Two California assessors have slapped workforce housing projects with large tax bills

8 min read

Rising interest rates have already slowed growth in a workforce housing bond program in California, and now efforts by some county assessors to levy possessory interest taxes on the property administrators are having a chilling effect.

So far, only Orange and San Diego counties have followed through, while others are contemplating doing so.

The program was created in 2020 by three of the state’s joint powers authorities, also bond conduit issuers, working with local governments across the state: the California Statewide Communities Development Authority (CSCDA), the California Municipal Finance Authority (CMFA), and the California Community Housing Agency (CalCHA), according to a white paper by John Bakker, a partner with Redwood Public Law in Oakland, who represents the JPAs.

The aim was to create affordable moderate-income housing more quickly by acquiring existing apartment communities and converting the units to below-market-rate as existing tenants moved out.

“Obviously California is going through a well-documented housing crisis,” said Sean Rawson, co-founder of Waterford Property Company. “There has never been a long-term dedicated funding source to provide moderate-income housing. In California, the stratification of projects being built are to the upper-income tier.”

There are resources for low- to very-low-income housing, though, Rawson said, not enough of that is being built, either.

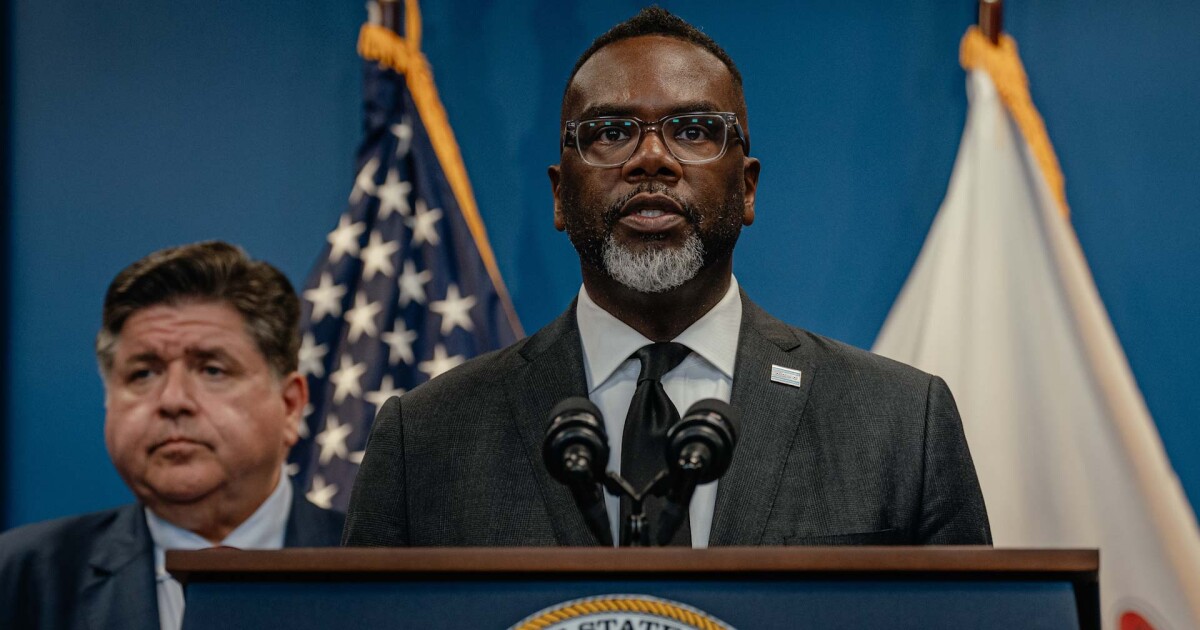

Waterford Property Co.

No one questions whether there is a housing crisis, but differences of opinion arise as to the best way to solve the problem.

The governor, attorney general, lawmakers and mayors of the state’s largest cities have all gone full-court press to try to eradicate the housing crisis using a variety of tools. Los Angeles Mayor Karen Bass declared a state of emergency around homelessness as her first act as mayor.

The state and cities have issued billions of dollars in bonds to build affordable housing. The rating agencies have mentioned housing as a challenge in the state’s credit reports, though as of yet, it hasn’t affected ratings.

Just over half (52%) of the state’s residents are housing burdened, spending more than 30% of their monthly income on shelter, according to Bakker’s white paper.

Relying on reports from the state’s housing department and McKinsey & Co., Gov. Gavin Newsom set a goal a few years ago of building 2.5 million homes in a decade to make up for the estimated deficit, expected to hit that amount by 2025.

“We are very proud of what this has accomplished,” Rawson said. “We can see the rental savings being passed on to the tenants.”

Tapping historically low-interest rates to issue debt, the program converted more than 13,000 market-rate units to middle income/workforce housing, Bakker wrote. The projects, which target residents making 60% to 120% of area median income, provided housing at rents reduced by $500 to $1,000 to people making $42,000 to $108,000 a year in 25 of the state’s mostly higher-priced cities from the San Francisco Bay region south to San Diego, he wrote.

Up to $10 billion in debt of this kind involving over 45 financings, was

The program Waterford is involved with should have been seen as a boon, instead it has hit a quagmire. While cities with these communities laud the program, county tax assessors are bemoaning the related loss of property tax revenue.

Waterford Property Company

The properties are owned by a joint powers authority involving the local government and the conduit. Under the structure, the bond conduits partner with private companies, who purchase apartment communities and then lower the rent. The concept is that as government agencies, they would not pay property taxes over the life of the 30-year bonds and could pass that savings on to tenants. After the bonds are paid off, the city ends up owning the apartment complex and can sell it and add it back to the tax rolls, or maintain it as workforce housing.

The cities they worked with, which include Glendale, Pasadena and Long Beach were enthusiastic about the concept once they saw the numbers, Waterford co-founder John Drachman said. City leaders realize how high rents are and liked the concept of providing residents with relief. They also liked the idea that the city would own the property after the 30-year bonds are paid off, he said.

One advantage of the program is it didn’t need to tap the highly sought-after

County tax assessors cried foul at the loss of revenue and questions also arose as to just how much the program was helping residents.

Bakker’s white paper estimates residents are saving on average $500 to $1,000 a month on rent, but Orange County Assessor Claude Parrish said an analysis he did shows some instances where residents were only saving $7 a month.

Parrish also asserted the communities raised market rents on non-subsidized units to pay for the subsidized units, a claim disputed, at least in Waterford’s case, by the financial documents shared with The Bond Buyer. The savings realized by tenants at Waterford’s properties match the averages included in Bakker’s white paper, and the market rents on the pre-existing tenants are in line with average market rents.

The possessory interest tax issue first arose when the Alameda County assessor began questioning why the properties being operated by private companies were not paying property taxes, said Bakker, who represents three JPAs. From there it percolated to the California Assessors Association and the Board of Equalization (BOE), he said.

Discussions by the assessors were whether a possessory interest tax could be levied to make up for the loss of taxes from the program.

Waterford Property Company

Though government-owned property is exempt from property taxes, if the government leases part of its property to a private entity, that private party may have a “possessory” interest that can be taxed. Some examples where the tax could apply are a McDonald’s at the airport, or a restaurant in a public park.

The initial solution — to levy possessory taxes on tenants receiving the subsidized rent — seemed at odds with the program’s intent of providing reduced rent to middle-class workers, including police officers, firefighters and teachers. It resulted in legislation being passed last year that protects low-income — but not moderate-income — residents from facing the possessory tax. And the focus has shifted to charging program administrators like Waterford.

The JPAs didn’t expect tenants would face possessory taxes when the deals were structured, because they relied on existing guidance from the BOE that would have exempted anyone receiving rent breaks, Bakker said.

In October 2022, the BOE changed its guidance and said residents at JPA properties do have a taxable possessory interest, but assessors should refrain from taxing low-income tenants.

Then, in January 2024, the statewide assessors’ association published a white paper asking the Legislature to draft legislation that would deem administrators’ use of JPA-owned properties as constituting taxable possessory interests. It would also require administrators to notify prospective tenants of the possibility they could be taxed and require local governments that enter into these JPAs to notify the local taxation body that it may experience a decrease in property tax revenue if those JPA-owned properties are not subject to assessment.

So far, none of the assessors have taxed tenants, Bakker said.

But in Orange and San Diego counties, the assessors have issued tax bills to property administrators.

Waterford has received property tax bills totaling $25 million, according to the co-founders.

Parrish, who served on the BOE, takes credit for steering the conversation toward taxing the program administrators.

“The taxable possessory interest is assessed on the administrators under section 107 of the revenue and taxation code and not the renters of the apartment complex,” Parrish said. “In fact, several county assessors wanted to assess the taxable possessory interest on the renters, but I convinced them that the correct entity that should be assessed are the property administrators.”

“I have to tax businesses being run on government property, because it’s the law,” Parrish said.

He said he ran an analysis — which he didn’t share with the Bond Buyer — that shows the JPAs are raising rents on market-rate tenants in order to provide lower rents for others.

“They aren’t helping anyone but themselves,” Parrish said. “They make millions and millions. You can make as much money as you want, but you have to pay the taxes on your business.”

His analysis, he said, showed that even after paying the tax and covering expenses, all JPA-owned apartments in Orange County made money.

Waterford disputes this.

The annual possessory taxes exceed earnings, Drachman said. For instance, he said, Waterford faces a $1.2-million annual tax bill on the Parallel apartments in Anaheim and earns roughly $700,000 a year.

The Orange County and San Diego County assessors “have issued full ad valorem tax bills. It’s $25 million in unsecured tax bills. These are government-owned assets. But they can’t send a property tax to the owner, so they are sending it to Waterford, as the administrator,” he said.

“These projects all have legal opinions from Orrick saying they are tax-exempt,” Rawson said.

Los Angeles County Assessor Jeffrey Prang hasn’t taken steps to either tax tenants or program administrators “because he’s waiting for more input and information from a variety of sources,” said spokesman Stephen Whitmore. “He said he is trying to find a solution to a very complicated law. He does not want to be an obstacle to housing solutions, creative or otherwise.”

He does ask, “Why didn’t the JPAs consult assessors before?”

As much as Waterford likes the structure, the firm can’t afford to operate the apartments at a loss, and if their tax appeal fails, the apartments would probably have to be sold and returned to market-rate, Rawson said.

“In California no deals are going to get done until the possessory interest tax question is solved,” Drachman said.

The duo has started looking outside of the state for properties and just closed on their first property in Texas, Drachman said.

They have appealed the tax bills and have filed a lawsuit against Orange County.

“What ticks us off, is that this will ultimately hurt tenants,” Drachman said. “Sean and I will be fine, but this will hurt our tenants, who will lose their income-restricted units.”