Fed’s Harker says rates should move down but not immediately

2 min read

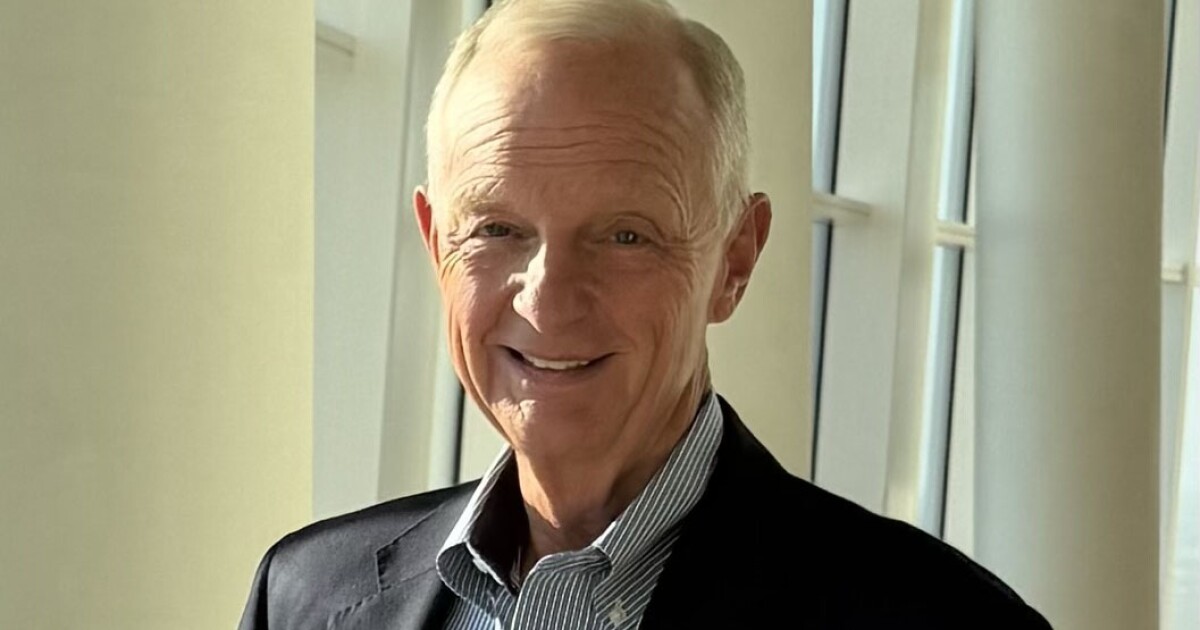

Federal Reserve Bank of Philadelphia President Patrick Harker said the central bank should begin to reduce interest rates — though not immediately — offering a softer pushback against widespread market expectations of early 2024 cuts than some of his peers.

“It’s important that we start to move rates down,” Harker said Wednesday in a local radio interview. “We don’t have to do it too fast, and we’re not going to do it right away.”

Bloomberg News

“We should hold rates where they are and start to bring rates down,” he said.

Harker’s comments were more supportive of the Fed’s next policy move being a cut than remarks by a handful of his colleagues in recent days. He said the economy appears to be slowing faster than government data suggest, given such figures are backward looking.

Other policymakers have been pushing back against rising market expectations that the Fed will begin easing in March, a bet that traders piled into after Chair Jerome Powell indicated officials were likely done tightening policy in a press conference last week.

While Harker won’t vote on policy next year, he’ll be part of the discussion during the Federal Open Market Committee meetings. He didn’t specify when it would be appropriate for the Fed to begin cutting rates or how many rate reductions he sees next year.

In Wednesday’s interview, he also noted businesses’ biggest challenge right now is the cost of capital — something lower borrowing costs would support.

Policymakers left rates unchanged for a third straight meeting last week and signaled their aggressive hiking campaign is finished. Annual price growth remains elevated but has slowed in recent months toward the Fed’s 2% target. The median official sees three quarter-point rate cuts next year, according to updated projections released after the meeting.

Harker said in early November that he preferred to hold rates steady but didn’t completely rule out a future rate increase, saying that the path of policy would depend on incoming data. That said, he was an early supporter of ending policy tightening, noting in October that the central bank shouldn’t overreact to month-to-month volatility in data.