Norfolk, Virginia, becomes first issuer to cancel BABs redemption plan

3 min read

Norfolk, Virginia, has canceled its plans to call some of its outstanding Build America Bonds, according to a financial filing issued Monday.

In March, the city said in a conditional notice that it was considering a redemption of $56 million of its direct-pay taxable

Norfolk gave no reason for the cancellation of its redemption plans or bond issuance. However, the city said it reserved the right to call the 2010B BABs for redemption in the future.

Indeed, several issuers each week are redeeming their outstanding taxable BABs using an extraordinary redemption provision that was included in initial bond offering documents.

In the most recent, on Wednesday the

According to J.P. Morgan and other firms, many issuers in the United States have

“In 2024 alone, we have identified 17 unique issuers that have either called BABs (eight issuers, affecting $3.9 billion of debt), posted conditional calls (five issuers, set to impact $3.6 billion of debt), or announced that they are considering financing plans in this regard (four issuers, potentially impacting $1.9 billion of debt),” J.P. Morgan said in Wednesday’s municipal morning intelligence report written by Peter DeGroot, Ye Tian and Roisin A. Gargan.

J.P. Morgan also noted in its constantly evolving list of possible BABs redemptions that Hampton Roads Sanitation District, Virginia, has posted a conditional call notice for $99 million of BABs with a call date of May 9.

It also noted that Sacramento Municipal Utility District posted the redemption price for $200 million of its BABs, which were redeemed this week, and also posted a conditional call notice for another $250 million of its BABs with a redemption date of May 15.

Last month,

Also last month, the

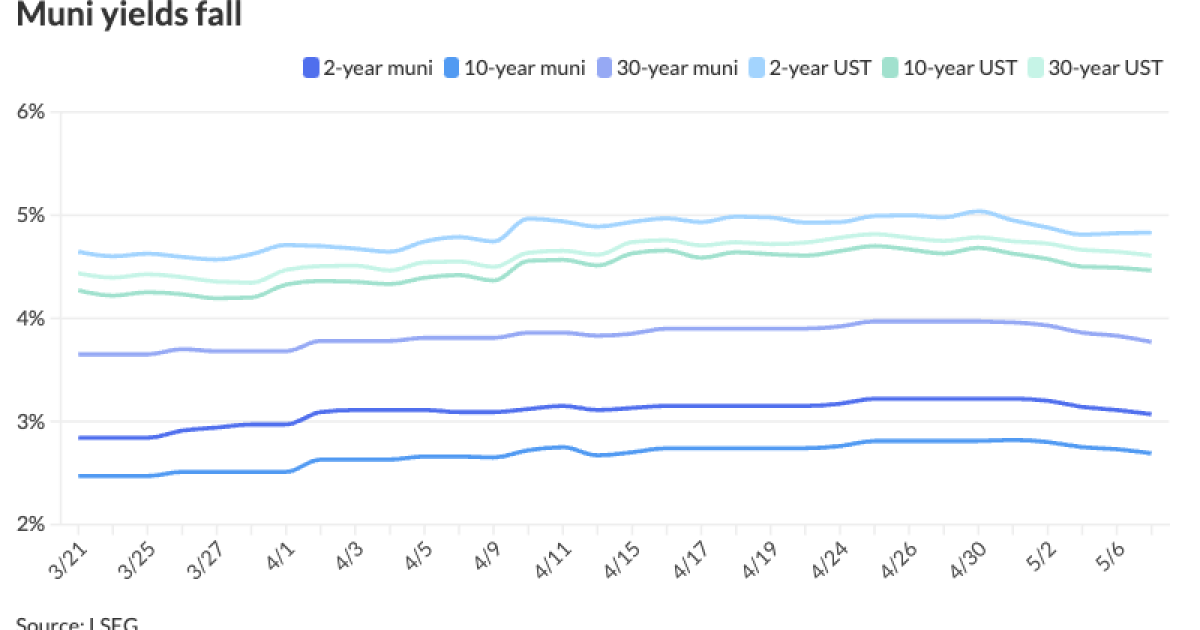

The investor challenges started earlier this year after issuers began to post notice they would refund their outstanding BABs following what many in the industry saw as clarity from a recent court case that determined sequestration by the federal government of their BABs subsidies can be used as an “extraordinary” redemption provision, along with the more attractive level of current interest rates.

The Regents of the

The Regents said in a supplement to its official offering statement they were proceeding with the issuance of the 2024 Series BV bonds — which was part of a

The UC Regents said investors have threatened to sue if the university system failed to either cancel the redemption or pay the make-whole price.

The UC redemption came on the heels of an action by investors who reached out to the Bank of New York Mellon, the trustee on a recent $622.765 million deal from the Maryland Transportation Authority, which called their $721 million of BABs.