S&P revises California’s outlook to stable from positive

4 min read

S&P Global Ratings revised California’s rating outlook to stable from positive citing the state’s projected $68 billion multi-year deficit, revenue uncertainties and economic conditions.

The state holds ratings of AA-minus from S&P, AA from Fitch Ratings and Aa2 from Moody’s Investors Service.

The state also has a stable outlook from Fitch. Moody’s

The Legislative Analyst’s Office announced earlier this month the state had a

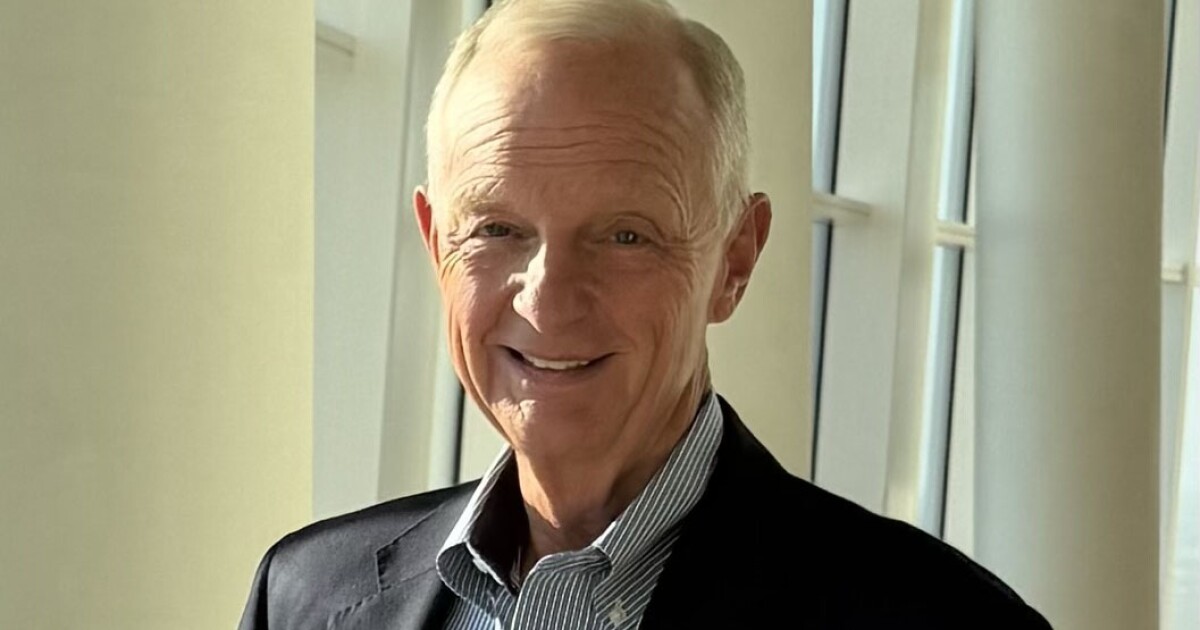

“The LAO’s report was informative,” said Oscar Padilla, director and S&P’s lead analyst for California. “We had mentioned in our October outlook that we wanted to see what personal income tax collections were. By the end of November, the state controller had released the revenue figures, and they were below what was expected.”

S&P said in the report the risk of longer-term structural imbalance is elevated, absent a meaningful budgetary course correction to reflect a period of subdued income tax growth, most notably among the state’s highest-income earners.

The state’s tax structure is highly dependent on income taxes — even more so from the state’s wealthiest residents. Some 40% of income tax revenues are paid by the 1% of taxpayers in the highest category, the

That dependence on high-net taxpayers also means a dependence on capital gains taxes, which tend to rise and fall with the stock market. It meant the state had a

While S&P believes the state has sufficient liquidity and strong enough reserves to weather the shortfall, analysts are not seeing the structural steadiness that led to the positive outlook, Padilla said.

“We will look to the governor’s proposed budget in January and what the Department of Finance estimates are — and whether they are able to achieve structural balance,” Padilla said.

S&P has the lowest rating among the three largest agencies at AA-minus, but Padilla said while the state scores at a double-A in their model, the revenue volatility has made it difficult to rate it higher.

“On a four-point scale, with 1.0 being the strongest and 4.0 the weakest, we have assigned a composite score of 2.0 to California under our state rating criteria, indicative of an AA rating,” Geoff Buswick, an S&P managing director said. “However, we have notched down to AA-minus as allowed as per our state rating methodology, due to California’s cyclical fiscal history and potential out-year spending pressures, which could affect future structural financial balance, as well as issues of financial transparency regarding timely release of its financial audits.”

California is much better positioned than it was in 2008 to address the $68 billion revenue shortfall projected by the LAO, according to Fitch.

“Fitch anticipates the state will take steps to close the budget gap while maintaining very strong financial resilience,” Fitch Senior Director Karen Krop wrote in a Thursday report.

In an interview, Krop ticked off several steps the state has taken to cure problems that led its rating to fall to the lowest among the states in 2009-2010. In January 2010, it had ratings of BBB, Baa1 and A-minus from Fitch, Moody’s and S&P, respectively.

When the rating dropped to BBB, “it was triggered by its inability to pass a budget, and liquidity was so poor it couldn’t issue cash flow notes, because it didn’t have a budget,” Krop said. “But they fixed some of the things that were structural. One was that lawmakers can now pass a budget with a majority, not a super majority, or two-thirds, vote. They have also incorporated more things into what is considered borrowable, so that eases liquidity.”

She also noted that as the economy grew, the state did not dramatically increase spending, used some of the surplus to pay down pension liabilities and made a lot of one-time expenditures using the surpluses of fiscal 2020 and 2021 that can be reversed.

One of the changes the state made in the years following the Great Recession is to automatically ramp up reserves through Proposition 2, approved by voters in 2014. Under that proposition, a set amount of the general fund has to go into reserves, and the K-12 spending guarantees drop if revenues fall.

In total, the state holds $37.8 billion in dedicated reserves, according to Fitch.

“It seems likely that the state will apply a significant portion, if not all, of its special fund for economic uncertainty (SFEU) to closing the prior year gap,” Krop wrote. “The SFEU held $3.3 billion as of the end of fiscal 2023. Another source of gap-closing capacity is the state’s rainy-day fund, the Budget Stabilization Account (BSA), which contains $22 billion, or 10% of state revenues. Both funds were built up through a combination of revenue surpluses and structural budget changes that mandated deposits.”

“That doesn’t mean they don’t have something to manage, but they are structurally in a different place then they were in 2008,” Krop said.