Unlocking private capital key to infrastructure boom: BlackRock CEO

3 min read

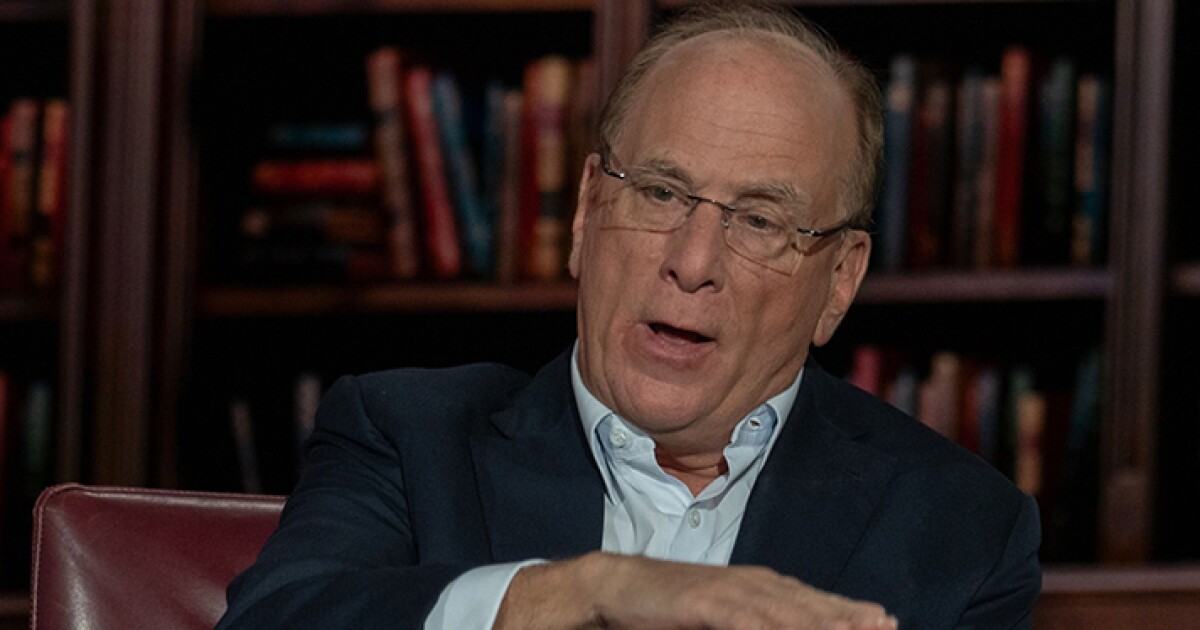

BlackRock Chief Executive Officer Larry Fink said he sees major opportunities in private infrastructure investment amid rising public deficits coupled with the coming energy transition and artificial intelligence needs.

“There’s a generational demand for capital and infrastructure, including the [need to] finance data centers for AI and for energy transition,” Fink said Monday during the firm’s second quarter earnings call. “Private capital will be critical in meeting these infrastructure needs, both stand-alone and through public-private partnerships.”

Investors are increasingly interested in investing in infrastructure, Fink said. He predicted they will continue to opt for fixed-income products like exchange-traded funds and alternative assets like infrastructure debt instead of traditional bond funds, creating a “barbell” effect that’s been a pattern in the equity markets.

Bloomberg News

“I do believe the macro trends toward more bond allocation because of the extensive equity rally over the last 10 years — a deeper allocation toward privates, especially private credit and infrastructure, is going to continue,” he said.

The comments come six months after the world’s largest asset manager made a major move into the “booming infrastructure market” with the $12.5 billion

“Over six months of feedback of our planned acquisition of GIP [have occurred] and the conversations we’re having with some of the most sophisticated investors worldwide has never been more robust about how we could partner, how we could be trying to develop more things,” Fink said on the call. The need for infrastructure to drive the energy transition and the growth of AI and data centers will require “trillions of dollars of investments,” he said. “The opportunity we have in infrastructure is way beyond I’ve ever imagined even just seven months ago when we were contemplating the [GIP] transaction and formalizing it.”

Private investments are necessary because neither federal or state and local resources can meet the country’s infrastructure investment needs, Fink said.

The U.S. infrastructure gap is well documented. The

Beyond the needs to maintain and rebuild failing infrastructure, the transition

In its

“As the real economy takes over from the financial economy, we think investors should actively position for waves of transformation like we have rarely seen before, we think,” the report said.

The rising U.S. deficit, estimated by the Congressional Budget Office to hit $1.9 trillion by the end of this fiscal year, limits public financing, BlackRock said.

Neither U.S. presidential candidate is talking enough about tapping the private sector and tackling the rising deficit, Fink said Monday in an interview with CNBC.

“No one is spending enough time talking about deficits,” he said. “Both candidates need to talk about growth. Growth is not going to come from tax cuts or tax increases. We need to be building America,” he said, which will require streamlining the permitting process.

“We have an infrastructure boom that is necessary, whether that’s for digitalization or decarbonization,” Fink said. “We’re going to get growth from the private sector — we can’t rely on public deficits anymore; the public deficits are just growing too fast.”