Project industrial development revenue bonds, consisting of $110 million of tax-exempts, Series 2023A, and $220 million taxable, convertible to tax-exempt, green bonds, Series 2023B. Goldman Sachs.

The Maryland Department of Housing and Community Development (Aa1//AA+/) is set to price Wednesday $300 million of social residential million of bonds, consisting of $115 million of tax-exempts Series 2023C, serials 2024-2035, terms 2038, 2043, 2049, 2054; and $185 million of taxables, Series 2023D, serials 2024-2035, terms 2038, 2043, 2047, 2053. RBC Capital Markets.

The Michigan State Building Authority (Aa2/AA-/AA/) is set to price next week $277.310 million of 2023 Facilities Program revenue refunding bonds, Series II, serials 2023-2043, term 2047. Barclays.

The San Francisco Public Utilities Commission (Aa2/AA-//) is set to price Wednesday $273.730 million of San Francisco Water revenue refunding bonds, consisting of $263.370 million of Series 2023C and $10.360 million of Series 2023D. Jefferies.

The Board of Regents of Texas Tech University System (Aa1//AA+/AA+/) is set to price Thursday $253.700 million of revenue financing system bonds, consisting of Series 2023A refunding and improvement bonds and Series 2023B taxable improvement bonds. J.P. Morgan Securities.

The Cities of Dallas and Fort Worth, Texas (A1/A+/A+/AA), is set to price Wednesday $230.230 million of taxable joint revenue refunding bonds, Series 2023A, serials 2023-2037, terms 2042, 2047, on behalf of the Dallas Fort Worth International Airport. Loop Capital Markets.

The Southwest Independent School District, Texas, is set to price Wednesday $200 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2024-2053. Hilltop Securities.

The South Carolina Jobs – Economic Development Authority is set to price Tuesday $191.625 million of Seafields at Kiawah Island Project retirement community revenue bonds, consisting of $84.165 million of Series 2023A, $41.385 million of Series 2023B-1, $50.915 million of Series 2023B-2 and $15.160 million of Series 2023C. Ziegler.

The Bexar County Hospital District, Texas (Aa1/AA+), is set to price Tuesday $186.865 million of certificates of obligation, Series 2023, serials 2025-2043, terms 2048, 2053. Siebert Williams Shank & Co.

The St. Lucie County School Board, Florida (A1/AA//), is set to price Thursday $185 million of Assured Guaranty Municipal-insured certificates of participation, Series 2023A and 2023B. RBC Capital Markets.

The Forney Independent School District, Texas (/AAA//), is set to price Tuesday $184.905 million of PSF-insured unlimited tax school building bonds, Series 2023. FHN Financial Capital Markets.

The Indiana Finance Authority (Aa3/AA//) is set to price Tuesday $175.370 million of CWA Authority Project forward delivery first lien wastewater utility revenue refunding bonds, Series 2024A, serials 2027-2045. Citigroup Global Markets.

The Rhode Island Housing and Mortgage Finance Corp. (Aa1/AA+//) is set to price Wednesday $160.290 million of homeownership opportunity bonds, consisting of taxable Series 80-T-I and non-AMT social Series 80-A. J.P. Morgan Securities.

The Las Vegas Convention and Visitors Authority (Aa3/AA-//) is set to price Wednesday $150 million of convention center expansion and renovation revenue bonds, consisting of $137.060 million of tax-exempts, serials 2027-2043, term 2049, and $12.940 million of taxables, series 2024-2027. BofA Securities.

The Pasadena Area Community College District, California (Aa1/AA+//), is set to price Tuesday $130 million of 2022 election GOs, consisting of $108.240 million of Series A-1, serials 2025, 2029-2043, terms 2047,2052, $10.690 million of Series A-TXB, serial 2024, and $11.070 million of Series A-2, serial 2024. Raymond James & Associates.

North Dakota (Aa1///) is set to price Tuesday $125 million of non-AMT social North Dakota Housing Finance Agency home mortgage finance program housing finance program bonds, Series 2023D, serials 2024-2035, terms 2038, 2043, 2048, 2054. RBC Capital Markets.

Competitive

The New York City Transportation Finance Authority is set to sell $130 million of taxable future tax-secured subordinate bonds, Fiscal 2024A Series A, Subseries A-2, at 11:15 a.m. eastern Wednesday.

Rochester, New York, is set to sell $105.250 million of bond anticipation notes, Series 2023 II, at 11 a.m. Wednesday.