Munis improve amid heavy new-issue slate

7 min read

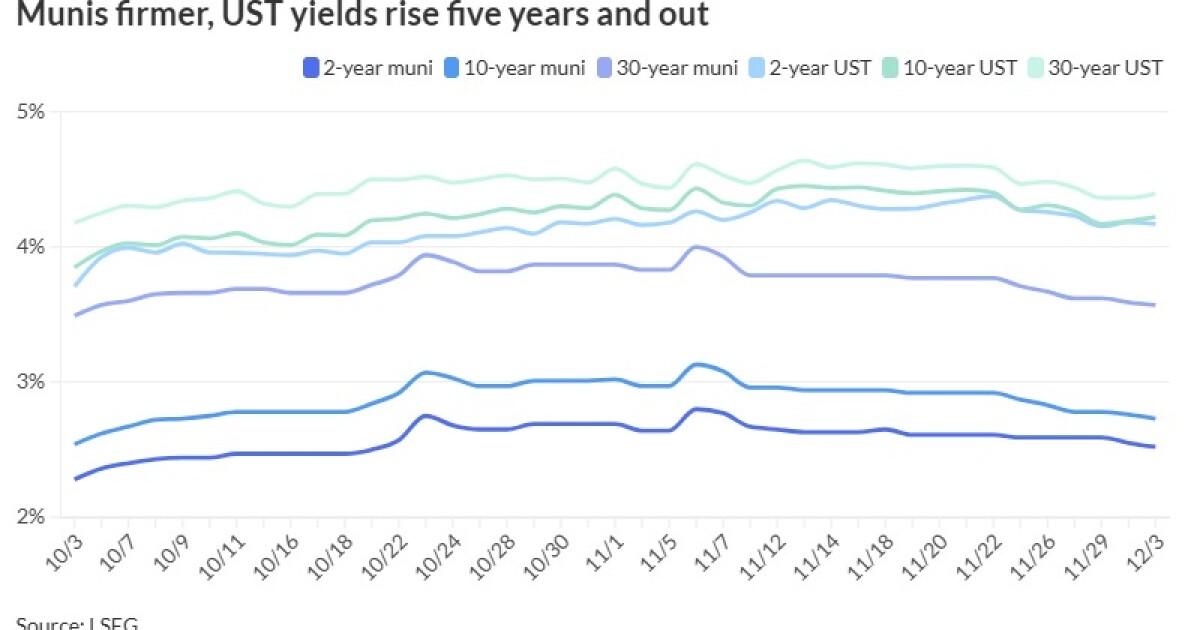

Municipals were firmer amid a busy new-issue calendar, as U.S. Treasury yields were slightly weaker outside of five years and equities were mixed.

Muni yields were bumped one to five basis points, depending on the scale, while UST yields rose up to three basis points out long.

The two-year municipal to UST ratio Tuesday was at 60%, the five-year at 62%, the 10-year at 65% and the 30-year at 81%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 61%, the five-year at 62%, the 10-year at 65% and the 30-year at 81% at 3 p.m.

As the holiday season is under way, muni investors hope “any move toward higher yields is steady, even dignified, such that it doesn’t catalyze an outflow cycle that would countervail year-to-date total returns just before we close out the year,” said Vikram Rai, head of municipal strategy at Wells Fargo.

The recent rate rally — due to confusion over the extent of the inflationary impact of extending the Tax Cuts and Jobs Act tax cuts, the timing and extent of the inflationary impact of tariffs and the demand for the United States dollar assets — “has been counter to our bearish expectations though it has been a very welcome surprise,” he said.

UST yields started to climb around Oct. 16 when the market started to price in President-elect’s Donald Trump’s victory and the potential red wave, selling off until mid-November, Rai noted.

Yields rose seven to 21 basis points across the curve, with the largest losses on the short end, he said.

Muni yields moved “almost commensurately” except for the 30-year, which rallied, Rai said.

However, while weaker Tuesday, since last week, Treasury rates have rallied “sharply” and as of today’s close were 18 to 20 basis points richer post-election.

Muni yields have moved lower, with yields bumped eight to 20 basis points since the election.

December is an “unusual month” and 2024 has been an “unusual year,” Rai said.

January historically performs the best and September the worst, he noted.

“But this has been an unusual year and we witnessed negative performance in January and positive performance in September,” Rai said. “We do not really have a good explanation for this anomaly vs. historicals except that the Fed’s actions or anticipation of the Fed’s actions were the primary catalysts for sharp rate moves.”

In December 2023, Fed Chair Jerome Powell gave “an unusually dovish post-FOMC speech which led to sharp rate rally and the upward move in January of 2024 was largely corrective though it led to negative returns for the month,” he noted.

Similarly, Rai said “rates rallied sharply into the September FOMC in anticipation of the Fed’s cut and though they sold-off post FOMC after the Fed delivered a hawkish 50bp cut, it wasn’t enough to negative the positive performance for the month.”

Muni returns are usually positive in December, and this has been true for election years outside of 2012, he said.

However, Rai noted December is also known for “low liquidity (towards the end of the month) and high volatility especially around FOMC.”

Performance in January is generally positive, and “we have a little more conviction about a continuation of the same,” Rai said, as there could be a “snapback” after a possible selloff in late December and supportive technicals.

In the primary market Tuesday, BofA Securities priced for the New York City Housing Development Corp. $550 million of 8 Spruce Street multi-family mortgage revenue bonds.

The first tranche, $276.8 million of Series A taxables (Aaa///), saw 5.458s of 12/2031 at par, callable 6/15/2029.

The second tranche, $49.6 million of Series B taxables (Aa3///), saw 6.033s of 12/2031 at par, callable 6/15/2029.

The third tranche, $19.7 million of Series C taxables (A2///), saw 6.433s of 12/2031 at par, callable 6/15/2029.

The fourth tranche, $25.5 million of Series D tax-exempts (Baa1///), saw 4s of 12/2031 at par, callable 6/15/2029.

The fifth tranche, $52.5 million of Series E tax-exempts (Baa3///), saw 4.375s of 12/2031 at par, callable 6/15/2029.

The sixth tranche, $125.9 million of non-rated Series F bonds, saw 5.25s of 12/2031 at par, callable 6/15/2029.

RBC Capital Markets priced for the Cherry Creek School District No. 5, Colorado, (Aa1/AA+//) $316.67 million of GOs, with 5s of 12/2025, 5.25s of 2032, 5.25s of 2034 at 2.80%, 5.25s of 2039 at 3.06% and 5.25s of 2044 at 3.38%, callable 12/15/2034.

Barclays priced for the New Jersey Housing and Mortgage Finance Agency (/AA-//) $273.66 million of non-AMT social multi-family revenue bonds. The first tranche, $42.05 million of Series 2024A, saw all bonds price at par: 3.25s of 11/2025, 3.55s of 5/2029, 3.35s of 11/2029, 3.8s of 5/2034, 3.8s of 11/2034, 4s of 5/2040, 4.35s of 5/2045, 4.5s of 5/2050, 4.55s of 5/2055 and 4.6s of 5/2060, callable 5/1/2034.

The second tranche, $71.61 million of Series 2024B, saw all bonds price at par: 3.375s of 11/2027 and 3.5s of 5/2029, noncall.

The third tranche, $75.655 million of Series 2023E-1, saw all bonds price at par: 3.25s of 11/2025, 3.55s of 5/2029, 3.35s of 11/2029, 3.8s of 5/2034, 3.8s of 11/2034, 4s of 5/2040, 4.35s of 5/2045, 4.5s of 5/2050, 4.55s of 5/2055 and 4.6s of 5/2060, callable 5/1/2034.

The fourth tranche, $84.345 million of Series 2023E-2, saw all bonds price at par: 3.3s of 11/2026 and 3.375s of 2027, noncall.

Wells Fargo priced for the Illinois Housing Development Authority (Aaa///) $200 million of non-AMT social revenue bonds, 2024 Series I, with all bonds at par — 3.35s of 10/2029, 4.45s of 10/2044 and 4.625s of 4/2050 — except for 6s of 10/2055 at 3.70%, callable 4/1/2033.

Jefferies priced for the Maryland Community Development Administration (Aaa///) Tuesday $178 million of Villages at Marley Station sustainability multifamily development revenue bonds. The first tranche, $98.57 million of Series D-1 Fannie Mae MBS-secured bonds, saw all bonds price at par: 3.3s of 8/2029, 3.7s of 2/2034, 3.75s of 8/2034, 4s of 8/2039 and 4.35s at 2/2044, noncall.

The second tranche, $79.43 million of Series D-2 cash-collateralized bonds, saw 3.3s of 1/2029 at par, noncall.

In the competitive market, Anchorage (/A//) sold $181.86 million of AMT port revenue bonds, Series 2024A, to Wells Fargo, with 5.5s of 2/2026, 5.5s of 2029 at 3.35%, 5.5s of 2034 at 3.83%, 5.5s of 2039 at 4.00%, 5.5s of 2044 at 4.21%, 5.25s of 2050 at 4.38% (Assured Guaranty-insured), 4.45s of 2055 at 4.37% (Assured Guaranty-insured), 4.5s of 2060 at 4.56% and 4.275s of 2065 at 4.48% (Assured Guaranty-insured), callable 2/1/2034.

Primary to come:

The New Jersey Transportation Trust Fund Authority (A2/A-/A/A) is set to price Thursday $1.5 billion of transportation program bonds, 2024 Series CC, serials 2030-2044, terms 2049, 2055. Barclays.

The

Connecticut (Aa3/AA/AA-/AAA) is set to price Wednesday $768.78 million of transportation infrastructure purposes special tax obligation bonds, Series 2024 A-2. Goldman Sachs.

Hawaii (Aa2/AA+/AA/) is set to

The Sales Tax Securitization Corp., Illinois, is set to price Thursday $679.68 million of sales tax securitization refunding bonds, consisting of $142.09 million of refunding bonds, Series 2024A, (/AA-/AAA/AAA), serials 2029, 2031-2044; $404.22 million of second lien sales tax refunding bonds, Series 2024A (/AA-/AA-/AA+), serials 2029-2030, 2032-2041; and $133.37 million of taxable second lien sales tax securitization refunding bonds, Series 2024B, serials 2025, 2027-2029, 2039. RBC Capital Markets.

The Mobile County Industrial Development Authority, Alabama, (Baa3/BBB-//) is set to price $480 million of AM/NS Calvert LLC Project solid waste disposal revenue bonds, Series 2024B. BofA Securities.

Austin (/AAA/AA+/) is set to price Wednesday $434.965 million in three series, consisting of $301.525 million of public improvement and refunding bonds, Series 1; $103.67 million of Series 2024 certificates of participation; and $29.77 million of Series 3 public property finance contractual obligations. Piper Sandler.

The Parish of St. John the Baptist, Louisiana, (A2/A-/A/) is set to price Thursday $400 million of Marathon Oil Corp. Project non-AMT revenue refunding bonds, Series 2017, Subseries 2017C, remarketing, serial 2037. Barclays.

The New York City Housing Development Corp. (Aa2/AA+//) is set to price Thursday $397.725 million of sustainable development multi-family housing revenue bonds, consisting of $269.53 million of Series F-1 and $128.195 million of Series F2. Jefferies.

The St. Vrain Valley School District RE-1J, Colorado, (Aa1/AA+//) is set to price Wednesday $346.55 million of general obligation bonds, insured by Colorado State Intercept Program, serials 2025-2032, 2034-2039. Stifel, Nicolaus & Co.

The Cumberland County Industrial Development Facilities and Pollution Control Financing Authority (Aaa///) is set to price Thursday $250 million of Project Aero solid waste disposal revenue bonds, serial 2027. Oppenheimer.

The Wisconsin Health and Educational Facilities Authority (nonrated) is set to price Wednesday $239.655 million of Chiara Housing and Services, Inc. Project senior living revenue bonds, terms 2035, 2045, 2055, 2060. D.A. Davidson.

The Colorado Bridge and Tunnel Enterprise (Aa1/AA+//) is set to price Thursday $238.975 million of senior revenue refunding bonds, Series 2024B, serials 2028-2049. Wells Fargo.

The Karegnondi Water Authority, Michigan, (/AA//) is set to price $166.135 million of Karegnondi Water Pipeline water system refunding bonds, insured by BAM. J.P. Morgan.

The Capital Projects Finance Authority, Florida, is set to price Thursday $144.4 million of PRG – Unionwest Properties LLC Project student housing revenue bonds, consisting of $108.385 million of tax-exempt senior bonds, Series 2024A-1 (Ba1///), serials 2033-2044, terms 2049, 2054, 2058; $7.455 million of taxable senior bonds, Series 2024A-2 (Ba1///), serials 2026-2033; and $28.56 million of tax-exempt subordinate bonds, Series 2024B (nonrated), term 2062. BofA Securities.

Chicago (/BBB+/A-/A) is set to price Thursday $126.595 million of general obligation refunding bonds, Series 2024B, serials 2025, 2029, 2031-2035. RBC Capital Markets.

The FAU Finance Corp., Florida, (A1//A+/) is set to price Thursday $117.75 million of capital improvement revenue bonds, serials 2027-2044, terms 2049, 2054. BofA Securities.

The Adams County General Authority, Pennsylvania, (//BBB+/) is set to price Thursday $110.815 million of The Brethren Home Community Project revenue bonds, consisting of $91.36 million of Series 2024A, $7.285 million of Series 2024B-1 and $12.16 million of Series 2024B-2. HJ Sims & Co.

The Illinois Housing Development Authority (Aaa///) is set to price $100 million of taxable revenue social bonds, Series J, serials 2025-2036, terms 2039, 2041. Ramirez.