TD Securities nabs former UBS banker to lead Western region

3 min read

TD Securities has hired Andrew Nakahata, f

The investment bank has been building its California public finance business for six years and has a San Francisco office opening April 1. The new office will house TD-Cowen Securities, as TD acquired Cowen in early March.

“I am really excited to work with the public finance team they have built and to help them grow,” Nakahata said.

TD Securities

Nakahata’s addition expands TD’s public finance team to nine people, the other eight in New York, but the banker said, “TD has been punching above its weight.”

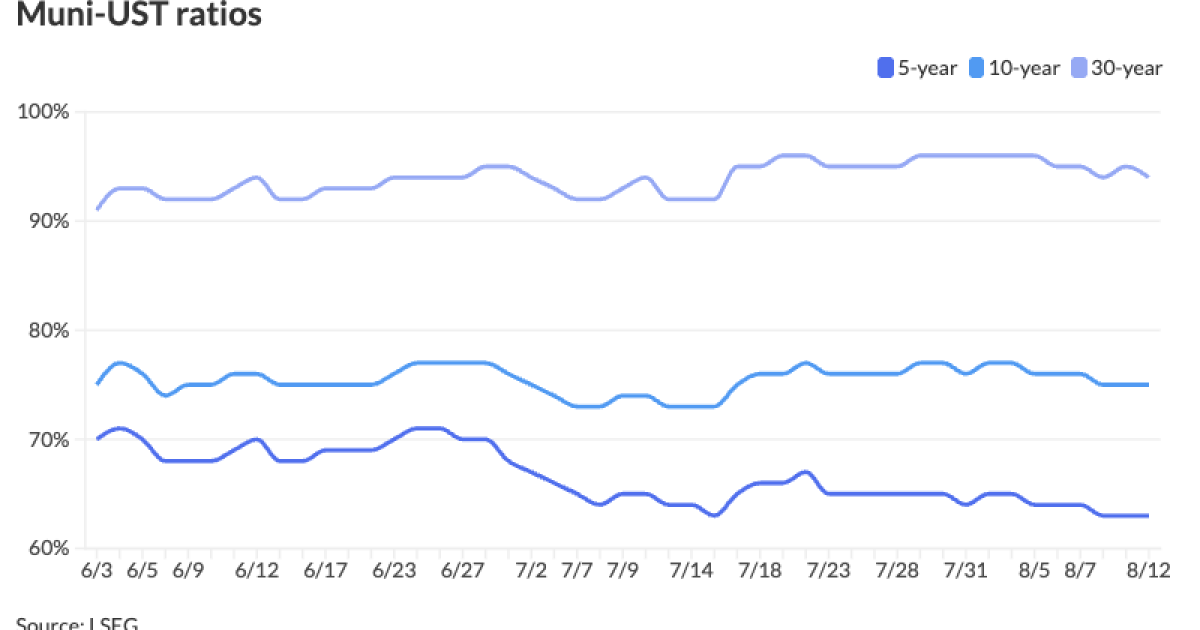

TD had $2.4 billion in municipal bond underwriting in 2023, according to LSEG.

It has co-managed University of California Regents and state of California transactions and been lead manager on some Los Angeles Department of Water and Power deals, and co-manager on others for the utility, to name a few.

Nakahata had worked for UBS since September 2017. He was hired by UBS to lead its western region, just after it hired 19 people across the country and five months after it

“UBS was a top 10 California negotiated underwriter,” said Nakahata, who co-chaired the Bond Buyer’s 2022 California Public Finance conference. “It took a lot of work to get there.”

Nakahata, who started March 18, will parlay the skills he gained first leading UBS’ western region, and before that

He doesn’t expect to bring over former members of his UBS team because most have already secured other positions. Among those are Shawn Dralle, who now

Growing TD’s underwriting business should be easier than it was for UBS, because the exit of the two large banks will likely mean underwriting pool slots will open up more quickly, Nakahata said.

“Andy’s expertise and creativity is a perfect fit for TD’s expansion efforts,” said

The changes that have occurred in the municipal bond industry — like the exit last year of UBS and Citi from public finance — “are leaving issuers with fewer choices for bond underwriters with significant balance sheets,” Gambone said.

TD is comfortable expanding in public finance, while others have been contracting, because the firm “has a very strong risk management culture and understands the inherent risks associated with the municipal and not-for-profit sectors,” Gambone said. “The current market needs another large highly rated financial partner in municipal finance to help taxable and tax-exempt debt issuers diversify and to support effective bond underwriting and TD embraces this opportunity to expand.”

Among the firm’s offerings are fixed-rate bond underwriting, remarketing services, commercial paper dealer services, guaranteed investment contract provider, and swap counterparty services. TD’s commercial bank, TD Bank, is also one of the most active providers of lines of credit, standby bond purchase agreements, and direct purchases, Gambone said.