Munis steady to start week while long-end strength grows

6 min read

Municipals were relatively steady throughout most of the curve Monday, while U.S. Treasuries were weaker and equities ended the session up.

The two-year muni-to-Treasury ratio Monday was at 58%, the three-year at 60%, the five-year at 61%, the 10-year at 65% and the 30-year at 88%, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the two-year at 60%, the three-year at 61%, the five-year at 60%, the 10-year at 65% and the 30-year at 89% at 4 p.m.

The Federal Open Market Committee meets this week where most market participants expect the Fed to hike rates by 25 basis points.

This has led to a “limited” new-issue supply as most issuers await Wednesday’s Fed meeting, Nuveen strategists Anders S. Persson and Daniel J. Close said.

And with this “25 basis point rate hike being the last one for the year, we could continue to see investors come back to the tax-exempt market,” said Jason Wong, vice president of municipals at AmeriVet Securities.

As the last week of the month approaches, “July continues to be a positive month for munis as month-to-date returns are at 0.65% and a year-to-date return of 3.34%,” he said.

At this point last year, there was a loss of 7.64% year-to-date, he said.

“With demand continuing to outpace supply, and with the Fed expecting to only hike one more time this year, we should expect to see positive returns for munis, especially in the long end.”

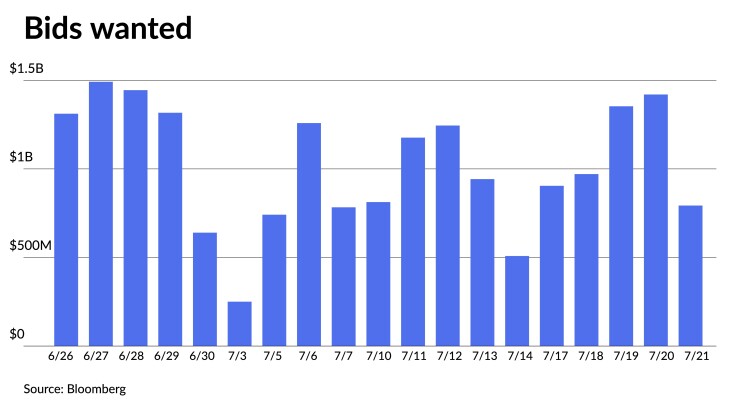

Last week, the muni market was “laser-focused on a heavy new-issue calendar, especially ahead of lighter supply … due to the Fed decision,” Birch Creek Capital strategists said in a report.

Investors added $1.04 billion into muni mutual funds last week, which “helped support demand alongside mid-month maturities and coupon payments,” they said. This was the first time inflows topped $1 billion since late January.

Muni yields fell for the third straight week, with 10-year notes falling by eight basis points to finish the week at 2.47%, Wong said.

With the rally in munis this past week, he said muni bonds outperformed Treasuries “as 10-year munis are now yielding 64.46% of Treasuries.” The week before, he noted the ratio was at 66.53%.

Investors are “showing strong interest in two portions of the muni yield curve,” Nuveen strategists said.

“Longer-dated bonds look attractive, as investors are locking in long-term rates before the expected decline in 2024,” while “a tremendous amount of money is also invested in the short end of the curve,” they said.

Birch Creek Capital strategists also noted long duration activity was heavier than usual last week.

They noted that J.P. Morgan reported offerings on long-maturity bonds rose 57% “as investors have seized on this pocket of liquidity and look to sell into the newfound demand.”

During the first two weeks of August, technical support for munis will peak, said CreditSights strategists Pat Luby and Sam Berzok.

August will see $44 billion redemptions, $29 billion of which will be paid out of Aug. 1 and $9 billion on Aug. 15, they said.

Investors will also receive $13.3 billion of interest in August, including $8.3 billion on Aug. 1, they noted.

“Incremental reinvestment demand will fall in September as redemptions are scheduled to total $19 billion,” CreditSights strategists said.

As of Monday, Bond Buyer 30-day visible supply sits at $9.99 billion while net negative supply is $20.3 billion, per Bloomberg.

This mismatch, along with more certainty from Fed policymakers, should provide support for the muni market.

Secondary trading

Wisconsin 5s of 2024 at 3.10%. California 5s of 2024 at 2.93%. North Carolina 5s of 2025 at 2.88% versus 2.86% on 7/18.

NYC 5s of 2028 at 2.67%. Seattle 5s of 2028 at 2.58%. NY Dorm PIT 5s of 2029 at 2.66%.

Washington 5s of 2032 at 2.57% versus 2.59% Friday and 2.58% Thursday. California Educational Facilities Authority 5s of 2033 at 2.31%. Santa Clara Valley Transportation Authority, California, 5s of 2034 at 2.47% versus 2.55%-2.54% Thursday and 2.55% original on Wednesday.

Clark County Water Reclamation District, Nevada, 5s of 2045 at 3.59% versus 3.71%-3.70% on 7/13. Lamar Consolidated ISD, Texas, 5s of 2053 at 3.91%. NYC TFA 5s of 2053 at 3.88%-3.89% versus 3.91%-3.93% Friday and 3.89% original on Thursday.

AAA scales

Refinitiv MMD’s scale was unchanged five years and out: The one-year was at 3.02% (+2) and 2.85% (-2) in two years. The five-year was at 2.52% (unch), the 10-year at 2.50% (unch) and the 30-year at 3.46% (unch) at 3 p.m.

The ICE AAA yield curve was bumped up to one basis point: 2.99% (unch) in 2024 and 2.90% (-1) in 2025. The five-year was at 2.50% (unch), the 10-year was at 2.47% (unch) and the 30-year was at 3.47% (-1) at 4 p.m.

The IHS Markit municipal curve was unchanged five years and out: 3.02% (+2) in 2024 and 2.85% (-3) in 2025. The five-year was at 2.52% (unch), the 10-year was at 2.51% (unch) and the 30-year yield was at 3.47% (unch), according to a 3 p.m. read.

Bloomberg BVAL was bumped up to one basis point: 2.93% (unch) in 2024 and 2.83% (unch) in 2025. The five-year at 2.50% (-1), the 10-year at 2.45% (-1) and the 30-year at 3.44% (-1) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.915% (+7), the three-year was at 4.509% (+6), the five-year at 4.149% (+5), the 10-year at 3.872% (+3), the 20-year at 4.128% (+2) and the 30-year Treasury was yielding 3.928% (+2) near the close.

Primary to come:

The Black Belt Energy Gas District (A2///) is set to price next week $680.920 million of gas project revenue refunding bonds, Series 2023D, consisting of $620.835 million of Series D-1; $10.085 million of Series D-2; and $50 million of Series D-3. Goldman Sachs.

The Medina Valley Independent School District, Texas (/AAA//), is set to price Thursday $363.690 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2026-2053. Raymond James & Associates.

The National Finance Authority (/BBB//) is set to price Tuesday $270.250 million of partially tax-exempt social municipal certificates, Series 2023-2 Class X, serial 2038. Citigroup Global Markets.

The National Finance Authority (/BBB//) is set to price Tuesday $270.250 million of social municipal certificates, Series 2023-2 Class A, serial 2038. Citigroup Global Markets.

The North Carolina Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $199 million of non-AMT social home ownership revenue bonds, Series 51, serials 2024-2035, terms 2038, 2043, 2048, 2054. RBC Capital Markets.

The Royse City Independent School District, Texas, is set to price Tuesday $187.995 million of PSF-insured unlimited tax school building bonds, Series 2023. FHN Financial Capital Markets.

Pflugerville, Texas (Aa1///AA+)m is set to price Tuesday $179.615 million of bonds and certificates of obligation, consisting of $103.615 million of limited tax bonds, Series 2023, serials 2024-2043, terms 2048, 2053; and $76 million of combination tax and limited revenue certificates of obligation, Series 2023A, serials 2024-2043, terms 2048, 2053. Siebert Williams Shank & Co.

The Charleston Educational Excellence Financing Corp., South Carolina (Aa3/AA-//), is set to price Thursday on behalf of the Charleston County School District $142.535 million of installment purchase revenue refunding bonds, Series 2023, serials 2023-2026, 2028. Wells Fargo Bank.

The Denison Independent School District, Texas (Aaa/AAA//), is set to price Thursday $131.405 million of PSF-insured unlimited tax school building and refunding bonds, Series 2023, serials 2024-2050. Raymond James & Associates.

The Minnesota Housing Finance Agency (Aa1/AA+//) is set to price Thursday $130 million of taxable social residential housing finance bonds, Series 2023J, serials 2023-2033, terms 2038, 2043, 2047, 2053. RBC Capital Markets.

The Michigan Finance Authority is set to price Monday $120.110 million of state aid revenue notes, Series 2023A, consisting of $59.955 million of Series A-1, serial 2024; and $60.155 million of Series A-2, serial 2024. PNC Capital Markets.

The Louisiana Local Government Environmental Facilities and Community Development Authority (Aaa///) is set to price Tuesday on behalf of the American Biocarbon CT Project $104 million of revenue bonds, consisting of $60 million of Series 2021 and $44 million of series 2023. Jefferies.

Competitive

Miami-Dade County, Florida, is set to sell $177.660 million of capital asset acquisition special obligation bonds, Series 2023A, at 9:30 a.m. eastern Tuesday.

Washington (Aaa/AA+/AA+/) is set to sell $347.615 million of various purpose GOs, Series 2023A – Bid Group 1, at 10:15 Tuesday; $344.630 million of various purpose GOS, Series 2023A – Bid Group 2, at 10:45 a.m. Tuesday; $381.580 million of motor vehicle fuel tax and vehicle-related fees GOs, Series 2024B, at 11:15 a.m. Tuesday; and $55.220 million of taxable GOs, Series 2024T, at 11:45 a.m. Tuesday.