July issuance falls 8%, YTD issuance down 16%

4 min read

July municipal bond issuance fell 8% from 2022 as issuers dealt with another month of mixed macroeconomic concerns and rising interest rates, but the month saw the smallest drop in issuance year-over-year in 2023.

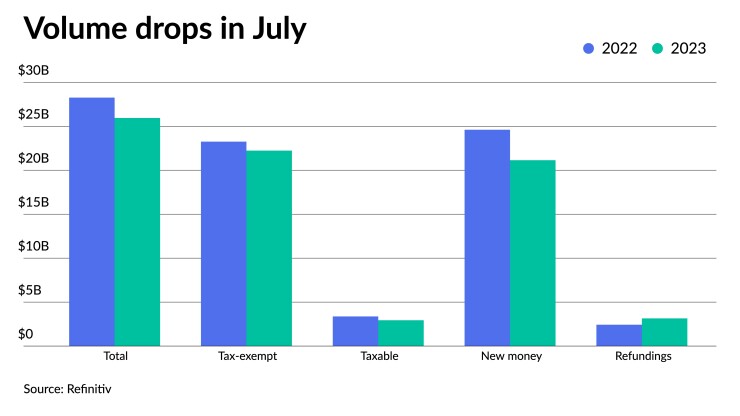

July’s total volume was $25.939 billion in 542 issues, down from $28.258 billion in 619 issues a year earlier, and lower than the $31.448 billion 10-year average, according to Refinitiv data.

Total issuance through July 31 is at $206.771 billion, down 16.1% from $246.497 billion through the same timeframe in 2022.

Like June, July experienced an uneven distribution of issuance week-to-week, with the lighter supply weeks dragging down volume for the month.

Tax-exempt issuance fell 4.4% to $22.228 billion in 489 issues from $23.252 billion in 548 issues in 2022. Taxable issuance totaled $2.938 billion in 49 issues, down 12.8% from $3.370 billion in 67 issues a year ago. Alternative-minimum tax issuance dropped to $773.6 million, down 52.7% from $1.636 billion.

New-money issuance fell 14.1% to $21.137 billion from $24.603 billion a year prior. Refunding volume rose 29.6% to $3.144 billion from $2.427 billion in 2022.

“One of the big reasons this issuance is so low this month is because we had the [Fourth of July] holiday and the Federal Open Market Committee meeting,” said Tom Kozlik, managing director and head of public policy and municipal strategy at Hilltop Securities.

These weeks contributed to issuance falling below Kozlik’s estimate of July volume being around $27 billion to $30 billion. However, he said he’s not surprised that issuance landed where it did.

“If issuance is going to go anywhere, it’s going to be lower than expected, not higher than expected,” he noted.

Volume being down year-over-year has to do with the Federal Reserve’s continued rate hikes, said Alice Cheng, municipal credit analyst at Janney Montgomery Scott.

While the FOMC paused hiking rates at its June meeting, there was still the indication that rates would continue to rise.

“That continues to deter issuers from going to market,” she said.

Rising interest rates are weighing on market participants, though Kozlik noted it’s starting to “sink in” for issuers that “we’ll be in this higher interest rate environment for longer than people thought.”

At the start of the year, he said the expectation was that rate cuts would come in the second half of this year,

However, he said “interest rates aren’t likely to start coming down this year, and it’s questionable if or when interest rates start coming down next year.”

But, Cheng noted, issuers can’t “hold off on borrowing forever.” Following the FOMC hiking rates 25 basis points at its July meeting, Cheng said Fed Chairman Jerome Powell indicated rates would remain high until 2026.

This has offered issuers some guidance and resets expectations.

“If this is a new normal, you just have to work with it,” she said. “Maybe reschedule, rebudget, and resize what you meet your financial goals and meet your capital needs.”

Despite issuance being down year-over-year, recent months have posted better numbers than the start of the year. For example, issuance was down 42% year-over-year in February and 30% in March, whereas volume was only down 9% year-over-year in June and 8% in July.

The “healthier” supply — despite volume remaining subdued — can be attributed, in part, to the reinvestment money going back into muni investments and stability on the horizon with the end of the rate hiking cycle, Cheng said.

Additionally, market sentiment has benefitted from recent inflows into muni mutual funds.

Moreover, she said the federal aid that had reduced the need for some issuers to come to market is close to being depleted.

She said issuers need access to capital more now as a result.

Issuance during the FOMC meeting ended up being more robust than typical Fed weeks, aided by a large Washington state competitive GO sale, boosting July’s figures.

Barclays strategist Clare Pickering said the market had already priced in the Fed’s decision to hike rates 25 basis points, which can explain the higher-than-expected issuance for that week.

She said issuance in August, which is already a slower month, may be more impacted by the 25 basis point hike. Volume in the remaining months of the year could be “good” as there is still plenty of cash on the sidelines and there have been two weeks of inflows into muni mutual funds.

“Retail is starting to really wake up to these yields,” she said, adding they are “very attractive” to investors looking at the taxable equivalent yields they can currently get.

Issuance details

Revenue bond issuance decreased 25.3% to $14.666 billion from $19.643 billion in July 2022, and general obligation bond sales rose 30.9% to $11.273 billion from $8.615 billion in 2022.

Negotiated deal volume was up 10.6% to $21.343 billion from $10.305 billion a year prior. Competitive sales decreased 41% to $4.522 billion from $7.671 billion in 2022.

Deals wrapped by bond insurance was at $1.712 billion in 103 deals from $2.196 billion in 92 deals in 2022, a 22.1% decrease.

Bank-qualified issuance dropped 9.2% to $558.8 million in 163 deals from $615.5 million in 161 deals a year prior.

In the states, Texas claimed the top spot year-to-date.

Issuers in the Lone Star State accounted for $35.429 billion, up 20.8% year-over-year. California was second with $30.345 billion, up 4.2%. New York was third with $19.338 billion, down 39.7%, followed by Illinois in fourth with $8.254 billion, up 21.8%, and Florida in fifth with $7.432 billion, a 29.7% decrease from 2022.

Rounding out the top 10: Washington with $6.066 billion, down 0.3%; Wisconsin with $5.239 billion, down 7.3%; Georgia with $5.219 billion, down 19.2%; Michigan at $5.142 billion, down 31.7%; and Massachusetts with $4.756 billion, down 19.1%.