While pricier, issuers turn to make-whole calls on short tax-exempt paper

3 min read

While a more common feature on corporate bonds and taxable munis, some issuers have priced recent deals with make-whole calls on their short-maturity tax-exempt bonds.

So far, the market does not appear to be penalizing issuers.

Two mega deals recently priced with make-whole calls for bonds due in 2034 and shorter where the market does not appear “to be penalizing issuers for including an optional make whole call feature in the short maturity tax-exempt bonds,” said Pat Luby, head of Municipal Strategy at CreditSights, in a report.

However, bondholders from the Regents of the University of California and

Luby said in the report “the complexity of optional make whole calls and the variability of the redemption prices will complicate investor disclosure and education efforts.”

Previously, issuers could have saved money on their refinancing through advanced refunding bonds, but “that door has closed and is unlikely to open anytime soon,” Luby said in an interview.

Therefore, while using a make-whole call is more expensive for an issuer, it gives them one more potential tool to use, he noted.

Make-whole calls are usually an “investor-friendly device,” said Matt Fabian, a partner at Municipal Market Analytics.

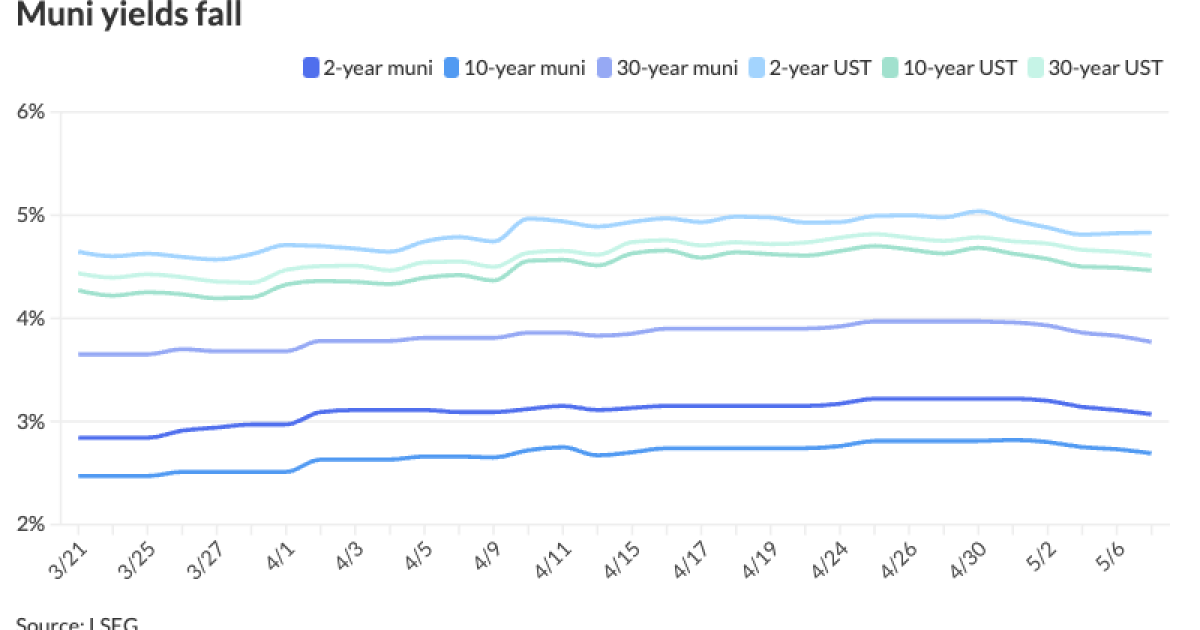

The long end of the muni curve has been relatively weak versus the front end where the strong SMA demand has been “very well bid,” Fabian said.

However, the back end has had a harder time attracting investors as mutual fund flows have been inconsistent and banks and insurance companies have reduced their muni holdings, he said.

“So to make their muni bonds more attractive to investors, more issuers may be willing to effectively give up their call rates on that bond through a make whole call structure,” Fabian said.

Make-whole calls are less appealing for issuers, coming with concessions and limiting their ability to restructure, Fabian said, noting that most of the BABs with optional calls have been restructured in prior years, unlike BABs with make whole calls.

Make-whole calls appeal to investors, though, as it removes a lot of risk for the investor, who no longer has to worry about the bond being called early, reinvestment and can lock in current yields for the longer term in their portfolio, Fabian said.

A handful of deals each week have non-traditional call options, including make-whole calls, Pruskowski said.

“This is part of living in the post-tax reform world where municipalities are giving themselves optionality at these high interest rates. They need to finance; they want to buy options to afford refinancing in the future,” he said.

Fabian does not expect a “meaningful” increase in make-whole calls.

Once the Fed starts to cut rates, the demand performance of muni bonds should improve.

And it’s unlikely that issuers will have to resort to make-whole calls.

This, Fabian said, is most likely a temporary phenomenon in a market lull before the Fed starts to cut rates.