Mega deals from NYC waters, Harvard, University of Cal Regents see strong demand in primary

6 min read

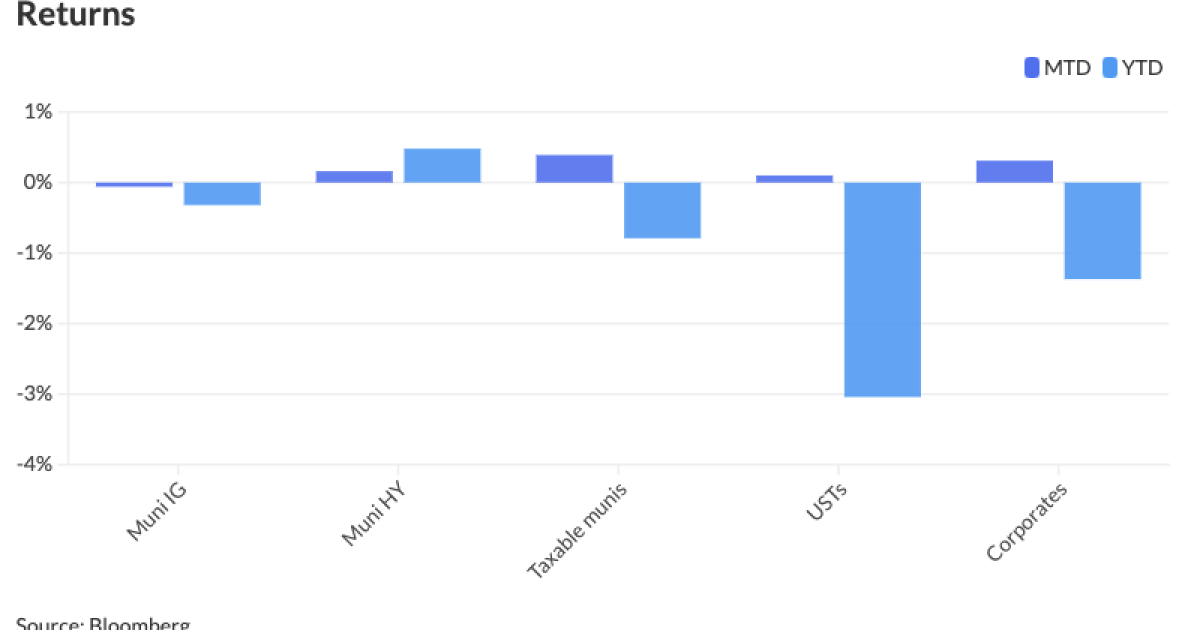

The primary market was the focus Tuesday, as several large deals priced to strong reception, led by an upsized pricing of $1.4 billion from the New York City Municipal Water Finance Authority. Municipals were little changed in secondary trading, underperforming U.S. Treasuries, while equities were down near the close, as all markets await Federal Reserve Chairman Jerome Powell’s testimony before Congress Wednesday.

Triple-A yields fell one to two basis points, depending on the curve, while UST yields fell six to nine basis points.

The two-year muni-to-Treasury ratio Tuesday was at 60%, the three-year at 59%, the five-year at 59%, the 10-year at 59% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 60%, the three-year at 59%, the five-year at 58%, the 10-year at 59% and the 30-year at 81% at 3:30 p.m.

The upsized pricing of $1.364 billion of water and sewer system second general resolution revenue bonds Fiscal 2024 Series BB, a $480 million increase, for institutions from the New York City Municipal Water Finance Authority (Aa1/AA+/AA+/), led the negotiated calendar. The issuer saw yields fall three to six basis points from the retail order period and ranged from 2.52% with a 5% coupon in 2028 to 3.69% with a 5.25% maturing in 2047.

Jefferies priced and repriced for the Regents of the University of California (Aa2/AA/AA/) $1.092 billion of general revenue bonds, 2024 Series BV, with yields falling two to five basis points and ranging from 3.00% with a 5% coupon in 2024 to 3.38% with a 5% maturing in 2045.

Raymond James priced and repriced for the Midland Independent School District, Texas, (Aaa/AAA//) $860.640 million of PSF-insured unlimited tax school building bonds, Series 2024, with yields falling two to five basis points and ranging from 3.01% with a 5% coupon in 2025 to 4.25% with a 4% maturing in 2054.

Goldman Sachs priced for the Presidents and Fellows of Harvard College (Aaa/AAA//) $750 million of taxable corporate CUSIPs, Series 2024A. The deal was being shopped initially at +65 U.S. Treasuries, went out in preliminary wires at +60, and finished at +47.

AllianceBernstein strategists expect supply to remain “heavy” over the next few weeks.

CommonSpirit Health is set to price $1.751 billion of taxable bonds, $775.270 million of revenue bonds through the Colorado Health Facilities Authority and $246.565 million of revenue bonds through the California Health Facilities Financing Authority.

The Los Angeles Department of Water and Power (AA-/Aa2//AA/) is set to price on March 13 $627.295 million of power system revenue bonds.

The Black Belt Energy Gas District, Alabama, is set to price $579.075 million of gas project revenue bonds.

Clark County, Nevada, is set to price March 13 $322.100 million of non-AMT airport system subordinate lien refunding revenue bonds and $152.225 million of non-AMT. airport system junior subordinate lien revenue notes.

The Idaho Housing and Finance Association (Aa1//AA+/) is set to price on March 14 $331.510 million of Transportation Expansion and Congestion Migration Fund sales tax revenue bonds.

But while the new-issue calendar is “building,” Anders S. Persson, Nuveen’s chief investment officer for global fixed income, and Daniel J. Close, Nuveen’s head of municipals, said there is still not enough supply to meet demand.

“March represents the fourth consecutive month with outside reinvestment money to be put to work,” they noted.

The calendar should increase, but outsized cash will remain.

“With dealer balance sheets growing and robust supply expected over the next few weeks, we anticipate that after-tax spreads will widen in the near term,” AllianceBernstein strategists said.

That said, they noted “the overall tone of the market still feels constructive given market inflows and a good amount of cash on the sidelines.”

Fund flows “remain thin but mostly positive,” said Matt Fabian, a partner at Municipal Market Analytics.

The Investment Company Institute has reported about $8 billion of inflows into traditional funds year-to-date, while exchange-traded funds “are flat to slightly negative (the latter, perhaps, on some liquidity-related selling), even as fund NAV returns are far from compelling,” he said.

“Who’s not buying is crossovers and, at least for now, banks, the former warded off by rich ratios, the latter by still emerging [commercial real estate] risks and a lack of timely Fed action on rates,” he said.

This has left

Secondary trading

Connecticut 5s of 2025 at 3.05%. NYC 5s of 2025 at 3.01%-2.95%. Washington 5s of 2025 at 2.95%.

Florida BOE 5s of 2028 at 2.50% versus 2.50% Friday and 2.51% on 2/27. California 5s of 2029 at 2.44% versus 2.43% on 2/23 and 2.45% on 2/22. Virginia Commonwealth Transportation Board 5s of 2030 at 2.50% versus 2.50% Friday and 2.50%-2.53% original on Thursday.

Wisconsin 5s of 2033 at 2.54% versus 2.56% Monday and 2.59%-2.58% Thursday. NYC 5s of 2034 at 2.61% versus 2.67%-2.66% Monday and 2.73% original on Thursday. Howard County, Maryland, 5s of 2034 at 2.52% versus 2.55%-2.54% Thursday and 2.55% Wednesday.

Raleigh Combined Enterprise System, North Carolina, 5s of 2048 at 3.44%-3.30% versus 2.49% Monday. NYC TFA 5s of 2049 at 3.89%-3.85% versus 3.90%-3.88% on 2/27 and 3.91% on 2/26.

AAA scales

Refinitiv MMD’s scale was unchanged. The one-year was at 2.97% and 2.73% in two years. The five-year was at 2.44%, the 10-year at 2.46% and the 30-year at 3.59% at 3 p.m.

The ICE AAA yield curve was bumped up to two basis points: 2.99% (unch) in 2025 and 2.77% (-1) in 2026. The five-year was at 2.45% (-1), the 10-year was at 2.46% (-1) and the 30-year was at 3.53% (-2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.95% in 2025 and 2.73% in 2026. The five-year was at 2.43%, the 10-year was at 2.46% and the 30-year yield was at 3.56%, according to a 3 p.m. read.

Bloomberg BVAL was bumped one to two basis points: 2.94% (-1) in 2025 and 2.79% (-1) in 2026. The five-year at 2.43% (-1), the 10-year at 2.51% and the 30-year at 3.62% (-1) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.547% (-6), the three-year was at 4.328% (-7), the five-year at 4.133% (-8), the 10-year at 4.134% (-9), the 20-year at 4.394% (-9) and the 30-year at 4.272% (-9) at 3:30 p.m.

Guam Waterworks $185M deal

Last week’s

The authority had $2.156 billion of orders on $184.9 million of bonds.

The bonds matured serially from 2025 to 2046, with bonds in 2025 with a 5% coupon yielding 3.30%, 5s of 2034 at 3.22% and 5s of 2046 at 3.97%, callable in 7/1/2034.

“It is gratifying to see the level of investor participation in this refunding, especially the tender transaction, which is a first for Guam and added about $9 million in debt service savings on refunding bonds that we otherwise would never have realized,” said Guam Waterworks Authority General Manager Miguel Bordallo.

Primary on Tuesday

Siebert Williams Shank upsized the pricing of institutions of $1.233 billion of water and sewer system second general resolution revenue bonds Fiscal 2024 Series BB, from the New York City Municipal Water Finance Authority (Aa1/AA+/AA+/), with yields bumped from Monday’s retail offering.

The first tranche was $203.775 million of Subseries BB-1.

| Maturity | Coupon | Yield |

| 6/2054 | 5.25% | 3.89% (-3) |

The second tranche was $1.161 billion of Subseries BB-2.

| Maturity | Coupon | Yield |

| 6/2028 | 5% | 2.52% (-6) |

| 6/2029 | 5% | 2.51% (-6) |

| 6/2034 | 5% | 2.63% (-4) |

| 6/2047 | 5.25% | 3.69% (-3) |

Jefferies priced and repriced for the Regents of the University of California (Aa2/AA/AA/) $1.092 billion of general revenue bonds, 2024 Series BV, with yields bumped up to five basis points from Tuesday’s preliminary offering.

| Maturity | Coupon | Yield |

| 5/2024 | 5% | 3.00% (unch) |

| 5/2029 | 5% | 2.24% (-5) |

| 5/2034 | 5% | 2.45% (-2) |

| 5/2045 | 5% | 3.38% (-5) |

Raymond James priced and repriced for the Midland Independent School District, Texas, (Aaa/AAA//) $860.640 million of PSF-insured unlimited tax school building bonds, Series 2024, with yields bumped from Tuesday’s preliminary pricing.

| Maturity | Coupon | Yield |

| 2/2025 | 5% | 3.01% (-5) |

| 2/2029 | 5% | 2.57% (-3) |

| 2/2034 | 5% | 2.69% (-2) |

| 2/2054 | 4% | 4.25% (-4) |

BofA Securities priced for Osceola, Arkansas $100 million of AMT Plum Point Energy Associates Project solid waste disposal revenue bonds, Series 2006.

| Maturity | Mandatory tender date | Coupon | Yield |

| 4/2036 | 1/2/2026 | 5.5% | 5.5% |

Robert Slavin contributed to this story.