Munis steady ahead of jobs data; macroeconomic woes persist

6 min read

Municipals were steady Thursday while the final large deals of the week priced in the primary. U.S. Treasuries were mostly firmer and equities were in the red ahead of the Friday payrolls data release.

“The last labor market reading before the [non-farm payrolls] report provided another reminder that the labor market is still strong,” said Edward Moya, senior market analyst at OANDA. Worker filings for unemployment benefits held steady at 205,000 in the week ending on Sept. 30, he said.

All eyes will be on Friday’s report, though “it seems most leading indicators suggest job growth will remain healthy, which should keep the bond market selloff going strong,” Moya said. “A strong headline number will likely be expected given we only saw the ADP private payroll miss.

“Eventually the surging cost of capital will support a softening of the labor market, but it doesn’t seem like that will be reflected in tomorrow’s report,” Moya added.

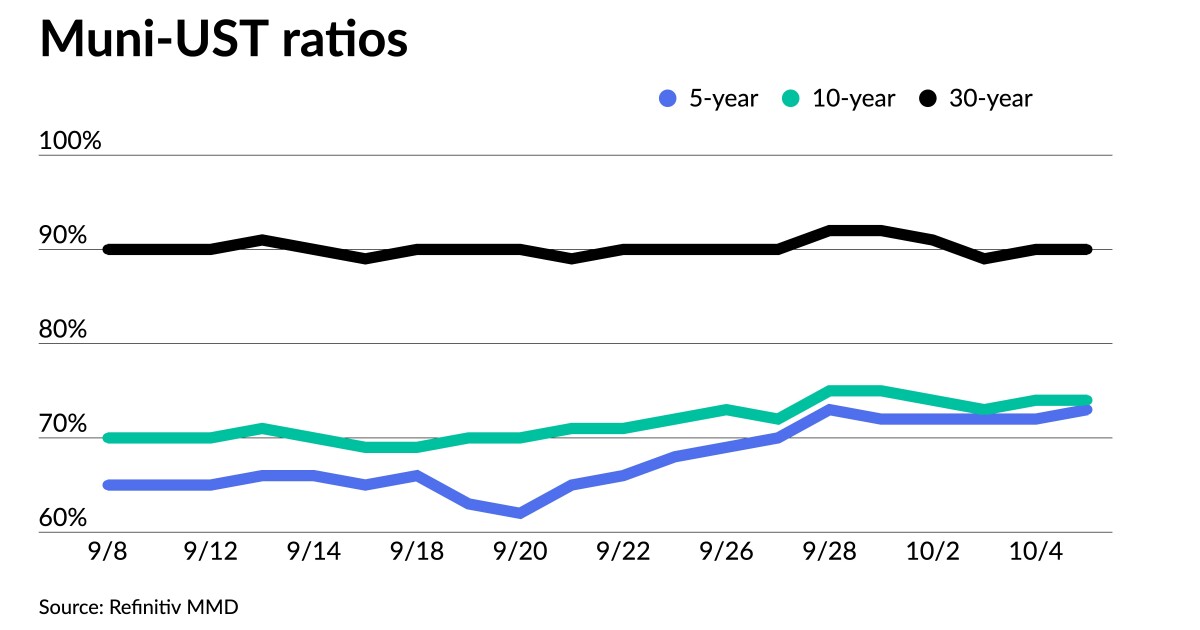

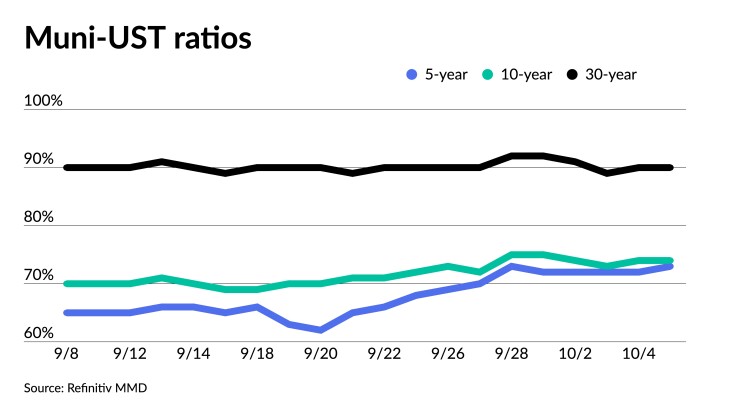

The quieter day held muni to UST ratios mostly steady.

The two-year muni-to-Treasury ratio Thursday was at 73%, the three-year was at 73%, the five-year at 73%, the 10-year at 74% and the 30-year at 90%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 73%, the three-year at 74%, the five-year at 72%, the 10-year at 74% and the 30-year at 90% at 4 p.m.

In the primary market Thursday, Morgan Stanley priced for Fort Lauderdale, Florida (Aa1/AA+//) $512.995 million of water and sewer revenue bonds. The first tranche, $167.945 million for the Enabling Works Project, Series 2023A, saw 5s of 9/2024 at 3.81%, 5s of 2028 at 3.59%, 5s of 2033 at 3.75%, 5s of 2038 at 4.17%, 5s of 2043 at 4.56%, 5.5s of 2048 at 4.63% and 5.5s of 2053 at 4.72%, callable 9/1/2033.

The second tranche, $345.05 million for the Prospect Lake Water Treatment Project, Series 2023B, saw 5s of 9/2024 at 3.81%, 5s of 2028 at 3.59%, 5s of 2033 at 3.75%, 5s of 2038 at 4.17%, 5s of 2043 at 4.56%, 5.5s of 2048 at 4.63% and 5.5s of 2053 at 4.72%, callable 9/1/2033.

Wells Fargo Bank priced for the Illinois Housing Development Authority (Aaa///) $178.750 million of revenue bonds, with all bonds pricing at par — 3.95s of 4/2025, 4.25s of 4/2028, 4.3s of 10/2028, 4.8s of 4/2033, 4.8s of 10/2033, 4.95s of 10/2038, 5.25s of 10/2043 and 5.25s of 4/2047 — except for 6.25s of 10/2053 at 5.01%, callable 10/1/2023.

A rough September, challenges continuing into October

September performance was decidedly negative across “fixed-income cohorts,” with munis underperforming both USTs and corporates, said to Jeff Lipton, managing director of credit research at Oppenheimer.

Several factors contributed to munis’ negative performance in September, including the selloff in the UST market, coming off the seasonal high period of demand, rich ratios and modest supply for the month, said Jeff Timlin, a managing partner at Sage Advisory.

“You’re seeing a confluence of things come together that have driven muni rates higher and returns [are in] significantly negative territory,” he said. “And that’s going to persist for a little bit here.”

Market volatility is “definitely elevated,” which can cause some people “to pause in terms of putting money to work.”

September had a similar tone to periods of 2022 when rates were rapidly selling off, which Timlin said it’s the first time he’s seen that type of weakness this year.

There was “widening of spreads to more extreme levels that are significantly away from the normal liquidity that we’ve seen in the market,” he said.

This, he said coincided with bid wanteds picking up and less of a supply-demand imbalance that was felt throughout the summer.

Munis lost 2.93% throughout September, and “like USTs, shorter-dated munis outperformed the broader index,” Lipton said.

Some bear-steepening also happened along the short muni curve, he said.

It is still unclear whether the “duration capitulation” has been reached, Lipton noted, adding that he believes the market is “closely approaching the end of the current selloff.”

However, bond yields could rise if Friday sees an “outsized payroll print,” though Lipton does not see that happening.

“Based upon a historical lack of generally supportive muni technicals for the month of October with a relatively thin net negative supply backdrop, our performance outlook for this month would ordinarily be rather somber,” Lipton said.

Timlin also noted that October is historically a soft month, but issuance tends to pick up.

“Aside from rates rising, which has been the big factor this year, October seems to be another normal month in terms of heightening of issuance,” he said.

Currently, “we’re in the period where people are still looking to position their portfolios going into year end and the market will offer ample opportunities in the next six weeks … for people to come in at these levels particularly,” Timlin said.

“For those with people with cash and want to redeploy some capital, this seems to be more of a buyers’ market than the majority of the year,” he noted.

However, if issuers “stay on the sidelines amid the varied rate headwinds, such lower supply scenario could turn out to be a small gift for October muni returns, with munis possibly outperforming a further selloff,” Lipton noted.

With the looming Federal Open Market Committee meeting in November and “the rising probability of divergent economic data points throughout the month, rates could remain under upward pressure for a bit longer,” according to Lipton.

Timlin’s sentiment was similar, noting that for the remainder of the year the real risk for munis comes from the broader markets, and more specifically, USTs.

“The bias at this point seems to be the higher rates but that’s a double-edged sword: the higher rates go, the more likely it’s going to collapse the economy or slow the economy down even further…, he said.”.

Secondary trading

Washington 5s of 2024 at 3.75% versus 3.79%-3.78% original on Tuesday. Maryland 5s of 2025 at 3.71% versus 3.75% Wednesday. Connecticut 5s of 2025 at 3.73%.

California 5s of 2027 at 3.49%-3.47%. Wisconsin 5s of 2028 at 3.54% versus 3.58% Tuesday. Oregon 5s of 2029 at 3.47% versus 3.50% Wednesday and 3.53%-3.52% on 9/29.

California 5s of 2033 at 3.62%-3.60% versus 3.36%-3.35% on 9/27 and 3.11% on 9/17. Triborough Bridge and Tunnel Authority 5s of 2033 at 3.79% versus 3.81%-3.80% Wednesday. Dane County, Wisconsin, 5s of 2035 at 3.80%.

Oklahoma Water Resources Board 5s of 2047 at 4.54%-4.52%. NYC TFA 5s of 2048 at 4.79% versus 4.65% on 9/27.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.74% and 3.66% in two years. The five-year was at 3.43%, the 10-year at 3.50% and the 30-year at 4.39% at 3 p.m.

The ICE AAA yield curve was bumped a basis point: 3.74% (-1) in 2024 and 3.69% (-1) in 2025. The five-year was at 3.45% (-1), the 10-year was at 3.48% (-1) and the 30-year was at 4.38% (-1) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.77% in 2024 and 3.69% in 2025. The five-year was at 3.47%, the 10-year was at 3.51% and the 30-year yield was at 4.40%, according to a 3 p.m. read.

Bloomberg BVAL was little changed: 3.78% (unch) in 2024 and 3.70% (unch) in 2025. The five-year at 3.43% (unch), the 10-year at 3.50% (unch) and the 30-year at 4.43% (unch) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 5.023% (-3), the three-year was at 4.82% (-4), the five-year at 4.676% (-5), the 10-year at 4.71% (-3), the 20-year at 5.071% (unch) and the 30-year Treasury was yielding 4.866% (unch) near the close.

NYC: $700M social bonds saw ample demand, repriced to lower yields

New York City’s sale of $965 million of taxable fixed-rate general obligation bonds was a success, the city said Thursday.

The deal included an issue of $700 million of social bonds that will support affordable housing and $265 million of bonds to fund general capital projects.

Barclays priced for New York City (Aa2/AA/AA/AA+/) $965 million of taxable GOs, Fiscal 2024 Series B. The first tranche, $700 million of social bonds, Subseries B-1, saw 5.828s of 10/2053 price at par, make whole call at T +15bp.

The second tranche, $265 million of bonds, Subseries B-2, saw all bonds price at par: 5.366s of 10/2025, 5.33s of 2028, 5.675s of 2033 and 5.975s of 2038, callable 10/1/2033.

The transaction was the city’s second sale of social bonds.

The city said it received indications of interest (IOI) for the social bonds that totaled $1.57 billion, making it 2.2 times oversubscribed.

Because of the demand, book-running senior manager Barclays was able to lower yields on the social bonds by four basis points from the IOI to final pricing for a final yield of 5.828%.

Barclays priced the capital project GOs with final yields ranging from 5.269% to 5.975%.

Joint senior managers were Citigroup and Morgan Stanley, with BofA Securities, J.P. Morgan, Jefferies, Loop Capital Markets, Ramirez & Co., Raymond James, RBC Capital Markets, Siebert Williams Shank, UBS and Wells Fargo Securities as co-managers.

Chip Barnett contributed to this story.