April volume drops 24% in another down month

5 min read

April municipal bond issuance dropped 24% year-over-year as issuers dealt with higher rates and states and municipalities are still flush with unspent stimulus cash.

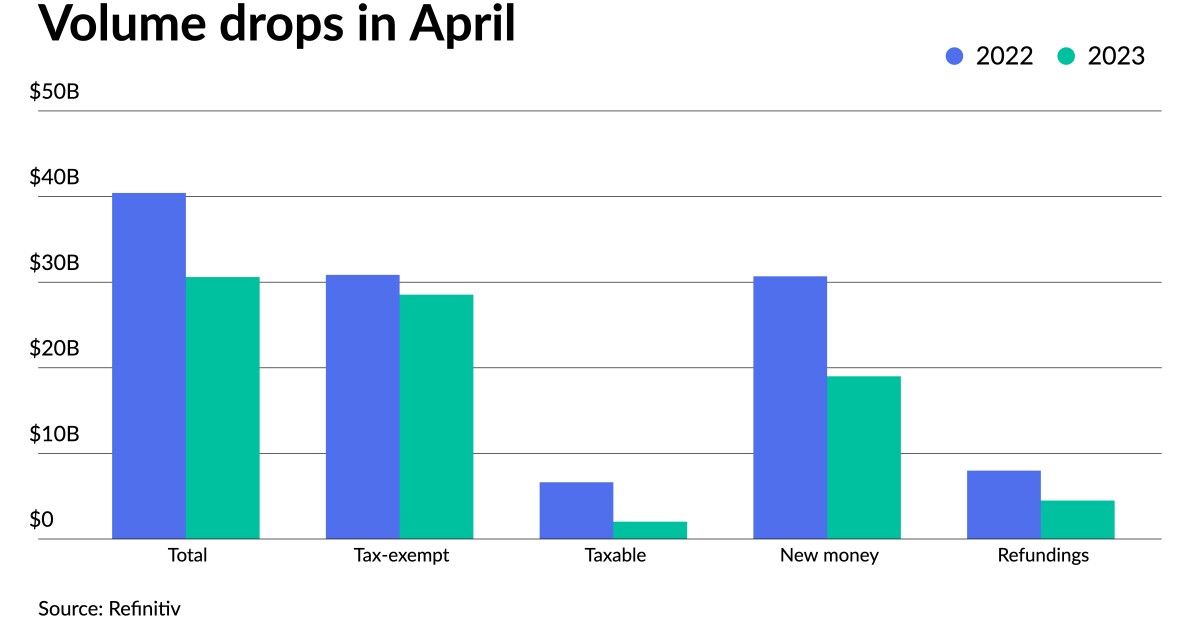

Total volume for the month was $30.599 billion in 577 issues, down from $40.423 billion in 900 issues a year earlier, according to Refinitiv data.

Tax-exempt issuance was down 7.5% to $28.539 billion in 503 issues from $30.854 billion in 752 issues in 2022. Taxable issuance totaled $2.026 billion in 70 issues, down 69.4% from $6.632 billion in 139 issues a year ago. Alternative-minimum tax issuance dropped to $33.567 million, down 98.9% from $2.937 billion.

New-money issuance fell 38.1% to $19.003 billion in 510 transactions from $30.686 billion a year prior. Refunding volume decreased 43.8% to $4.493 billion from $7.991 billion in 2022.

Total issuance year-to-date is at $107.626 billion, falling 25.2% from $143.872 billion in the same period of 2022.

One of the biggest reasons for the drop in issuance stems from states and municipalities being flush with cash, said Cooper Howard, a fixed income strategist focused on munis at Charles Schwab. This cash has allowed states and local governments to sit on the sidelines as they have the ability to wait to use their unspent federal aid.

“We don’t know how much more money state and local governments have from the federal aid assistance,” said Alice Cheng, a municipal credit analyst at Janney.

However, she said, “if Congress were to claw back on the unspent funds from the COVID-19 aid, that could be a factor to help with the muni market, because the more funding that they have to spend until 2024, the more difficult the market is going to be in terms of volume.”

But while down year-over-year, issuance was helped by several billion-dollar state deals as larger deals “came into market that we have not seen in the past few months,” according to Cheng.

At the start of the month, California priced $2.6 billion of GOs in the negotiated market, followed by Illinois pricing $2.3 billion of GOs in mid-April in the negotiated, as well. Washington sold $1.3 billion of GOs in the competitive to cap off the month.

Moreover, the month also provided some clarity on where the Federal Open Market Committee will hike rates for the remainder of the year, she said.

A 25 basis point rate hike is expected at the May meeting, with the possibility of another one at the June meeting.

“That helped issuance because investors are more attracted to better quality investments there,” she said. “That’s probably why we saw Treasuries rally in early April, which helped to boost a little bit more confidence and drive the demand.”

Howard also expects the Fed to hike rates at the May meeting, noting it’s “very much baked into the cards at this point.”

“But more important will be what the direction that they provide, in terms of Fed policy and where the Fed funds rate goes,” Howard said. “There’s something notable is with the markets expecting about two to three rate cuts by the end of the year, which differs from the Feds’ mantra that they’re ‘hike, hold and and recalibrate.'”

If the Fed does cut rates, that could present an opportunity for refundings, if issuers are able to “capture those opportunities,” Cheng said.

And while refundings decreased year-over-year, they did manage to capture a larger percentage of the market month-over-month. Refundings accounted for 14.7% of total issuance in April, compared to 9% in March.

“This suggests that tax-exempt muni rates have declined to good levels to trigger large increase in current and forward refunding activity,” said BofA strategists.

If “we are correct about muni rates, then refunding volume going forward should be robust for the rest of the year and account for high percentages of monthly issuance volumes,” they added.

“These refundings are mostly tax-exempt refundings, and at a time when tax-exempt muni supply is at shortage, this is certainly a welcome change,” BofA strategists said.

The muni market continues to be largely unaffected by the continued fallout from the banking sector crisis that started in March with the failure of Silicon Valley Bank, according to Howard.

He said there’s some lingering concern over what might happen but the muni market has moved on from that.

“That’s not to say that something won’t happened or the next to shoe drops. If it does, that would most likely hit Treasury rate, and then, as a result, munis would follow suit as well in terms of having to sell their muni portfolios to large buyers and municipal bonds to shore up liquidity, but I don’t anticipate that happening because of the programs in place.”

Howard said issuance is expected to be lighter next week amid the May FOMC meeting, per usual.

“Issuers are hesitant to issue when it could be a volatile environment,” Howard said. “So they kind of hold off a little bit rather pricey deals on a less eventful week.”

For the month as a whole, BofA strategists expect $33 billion of new issuance for long-term bonds [in May], while principal redemptions should be about $31.3 billion and coupon payments on the order of $13.7 billion.”

They said the “ongoing imbalance of supply/demand conditions will continue.”

Starting from May, BofA strategists said, “the muni market is entering a season of strong performance months May-August as established over the past several years.”

The season, they said, “represents the expansion of traditional strength in June/July redemptions to May-August.”

This year, they estimate “principal redemption for the four months totals $169 billion and coupon payments $63 billion.”

Total expected issuance “for the four months is $143 billion — a very large imbalance.”

Issuance details

Revenue bond issuance decreased 55% to $12.998 billion from $28.854 billion in April 2022, and general obligation bond sale totals rose 52.1% to $17.601 billion from $11.569 billion in 2022.

Negotiated deal volume was down 21.2% to $23.353 billion from $29.639 billion a year prior. Competitive sales decreased 4.6% to $6.982 billion from $7.320 billion in 2022.

Deals wrapped by bond insurance declined to $1.489 billion in 100 deals from $2.612 billion in 122 deals in 2022, a 43% decrease.

Bank-qualified issuance dropped 35.6% to $639.3 million in 161 deals from $993.2 billion in 241 deals a year prior.

In the states, Texas claimed the top spot year-to-date.

Issuers in the Lone Star State accounted for $17.988 billion, up 15.6% year-over-year. California was second with $17.767 billion, down 5.4%. New York was third with $10.281 billion, down 42.1%, followed by Illinois in fourth with $5.751 billion, up 31.3%, and Florida in fifth with $3.637 billion, a 45.4% decrease from 2022.

Rounding out the top 10: Wisconsin with $3.231 billion, up 2.7%; Oregon with $3.054 billion, up 62.5%; Louisiana with $2.780 billion, up 43.8%; Michigan at $2.739 billion, down 53.2%; and Washington with $2.667 billion, down 14.1%.