SAFER Banking Act garners local support

3 min read

The Secure and Fair Enforcement Regulation Banking Act, a bipartisan bill introduced last week that would give communities and small cannabis businesses access to financial institutions, has a strong chance of passing and has already garnered the support of local government groups.

The bill will be marked up on Wednesday in the Senate Committee on Banking, Housing and Urban Affairs and is expected to pass “decisively” soon after, according to Senate Banking Committee Chairman Sherrod Brown, D-Ohio. If it becomes law, the bill could be part of a series of changes that impacts state collection of marijuana tax revenue.

“We are pleased to introduce the Secure and Fair Enforcement Regulation (SAFER) Banking Act. The legislation will help make our communities and small businesses safer by giving legal cannabis businesses access to traditional financial institutions, including bank accounts and small business loans,” a joint statement issued by Sens. Chuck Schumer, D-N.Y., Jeff Merkley, D-Ore., Steve Daines, R-Mont., Kyrsten Sinem, I-Ariz., and Cynthia Lummis, R-Wyo.

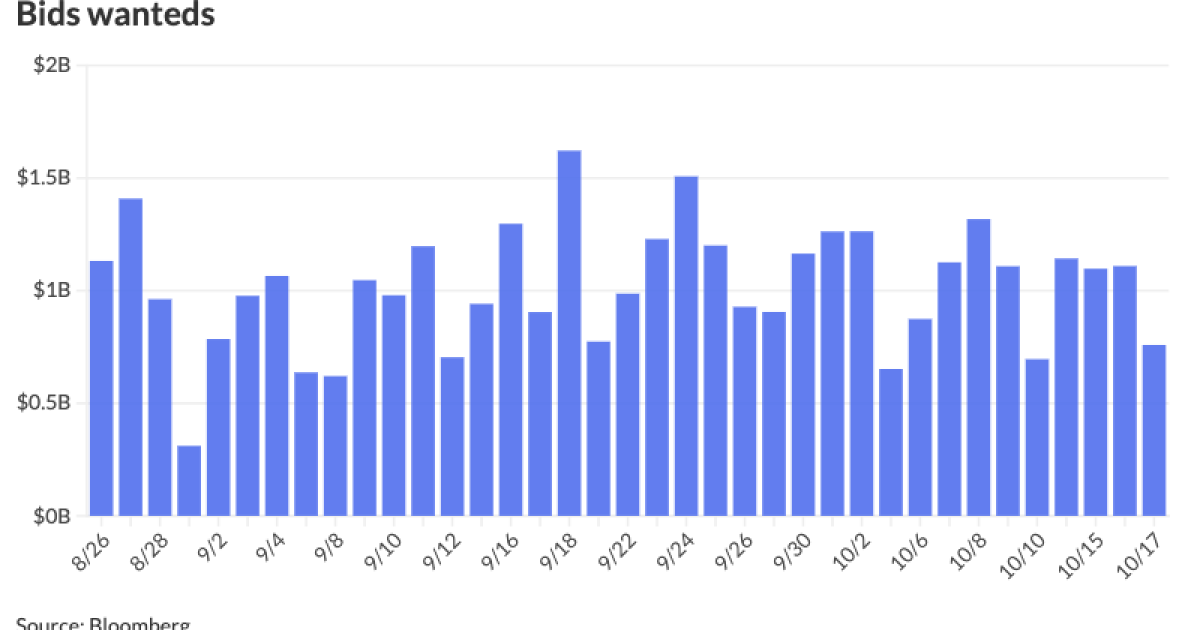

Bloomberg News

“It also prevents federal bank regulators from ordering a bank or credit union to close an account based on reputational risk. We look forward to markup of this bill in the Senate Committee on Banking, Housing and Urban Affairs on Sept. 27th,” the statement said.

In a letter sent to Sens. Schumer and Republican leader Mitch McConnell, the National Conference of State Legislatures celebrated the bill and said it stands ready to provide more information on how it will impact states.

“The SAFER Banking Act is a much-needed solution to reconciling the conflict between a burgeoning and legitimate state cannabis industry and its ability to comply with federal cannabis laws. Our current system relies on cash-only cannabis transactions, increasing the real risk that these cannabis businesses become prime targets for theft, burglary, armed robbery and other property crimes that jeopardize the safety of the business owners and the communities in which they operate,” said the letter signed by NCSL Chief Executive Officer Tim Storey. “The bipartisan SAFER Banking Act will create a safe environment for cannabis businesses and would allow financial institutions to provide banking services to legitimate state authorized cannabis-related businesses.”

The bill comes a couple weeks after the Department of Health and Human Services sent a letter to the Drug Enforcement Agency recommending marijuana be reclassified as a Schedule III drug, and together, could significantly alter how state and local governments deal with cannabis and cannabis revenue collection.

Sen. Schumer has proposed that the bill include expungement provisions for those previously convicted of marijuana-related offenses. The bill may have some unintended consequences that may spring up in negotiations.

“Energy companies in Wyoming are threatened daily by woke ESG initiatives that could cause these energy producers to lose access to bank accounts and loans,” Sen. Lummis, a co-sponsor of the bill said in a statement. “The SAFER Banking Act prohibits federal bank regulators from ordering a bank or credit union to close an account based on reputation risk, which will protect energy companies and gun manufacturers from attacks from the left that threaten their business each day. All legal businesses should have access to bank accounts, and this legislation ensures the federal governments cannot pick winner and losers when it comes to providing access to financial services.”