New York State rakes in $727M from high taxes on mobile sports betting

3 min read

New York state tax collections from mobile sports betting totaled $727.4 million in fiscal 2022-2023, according to a report from the state comptroller’s office.

“Gaming has significantly expanded in the state in the last several years,” Comptroller Thomas DiNapoli said Wednesday. “With the ease and 24/7 availability of mobile betting apps, problem gambling and addiction are poised to increase.”

Bloomberg News

The increase was due primarily from new types of gaming rather than from increased use of existing ones, the report said. New York is now among eight states that offer the most forms of gaming in the U.S.

With the exception of Vermont, nearly all of New York’s neighboring states allow mobile sports wagering.

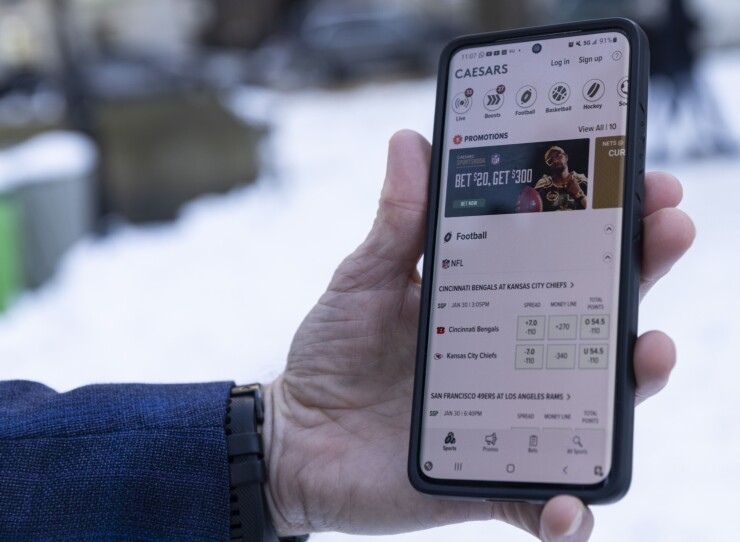

In January 2022, mobile sports betting went live. With a 51% tax rate on gross gaming revenues, New York has the highest gaming taxes in the nation along with New Hampshire and Rhode Island, according to the report.

In fiscal 2021-2022, mobile sports betting generated $360.7 million for the state, far more than the $99 million originally forecast.

In fiscal 2022-2023, the first full year of mobile sports betting, the $727.4 million take was double the projection of $357 million. The higher collections were due to the number of licenses issued to mobile sports wagering providers and the higher tax rate, the report said.

Revenues in the first quarter of the current fiscal year have continued to grow, although the report notes the state Division of the Budget is now projecting tax collections will level out and rise just 6.9% over the next four fiscal years.

From fiscal 2011-2012 to 2022-2023, state revenues from lottery sales and taxes on all gaming revenues increased 69.5% to $4.8 billion from $2.8 billion. The $4.8 billion in revenues comprised 3.6% of total state operating funds spending.

Nearly 95% of the revenues were used for education purposes and averaged out to about $1 out of every $8 spent on education in the past 12 years.

Since mobile sports wagering has gone into effect, gross gaming revenue from in-person sports wagering at the state’s commercial casinos has declined, falling 45% in fiscal 2022-2023.

In fiscal 2020-2021, state revenues from video lottery terminal (VLT) facilities, casinos and tribal-state compacts were less than half of those collected in fiscal 2019-2020, mostly because physical facilities were closed for five months because of the COVID-19 pandemic.

Still, two years later, taxes on gaming revenues from casinos have yet to return to fiscal 2019-2020 levels. In addition, the industry has not recovered from the 2020 loss of about 3,400 jobs. Employment in 2022 was nearly 20% lower than pre-pandemic levels.

DiNapoli noted that gaming expansion is continuing across the state.

The state’s fiscal 2022-2023 budget gave approval for three additional casinos that will be located in New York City or Long Island or in Westchester, Rockland or Putnam counties. Just to be considered, companies must pay a $1 million application fee and the winners then will pay $500 million for a license.

Other legislative proposals to expand gaming include authorizing online casino gaming and a plan to double the number of VLTs to 2,000 from 1,000 at a casino/hotel on Long Island.

“With three new commercial casinos expected, careful analysis should be done to ensure projections of revenues and economic benefits are reasonable and attainable,” the report said.

In a separate report, the comptroller’s office said actual revenues received from the four upstate casinos fell short of forecasts and also fell short of projections they would create more than 4,700 jobs. When all four casinos were operational in 2019, jobs in the leisure and hospitality industry increased by about 3,800 where the casinos were located.

“With mobile sports wagering, the need to travel to a casino diminishes, as shown in the decline in revenue from in-person sports betting,” the report said. “With proposals to authorize online casino gaming introduced, economic benefits from the casinos could be eroded as foot traffic potentially declines.”

After the legalization of mobile on-line sports betting, the New York State Gaming Commission noted a 26% year-over-year increase in problem gambling-related calls to the Office of Addiction Services and Supports.

“More attention should be devoted to understanding the implications of mobile sports betting, particularly on young New Yorkers,” DiNapoli said.