BofA hires former Citi housing, aviation bankers

2 min read

BofA Securities has hired three former Citi employees to help it grow and expand into aviation technology and housing securitization.

The latest hires from Citi are Bob DeMichiel as a managing director and senior investment banker for the airline and transportation sector, and Raymond High and Mike Koessel as directors and senior investment bankers for housing and securitization.

“These additions will enable us to expand our offerings to these highly specialized sectors and drive further responsible growth,” said Matthew McQueen, head of Global Mortgage and Securitized Products and Global Municipal Banking and Markets, and Ed Sisk, head of Municipal Investment Banking and Public Sector Banking Client Management, in a memo seen by The Bond Buyer. BofA declined to comment.

BofA Securities is the latest firm to scoop up former employees from Citi, which decided to shutter its muni division late last year.

Before Citi’s exit from muni market, Jefferies hired around 10 healthcare bankers. Since Citi exited the muni market, former employees have been hired by

DeMichiel, the former managing director and head of Airport and Aviation Finance at Citi, has nearly 40 years of experience managing relationships and providing technical expertise in public finance and the airline/airport sector. He will be based in New York and report to Jim Calpin, the memo said.

High and Koessel, both former employees of Citi’s Municipal Housing Group, have widespread experience and knowledge of public finance and the housing and securitization sector, the memo said.

High will be based in Raleigh, while Koessel will be based in New York. They will both report to Joe Monitto, according to the memo.

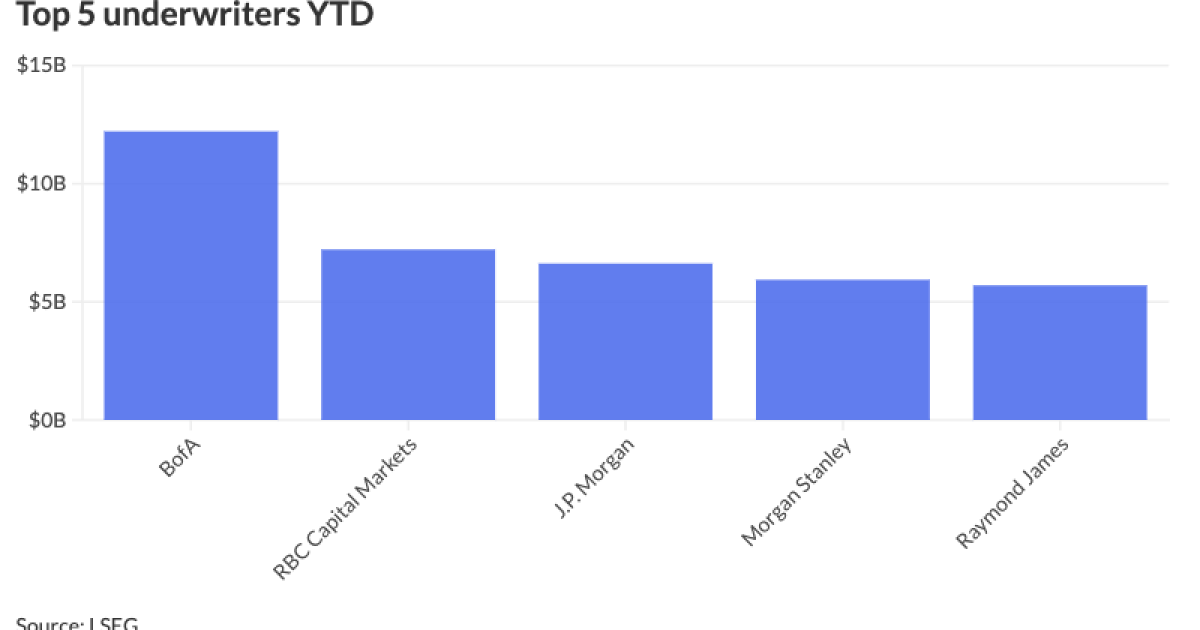

BofA Securities ranks as the top underwriter year-to-date, underwriting $12.214 billion in 68 issues. The largest deals it has led in 2024 include

The firm remained the top underwriter in 2023, accounting for $45.219 billion and a market share of 12.5%, This was a slight increase from the $44.765 billion and 12.4% market share it totaled in 2022, LSEG said.