Munis stronger, fund outflows grow

4 min read

Municipals were firmer Wednesday amid another stronger session for U.S. Treasuries while equities sold off on concerns of an overbought market.

Triple-A yields fell two to four basis points while UST yields were lower by up to seven on the short end near the close.

The two-year muni-to-Treasury ratio Wednesday was at 58%, the three-year at 58%, the five-year at 59%, the 10-year at 59% and the 30-year at 86%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 58%, the three-year at 57%, the five-year at 57%, the 10-year at 59% and the 30-year at 86% at 3:30 p.m.

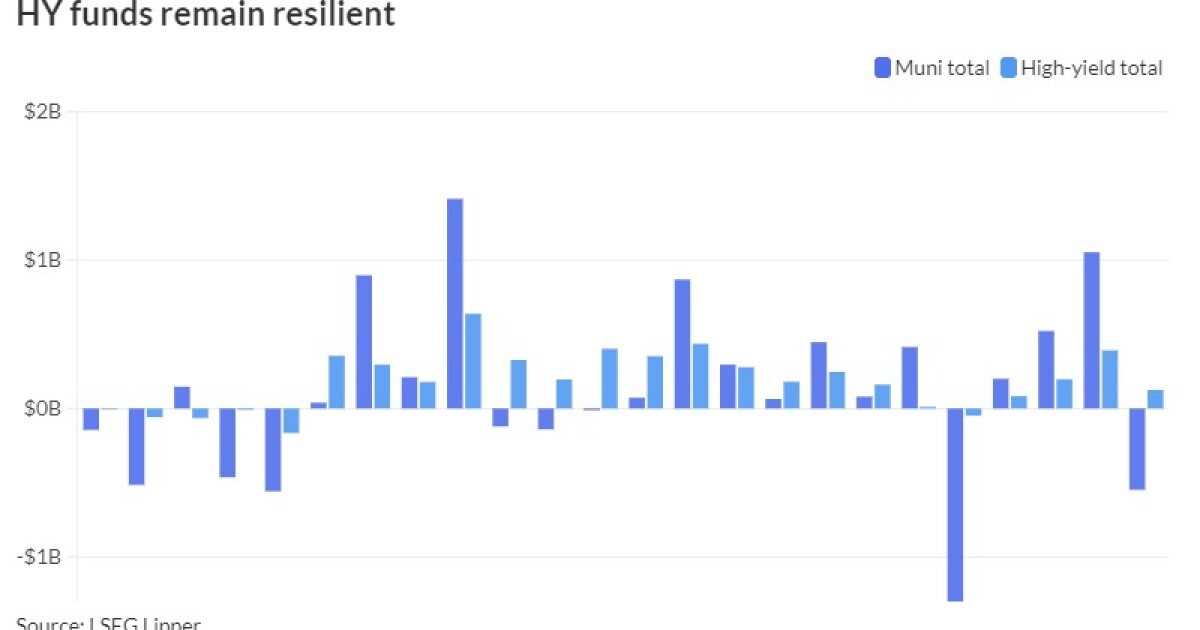

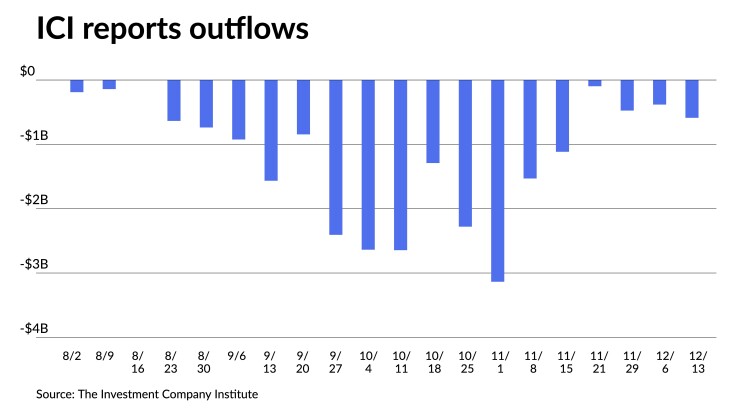

The Investment Company Institute reported more outflows from municipal bond mutual funds for the week ending Dec. 13, with investors pulling $588 million from the funds following $382 million of outflows the week prior. Exchange-traded funds also saw inflows of $11 million following $40 million of outflows the week prior.

“As the UST market revisits a yield range from the summer period, muni investors are likewise experiencing a dramatic turn from just two months ago,” said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

Following a 10-year AAA spot that rose above 3.60%, current levels have fallen 125 basis points, she said.

Long high-grade munis have “rallied from the mid-4% range to settle around 3.50%,” she said.

Due to the volatile dynamic, cash is being forced into segments “that offer some concession — low-AA/single-A rated credits and short-optioned bonds trading at 30 basis points or wider discounts to comparable noncallable bonds (even with risk of extension),” according to Olsan.

A sale of Harris County TX Facility/Texas Medical Center (A1/AA-/) 5s due 2029 at 2.71% “represented a modest spread of +41/MMD, about 15 basis points through indicative healthcare spreads to AAA benchmarks,” she said.

“One kink in the armor is the anomaly in floating-rate bonds with yields above 4% surfacing in current resets on weakening demand,” she noted.

The inference is that “cash is leaving money markets and being allocated into fixed maturities — another indication of more rate certainty heading into 2024,” Olsan said.

Fund balances can show the declining money-market demand, she said.

Tax-exempt municipal money market funds saw a second consecutive week of outflows as $1.29 billion was pulled the week ending Dec. 18, bringing the total assets to $119.92 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds rose 3.06%.

Taxable money-fund assets saw $60.11 billion added to end the reporting week.

The average seven-day simple yield for all taxable reporting funds remained at 5.05%.

In the last large syndicate pricing of 2023, Connecticut’s GO offering generated two interesting results, Olsan noted: “the state paid less than 2.50% to finance the 10-year maturity (60 days prior that yield would have been above 3.50%) and several longer maturities implemented 4% structures (a sign that buyers’ attention to rate-risk has receded).

Across several measures in the market, Olsan said “the supply factor had a meaningful influence on market direction this year.”

Issuance year-to-date is at $375.5 billion.

There was one deal above $100 million in the primary market Wednesday.

Morgan Stanley priced for the Florida Development Finance Corp. $190 million of AMT Brightline Florida Passenger Rail Project surface transportation facility revenue bonds, Series 2019-A, with 6.25s of 1/2049 with a mandatory tender date of 12/18/2024 at par,

With barely any issuance through the remainder of the year, volume will not surpass the $390.7 billion seen in 2022.

“Revenue volume had lagged 2022 by 10% while GO supply is set up to end flat year-over-year. Issuers likely drew on federal stimulus funds for financing areas traditionally served by GO issuance,” she said.

Within the revenue category, supply for education and utility purposes is “virtually” unchanged from 2022, she said.

However, Olsan noted housing issuance will rise year-over-year, indicated at $34 billion through November.

Healthcare volume fell at half that of 2022 and transportation supply has fallen 25%, she said.

Sector performance has followed specific supply conditions.

“A Bloomberg Barclay’s Healthcare index has outperformed the broad market by 110 basis points this year and the Transportation index outperformance is 75 basis points,” she said. “Conversely, a Water/Sewer index is lagging by 55 basis points on steady supply this year.”

Secondary trading

Washington 5s of 2024 at 3.51%. California 5s of 2024 at 2.76%. DC 5s of 2025 at 2.67%.

Massachusetts 5s of 2028 at 2.34%. Washington 5s of 2029 at 2.36% versus 2.65%-2.62% original on 12/4. NYC TFA 5s of 2029 at 2.39%-2.37%.

NYC 5s of 2033 at 2.46%-2.45%. Tennessee 5s of 2034 at 2.37%-2.34%. NY State Urban Development Corp. 5s of 2036 at 2.64% versus 2.67%-2.66% Monday and 2.75% original on Friday.

San Diego County 5s of 2048 at 3.45% versus 3.54%-3.53% Monday and 3.63%-3.64% Thursday. Massachusetts 5s of 2053 at 3.79% versus 4.00% Friday and 3.90%-3.87% Thursday.

AAA scales

Refinitiv MMD’s scale was bumped two to three basis points: The one-year was at 2.69% (-2) and 2.54% (-2) in two years. The five-year was at 2.28% (-3), the 10-year at 2.28% (-3) and the 30-year at 3.47% (-3) at 3 p.m.

The ICE AAA yield curve was bumped two to four basis points: 2.73% (-2) in 2024 and 2.55% (-2) in 2025. The five-year was at 2.27% (-3), the 10-year was at 2.31% (-3) and the 30-year was at 3.47% (-4) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve saw bumps: The one-year was at 2.68% (-3) in 2024 and 2.55% (-3) in 2025. The five-year was at 2.31% (-3), the 10-year was at 2.34% (-6) and the 30-year yield was at 3.43% (-3), according to a 3 p.m. read.

Bloomberg BVAL was bumped two to three basis points: 2.58% (-2) in 2024 and 2.50% (-2) in 2025. The five-year at 2.21% (-2), the 10-year at 2.28% (-3) and the 30-year at 3.37% (-3) at 4 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.366% (-7), the three-year was at 4.076% (-7gt), the five-year at 3.867% (-7), the 10-year at 3.869% (-6), the 20-year at 4.169% (-5) and the 30-year Treasury was yielding 3.996% (-4) at 3:30 p.m.

Primary market on Tuesday

RBC Capital Markets priced for the California Public Finance Authority (Aa3/AA//) $342.125 million of Sharp Healthcare revenue bonds, Series 2024A, saw 5s of 8/2024 at 2.78%, 5s of 2028 at 2.42%, 5s of 2033 at 2.44% and 5s of 2035 at 2.48%, callable 8/1/2033.