Citi’s potential muni exit has market prepared for change

3 min read

Fresh signs of a retrenchment among Wall Street firms came Friday with news that Citi CEO Jane Fraser is considering closing the firm’s muni trading and origination business, which some market sources saw as a trial balloon being floated by top executives to test reaction.

The potential exit, reported by Bloomberg News, came as a surprise to many municipal market participants despite recent rumors of more layoffs at the firm and its slide down the ranks of top senior managers in the municipal bond market over the past few years.

“The concern might be that there’s contagion; an assessment that the municipal business is not a business these firms should be in or invest in,” said Ajay Thomas, head of public finance at FHN Financial Capital Markets. “How does that ultimately harm issuers like states and communities that need the market to function?”

Citi declined to comment.

While no decisions have been made yet, the potential exit comes amid Fraser’s planned major restructuring aimed at bringing the firm to profitability. The reorganization will reduce management levels and allow Fraser more control over Citi’s five primary business divisions.

Citi has slowly cut several positions from muni ranks over the past year, including its high-profile head of municipal strategy Vikram Rai in June. The firm’s efforts to scale back its muni business have been happening over the last two years, starting with “senior, big title legacy talent,” said James Pruskowski, chief investment officer at 16Rock Asset Management.

Additionally, “the transition as a liquidity and banking provider has been taking its course and decreasing over the last several years,” he said.

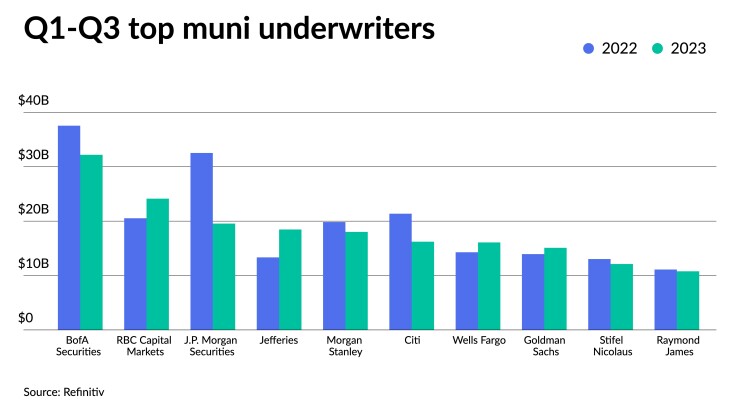

Over the past few years, Citi has fallen in the rankings for the top municipal underwriter rankings. In the first three quarters of 2023, the firm fell out of the top five senior managers to sixth from third for the same period last year, according to Refinitiv. The firm last year fell to fourth place from its second place finish in 2021 among senior managers.

Citi is the most recent firm to curtail its muni efforts amid a challenging year for the public finance business due to low issuance, compressed spreads and other challenges. UBS in September exited the muni underwriting business, resulting in the layoffs of most of its team.

A wholesale exit by Citi would likely carry more ramifications than the UBS move, market sources said.

One sell-side source said they have heard that every Wall Street firm has a hiring freeze in munis.

Along with the hiring freeze, more layoffs may be on the horizon, Pruskowski said.

“It’s a combination of challenging backdrop, the broader economic environment seems to be slowing, there’s an imminent risk of a recession, and deal flow, given high inflation, has slowed down infrastructure builds, and that means less supply,” he said.

Higher rates have led to significant losses for the year, and “going into yearend as you budget tough decisions need to be made,” he said.

While it’s been a tough year across fixed-income generally, the Wall Street muni retrenchment marks an opportunity for regional and middle-market firms to gain more of a foothold, market participants said.

“The market runs pretty deep regionally and with a lot of talent, so there’s a lot of second and third-tier shops ready, willing and able to step up to the plate,” Pruskowski said.

Thomas said the business is “shifting and evolving and it’s gotten more regionalized. Firms like FHN as well as Raymond James, which hired a trio of bankers in June, Stifel, Nicolaus & Co. Inc., which recently hired longtime financial advisor Chris Valentino, and Piper Sandler are “all in hiring mode right now,” Thomas said.

“More talent is available and you can enhance your own team so you become more of a full-service municipal service,” he said. “Regional firms that have made investments are now being considered, and once an issuer gives them a chance, they’re discovering that they’re getting across their transactions better service and better business than what they could get from bankers out of New York.”