Hefty slate of new-issues price into constructive market

6 min read

Municipals were slightly firmer Thursday amid another busy day in the primary market, which saw a $1.1 billion deal from the North Texas Tollway Authority price and $850 million of general obligation bonds from Massachusetts sold in the competitive market. U.S. Treasury yields fell and equities were mixed.

The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 71% and the 30-year at 88%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 71% and the 30-year at 88% at 3:30 p.m.

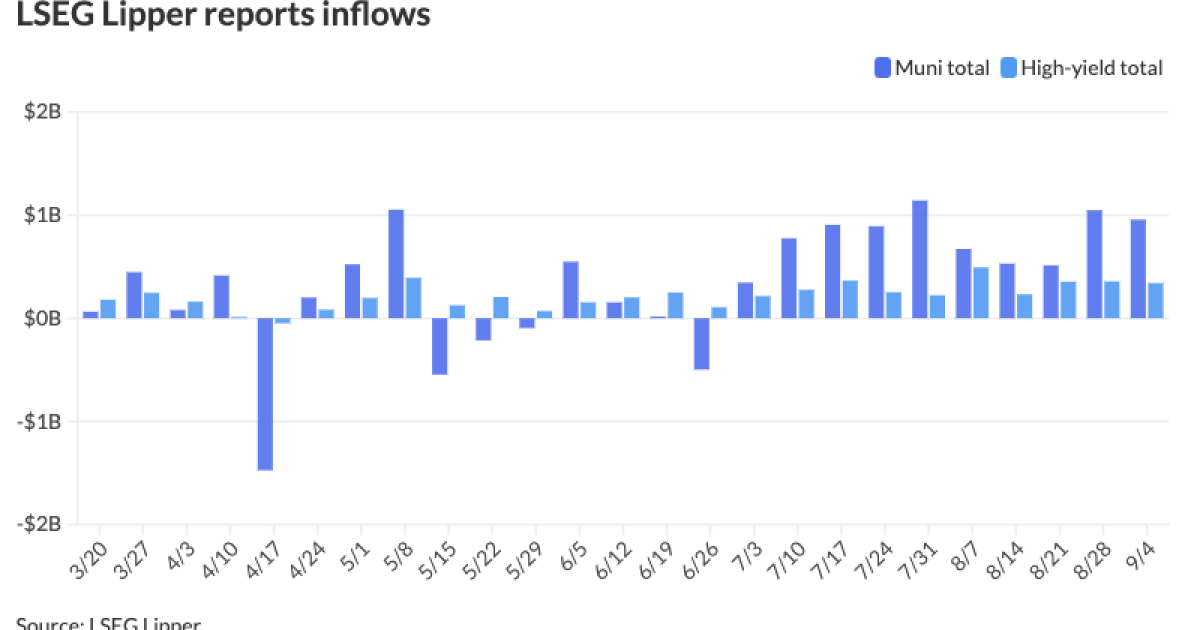

Municipal bond mutual funds saw inflows as investors added $956 million to funds after $1.047 billion of inflows the week prior, according to LSEG Lipper. This marks 10 straight weeks of inflows.

Munis, like most bonds, are “biding their time waiting for the debate, the Fed, the Congressional [Continuing Resolution], and the election, in chronological order,” said Matt Fabian, a partner at Municipal Market Analytics.

It is reasonable for expected pricing strength/lower yields in munis once the Federal Open Market Committee starts to cut its target rate, “driven by a migration of dollars from cash alternatives (like 2a7 funds) and other asset classes into fixed income,” he said.

“Those views have reshaped the municipal curve a bit already, bidding up early maturities enough to erase the front-end’s inversion as of last week and push the 5yr spot into risk/overbought territory,” he said.

“This raises the stakes for front-end purchases this week; bonds should be picked a bit more carefully if possible,” Fabian said. “Intermediates and the long end now read as oversold, if only moderately and could present better total return opportunities.”

With the summer months “behind us,” the muni market is entering a somewhat seasonally softer period, said Jeff Timlin, a managing partner at Sage Advisory.

There may be some volatility in the coming weeks, depending on upcoming economic data and the FOMC meeting, he said.

However, most of that is “baked” into the market, Timlin noted.

Supply has been surging this year, with

Ramirez projects $122 billion of additional supply through yearend, bringing the total to around $450 billion, said Peter Block, managing director of credit strategy at the firm. Around $65 billion, a little more than half of the $122 billion, will occur in September and October, Block said.

Issuance will continue to pick up as rates heading lower proves to be “conducive” for additional supply, specifically for sidelines deals waiting for a better entry point, Timlin said.

The influx of supply creates a little bit of a softer tone in the market “in terms of it being a better buying opportunity for investors coming in and being more selective with redeploying their cash flow, those monies and that they come to market with,” Timlin said.

There is a record amount of money sitting in tax-exempt money market funds, he said, but they snapped a two-week run of inflows as investors pulled $2.07 billion from the funds for the week ending Sept. 3. That brings the total assets sitting in the funds to $128.81 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 2.82%.

Taxable money-fund assets saw $34.07 billion added to end the reporting week. The average seven-day simple yield for all taxable reporting funds was at 4.96%.

The money is set to be redeployed into longer-dated maturities “once people get a feel that rates will come down a bit more,” or there is a more normalized yield curve where the daily and weekly rates are below the longer-term rates, Timlin said.

When that happens, money will flow out of the money market funds into higher-yielding opportunities along the maturity curve, which could be supportive, he said.

In the primary market Thursday, BofA Securities priced for the North Texas Tollway Authority

The second tranche, $679.875 million of second tier bonds, Series 2024B, (A1/A+//), saw 5s of 1/2026 at 2.63%, 5s of 2030 at 2.73%, 5s of 2034 at 3.14% and 5s of 2037 at 3.32%, callable 1/1/2034.

Goldman Sachs priced for the San Diego Unified School (Aa2//AAA/AAA/) $513.15 million of GO dedicated unlimited ad valorem property tax bonds. The first tranche, $323.15 million of green Election of 2018 bonds, Series H-2, saw 5s of 7/2025 at 2.45%, 5s of 2029 at 2.24%, 5s of 2034 at 2.59%, 5s of 2039 at 2.99%, 5s of 2044 at 3.41% and 5s of 2049 at 3.59%, callable 7/1/2034.

The second tranche, $190 million of sustainability Election of 2022 bonds, Series B-3, saw 5s of 7/2028 at 2.26%, 5s of 2029 at 2.24%, 5s of 2034 at 2.59%, 5s of 2039 at 2.99%, 5s of 2044 at 3.41% and 4s of 2054 at 4.07%, callable 7/1/2034.

BofA Securities priced for the Michigan State Housing Development Authority (/AA+//) $424.71 million of non-AMT rental housing revenue bonds, Series A, with all bonds price at par: 3.1s of 10/2026, 3.5s of 4/2029, 3.625s of 10/2029, 3.875s of 4/2034, 3.875s of 10/2034, 4.05s of 10/2039, 4.45s of 10/2044, 4.625s of 10/2049, 4.7s of 10/2054, 4.75s of 10/2059, 4.8s of 10/2064 and 4.85s of 4/2067, callable 10/1/2033.

BofA Securities priced for the Municipal Electric Authority of Georgia (A2/A-/A-/) $402.25 million of subordinated bonds. The first tranche, $380.315 million of Project 1 bonds, Series 2024A, saw 5s of 1/2026 at 2.73%, 5s of 2029 at 2.76%, 5s of 2034 at 3.12%, 5s of 2039 at 3.46%, 5.25s of 2044 at 3.70% (BAM-insured), 5.25s of 2049 at 3.93% and 5.25s of 2054 at 3.95% (BAM-insured), callable 1/1/2034.

The second tranche, $21.935 million of general resolution projects bonds, saw 5s of 1/2026 at 2.73%, 5s of 2029 at 2.76% and 5s of 2034 at 3.12%, noncall.

Piper Sandler priced for Barbers Hill Independent School District, Texas, $180.365 million of PSF-insured unlimited tax school building bonds, Series 2024, 5s of 2/2025 at 2.71%, 5s of 2029 at 2.60%, 5s of 2034 at 3.00%, 5s of 2039 at 3.32%, 5s of 2044 at 3.64%, 4s of 2049 at 4.12% and 4.25s of 2054 at 4.26%, callable 8/15/2034.

J.P. Morgan priced for the Louisiana Local Government Environmental Facilities and Community Development Authority (A1/A+//) $150.465 million of East Baton Rouge Sewerage Commission Projects subordinate lien revenue refunding bonds, Series 2024, with 5s of 2/2025 at 2.72%, 5s of 2029 at 2.66%, 5s of 2034 at 3.10%, 5s of 2039 at 3.40 and 5s of 2041 at 3.52%, callable 2/1/2034.

In the competitive market, Massachusetts (Aa1/AA+/AA+/) sold $400 million of GO consolidated loan of 2024 bonds, Series F, to Jefferies, with 5s of 8/2051 at 3.80% and 5s of 2054 at 3.86%, callable 8/1/2034.

The state sold $220 million of GO consolidated loan of 2024 bonds, Series D, to BofA Securities, with 5s of 8/2040 at 3.20%, 5s of 2044 at 3.49% and 5s of 2046 at 3.58%, callable 8/1/2034.

Massachusetts sold $130 million of GO consolidated loan of 2024 bonds, Series C, to Morgan Stanley, with 5s of 8/2032 at 2.64%, 5s of 2034 at 2.77% and 5s of 2038 at 3.01%, callable 8/1/2034.

The state sold $100 million of taxable GO consolidated loan of 2024 bonds, Series F, to Wells Fargo, with 4s of 8/2026 at 3.80%, 4s of 2029 at 3.76%, 4.25s of 2034 at 4.19% and 4.25s of 2035 at par, noncall.

Dane County, Wisconsin, (/AAA//) sold $144.61 million of GO promissory notes, Series 2024A, to J.P. Morgan, with 4s of 6/2025 at 2.56%, 4s of 2029 at 2.52%, 4s of 2034 at 2.80%, 4s of 2039 at 3.55% and 4s of 2044 at 3.94%, callable 6/1/2034.

AAA scales

Refinitiv MMD’s scale was bumped three to four basis points: The one-year was at 2.47% (-4) and 2.40% (-3) in two years. The five-year was at 2.37% (-3), the 10-year at 2.66% (-4) and the 30-year at 3.55% (-4) at 3 p.m.

The ICE AAA yield curve was bumped two to four basis points: 2.49% (-2) in 2025 and 2.43% (-3) in 2026. The five-year was at 2.39% (-4), the 10-year was at 2.63% (-3) and the 30-year was at 3.56% (-3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped four to five basis points: The one-year was at 2.47% (-4) in 2025 and 2.41% (-4) in 2026. The five-year was at 2.38% (-5), the 10-year was at 2.62% (-5) and the 30-year yield was at 3.54% (-4) at 3 p.m.

Bloomberg BVAL was bumped two to three basis points: 2.48% (-3) in 2025 and 2.42% (-2) in 2026. The five-year at 2.41% (-2), the 10-year at 2.63% (-3) and the 30-year at 3.54% (-3) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 3.748% (-1), the three-year was at 3.612% (-2), the five-year at 3.540% (-1), the 10-year at 3.730% (-3), the 20-year at 4.107% (-3) and the 30-year at 4.02% (-4) at 3:30 p.m.