Bond volume increases in November, but shy of 10-year average

4 min read

November issuance was up year-over-year for the third consecutive month as a muni market rally led to an acceleration and upsizing of deals.

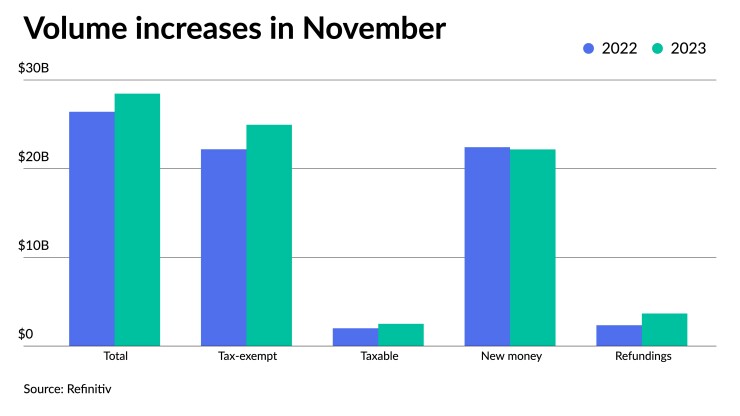

November’s total volume rose 7.8% to $28.464 billion in 652 issues from $26.415 billion in 678 issues a year earlier.

However, issuance for the month is lower than the $31.949 billion 10-year average, according to LSEG Refinitiv data.

November is the fourth month to see an increase in supply from 2022 in a year that has seen mostly losses. In June, issuance rose 4.3% to $39.476 billion from $37.775 billion year-over-year, while in September, issuance ticked up 1.2% to $27.585 billion from $27.251 billion a year earlier. In October, issuance surged 29.4% year-over-year, rising to $37.156 billion from $28.724 billion.

Tax-exempt issuance rose 12.4% in November to $24.956 billion in 586 issues from $22.193 billion in 591 issues in 2022. Taxable issuance totaled $2.507 billion in 57 issues, up 24.9% from $2.007 billion in 77 issues a year ago. Alternative-minimum tax issuance fell to $1.001 billion, down 54.8% from $2.216 billion.

New-money issuance fell slightly by 1.1% to $22.173 billion from $22.425 billion a year prior. Refunding volume rose from a year ago to $3.673 billion from $2.349 billion in 2022, marking a 56.4% increase.

The month got off to a slow start due to the Oct. 31-Nov. 1 Federal Open Market Committee meeting where the Fed decided to hold interest rates.

During Fed weeks issuance slows as issuers are more hesitant to come to market, said Cooper Howard, a fixed income strategist at Charles Schwab.

While many market participants expected the Fed to hold interest rates, the outlook for Fed policy “wasn’t firmly entrenched at the beginning of the month, so was a potential catalyst for volatility,” he noted.

Despite this, the “beginning of the month came out of the gate like nobody expected,” said Peter Block, managing director of Ramirez & Co.

Following the FOMC meeting, munis followed USTs in rallying.

After Fed Chairman Jerome Powell indicated the Fed was nearing the end of its hiking cycle during his post-FOMC meeting speech on Nov. 1, the AAA yield curve rallied hard. Muni yields were bumped 24 to 28 basis points by the following Monday, Nov. 6, according to Refinitiv MMD.

From there, muni yields have fallen even further, with triple-A yields declining by an additional 48 to 64 basis points through Wednesday, according to Refinitiv MMD.

“That gave everybody encouragement to get into the market,” Block said. “If deals were on the sideline or questionable from a refunding perspective, that was the impetus, that was your catalyst.”

This “encouragement” led to an acceleration of supply and some deals being pulled forward or upsized, primarily driven by rates, market participants said.

This week, for instance, saw both the Ohio Water Development Authority and the Los Angeles Community College District advance pricings of $300 million of green Water Pollution Control Loan Fund revenue bonds and $575 million of tax-exempt GOs, respectively.

Additionally, New York Transportation Development Corp. decided to price an upsized $2 billion from $1.5 billion of green AMT John F. Kennedy International Airport New Terminal One Project special facilities revenue bonds.

“Given that yields are lower, and there’s been a big rally in the Treasury market, that’s one of the reasons why you’ve seen some of the deals get pulled forward,” Howard said

Several large deals are already on the calendar for early December.

Pennsylvania is slated to price $2.1 billion of GOs next week, for the first time since late 2010, and the New York City Transitional Finance Authority is set to price $1.4 billion of future tax-secured subordinate bonds in both the negotiated and competitive market next week.

Despite these large deals, 2023 issuance is unlikely to best 2022’s volume of $390.715 billion. Issuance for the year currently stands at $346.386 billion, down 6.6% from $370.666 billion through November 30, 2022. For volume this year to top total 2022 issuance, December would need to see $44.329 billion of issuance. This is not something market participants expect to happen.

For one, issuance tends to be higher in November than December as market participants “wind down” for the year come the holidays, Block said.

Due to this, along with supply being down year-over-year, Block sees issuance in December falling to around $25 billion.

Issuance details

Revenue bond issuance increased 13.3% to $19.339 billion from $17.062 billion in November 2022, and general obligation bond sales fell 2.4% to $9.126 billion from $9.353 billion in 2022.

Negotiated deal volume was up 16.6% to $23.375 billion from $19.192 billion a year prior. Competitive sales increased 7.7% to $5.722 billion from $5.312 billion in 2022.

Deals wrapped by bond insurance saw a 17.3% increase to $2.76 billion in 158 deals from $2.353 billion in 109 deals in 2022.

Bank-qualified issuance rose 11.9% to $902.4 million in 221 deals from $806.5 million in 201 deals a year prior.

In the states, Texas claimed the top spot year-to-date.

Issuers in the Lone Star State accounted for $56.586 billion, up 20.5% year-over-year. California was second with $50.124 billion, up 10.4%. New York was third with $36.435 billion, down 22.1%, followed by Illinois in fourth with $12.551 billion, up 7.3%, and Florida in fifth with $12.162 billion, a 21.8% decrease from 2022.

Rounding out the top 10: Pennsylvania with $9.421 billion, down 6.5%; Georgia with $9.023 billion, up 1.4%; Washington with $8.986 billion, up 3.1%; Massachusetts at $8.449 billion, down 29.9%; and Michigan with $8.429 billion, down 3.4%.